NAR Media Relations

@narmedia

The latest real estate news and updates from the media team at the National Association of REALTORS®. Have a press inquiry? Email us at [email protected].

ID: 2416008776

https://www.nar.realtor/newsroom 28-03-2014 14:41:24

11,11K Tweet

22,22K Takipçi

1,1K Takip Edilen

The National Association of REALTORS® will release Pending Home Sales data for March 2025 today at 10 a.m. Eastern. NAR Research #NARPHS

The National Association of Realtors® will release its Q1 2025 metro home prices data at 10 a.m. Eastern. NAR Research #NARQuarterly

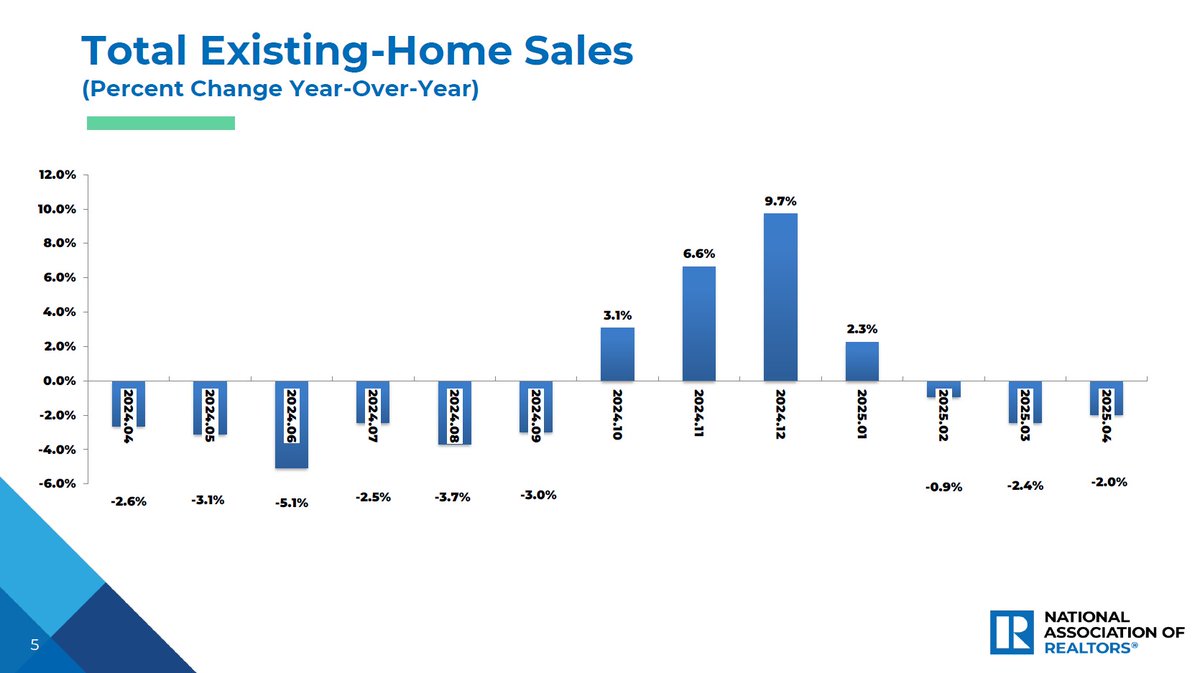

The National Association of Realtors® will release Existing-Home Sales data for April 2025 today at 10 a.m. Eastern. NAR Research #NAREHS

The National Association of REALTORS® will release Pending Home Sales data for April 2025 today at 10 a.m. Eastern. NAR Research #NARPHS