Daniel Marcinek

@marcajs

Actuary. Investing enthusiast.

ID: 3372209849

12-07-2015 12:24:18

690 Tweet

118 Takipçi

375 Takip Edilen

Joeri Chris Shipping 🚢🚢 Quite incredible how they were all eager to buy tankers during a 1 days spike caused by an exogenous event (Israel-Iran war), but they’re now avoiding the sector on a organic growth on strong fundamentals (OPEC hikes which will soon materialise in increased exports, and reduced

The full video from last week's #shipping #webinar is now available on YouTube. Check it out to hear the latest about the industry and why $CMBT is our top public pick for 2026 at Value Investor's Edge. $15/sh mid-2026 target: youtube.com/watch?v=S2n6pB…

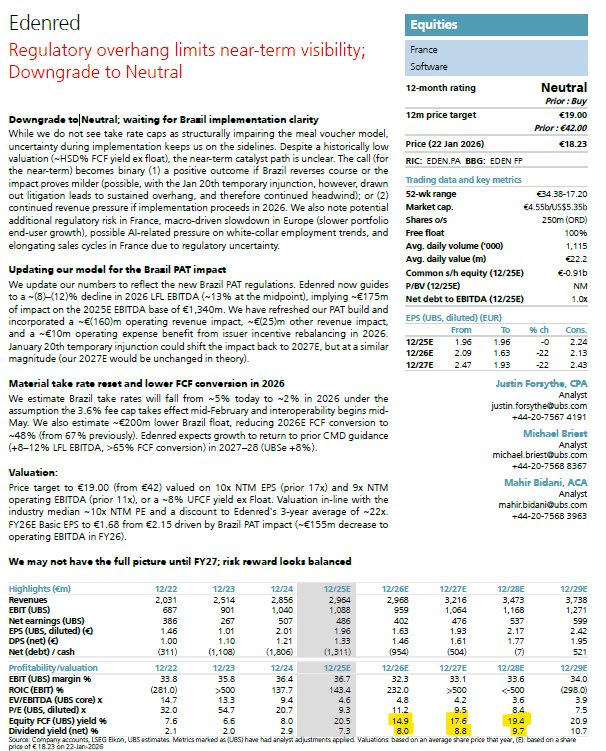

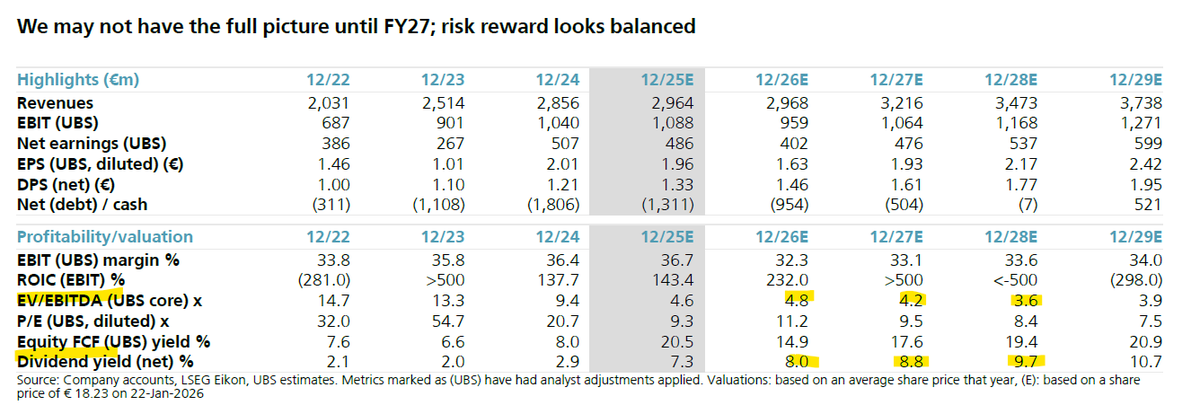

Tell me you have no idea what you just wrote, without telling me... 🤡🤡🤡 $EDEN $QSV.F Edenred Group #edenred In case you are sleeping like UBS. Brazilian PAT regulation was approved Nov 12th 25 and HALTED on Jan 21st 2026... But even if not, it's cool to downgrade 20% fcf yield