Stak

@stakfund

Deals that are better for buyers

ID: 1991296257319677952

http://stak.fund 20-11-2025 00:04:20

58 Tweet

352 Takipçi

23 Takip Edilen

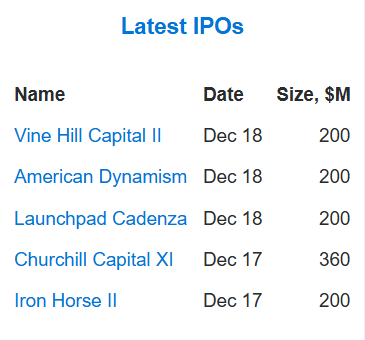

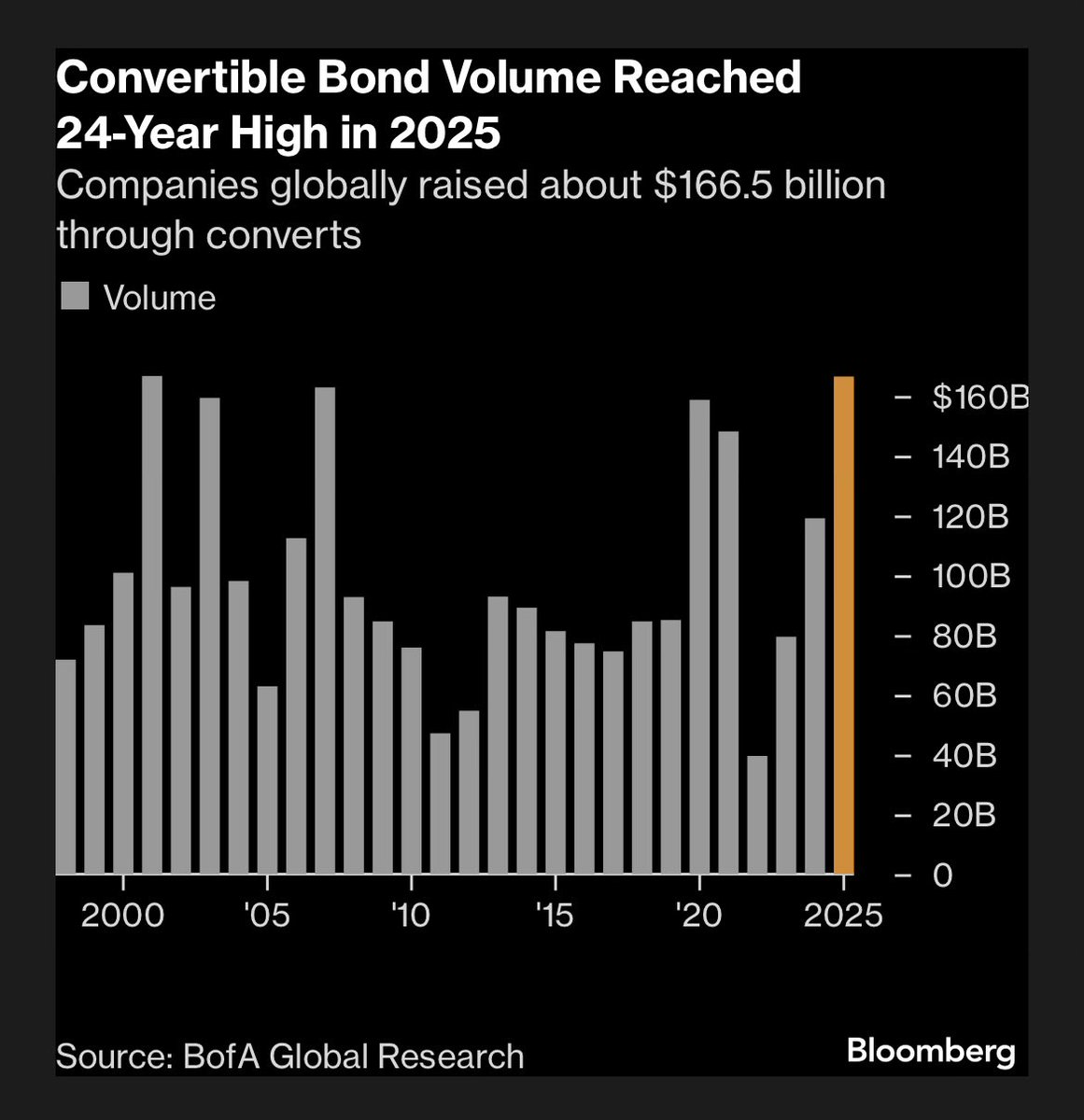

Cash is FLOWING this week. SPACs brought in $1.16B in the last two days. The buyers of these deals are professional funds that want their money back. plus an upside option. Semi-redeemable deals deliver this same value proposition with lower cost to buyers From SPAC Research