lesigh

@lesigh3100

le sigh

ID: 1019312837959745538

17-07-2018 20:08:13

2,2K Tweet

267 Takipçi

631 Takip Edilen

"The scaling constant can preserve more decimal places of precision for small numbers (especially 0 < u < 1), and requires the algebraic model to be retrofit to compensate for the re-scaled parameterization." See Mark Richardson's full presentation on YouTube: 'Fixed-Point

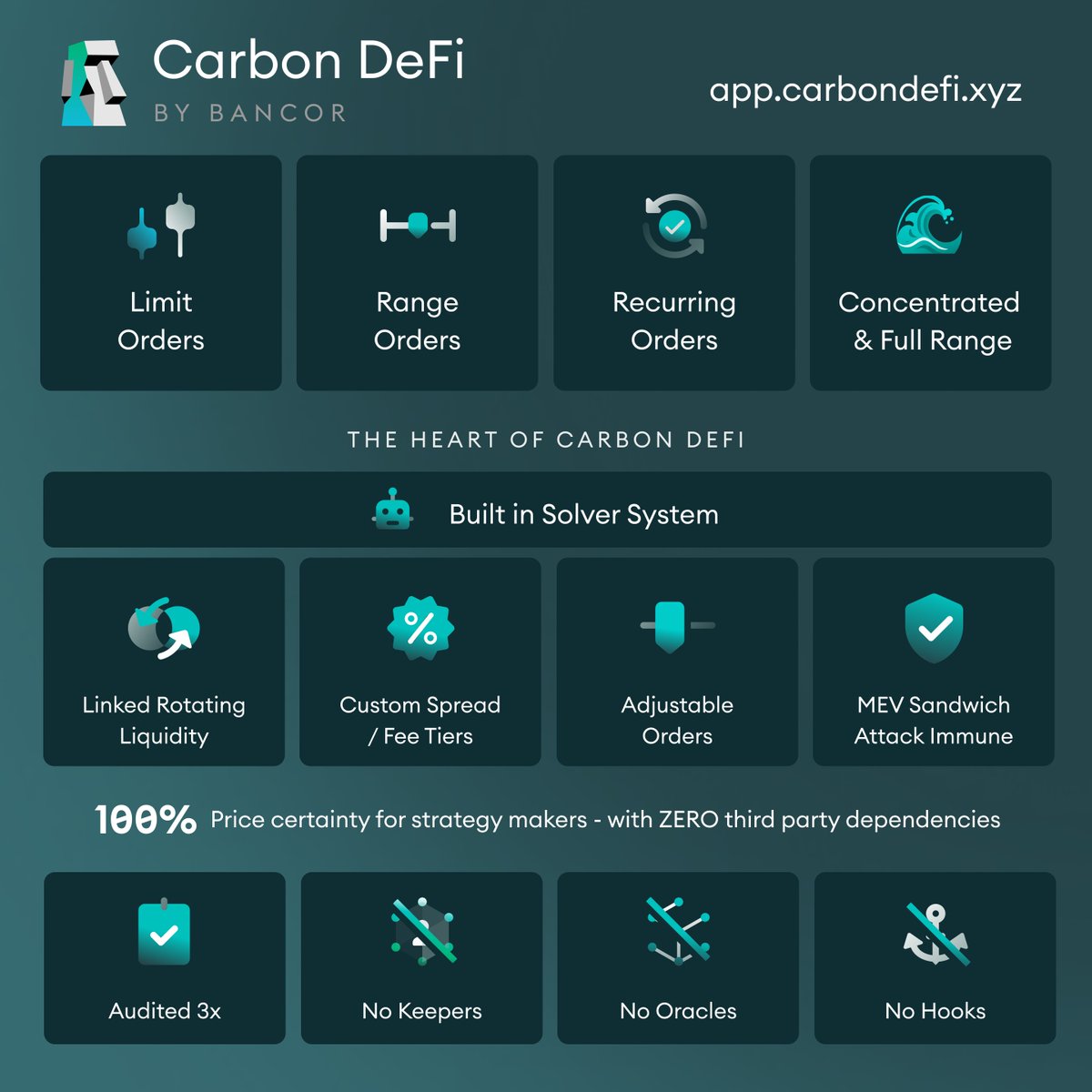

Trading should happen on your terms – not the market’s, not the AMM's. If you’re not getting: 🎯 Price certainty 🌊 Chainwide liquidity 💪 Flexibility, Efficiency, and Accuracy 🥪 Full immunity to MEV sandwich attacks … it's time you visit Carbon DeFi.

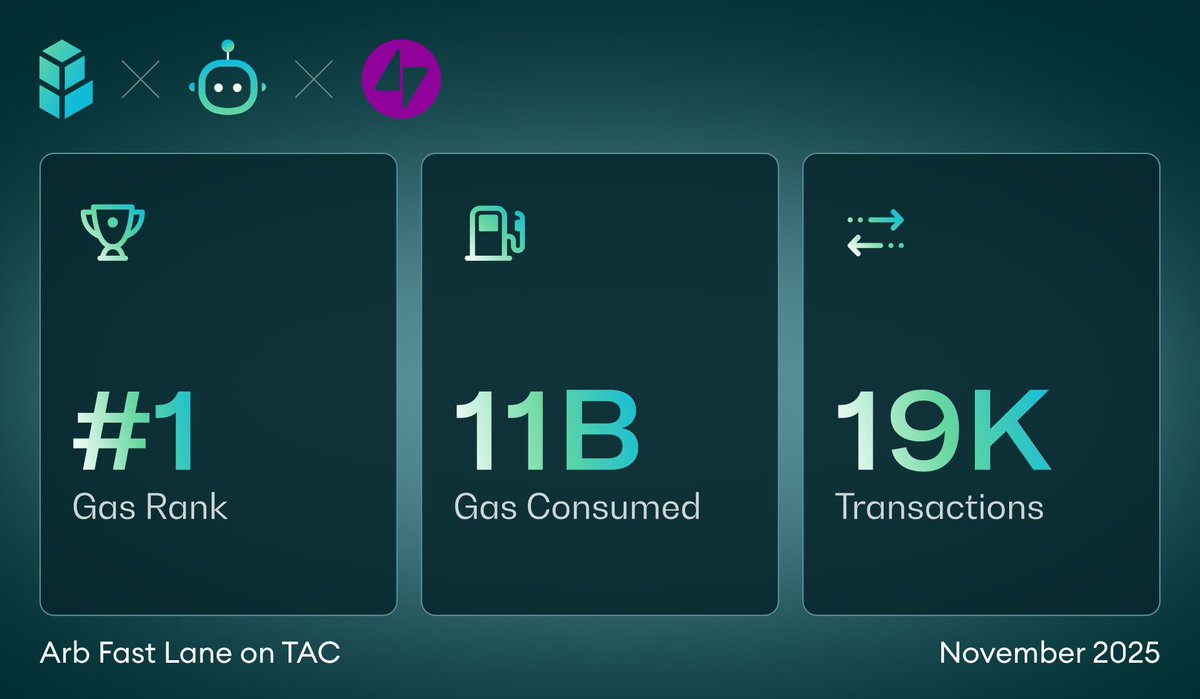

Ranked #1 in gas consumption — with almost 11 billion utilized and over 19K onchain arbitrage transactions in November 2025 — the Arb Fast Lane is still leading on TAC (🫰,✨️) (🫰,✨) Sustaining price equilibrium and driving Carbon DeFi trading activity 🗿

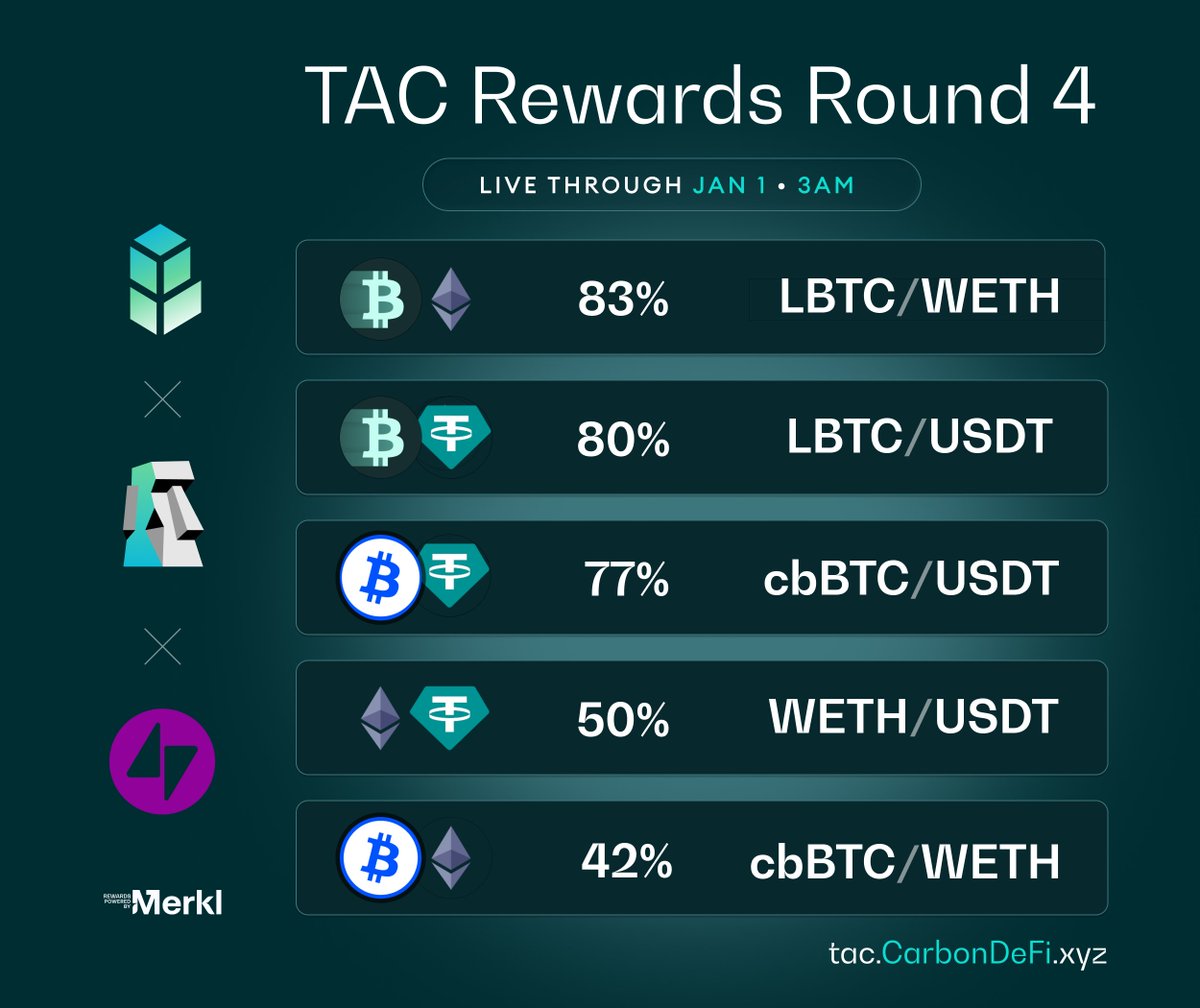

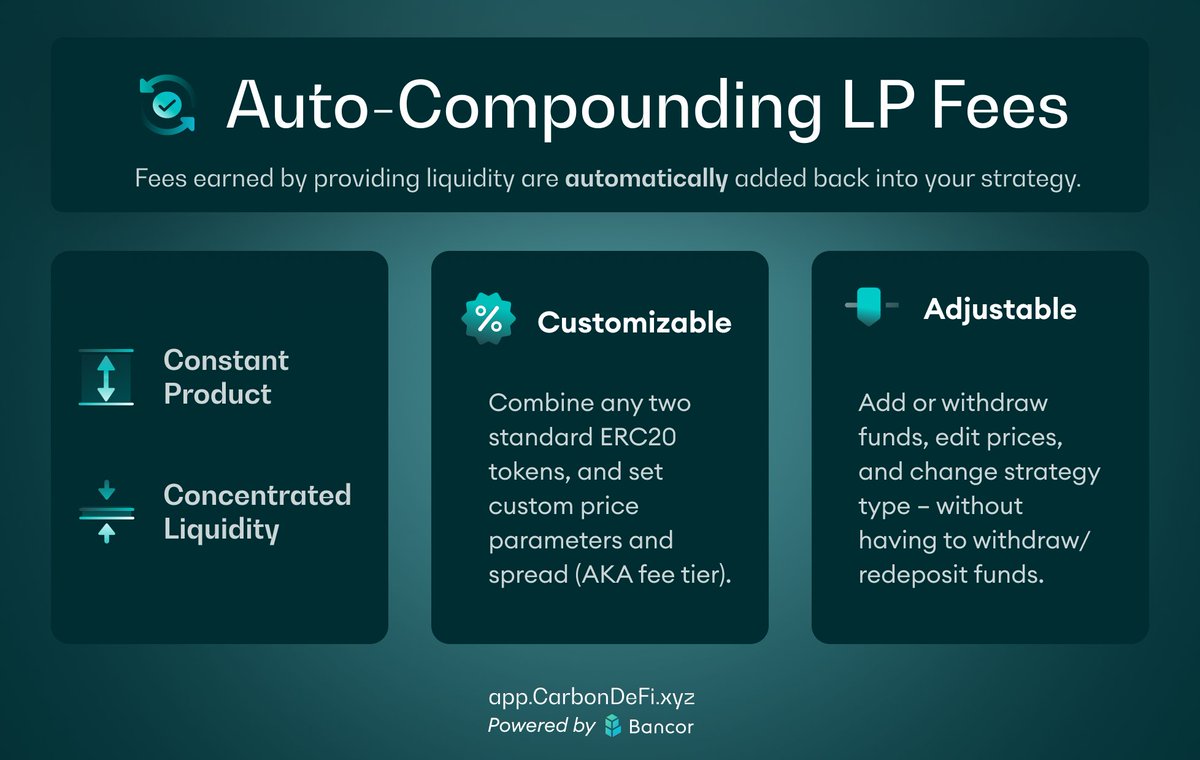

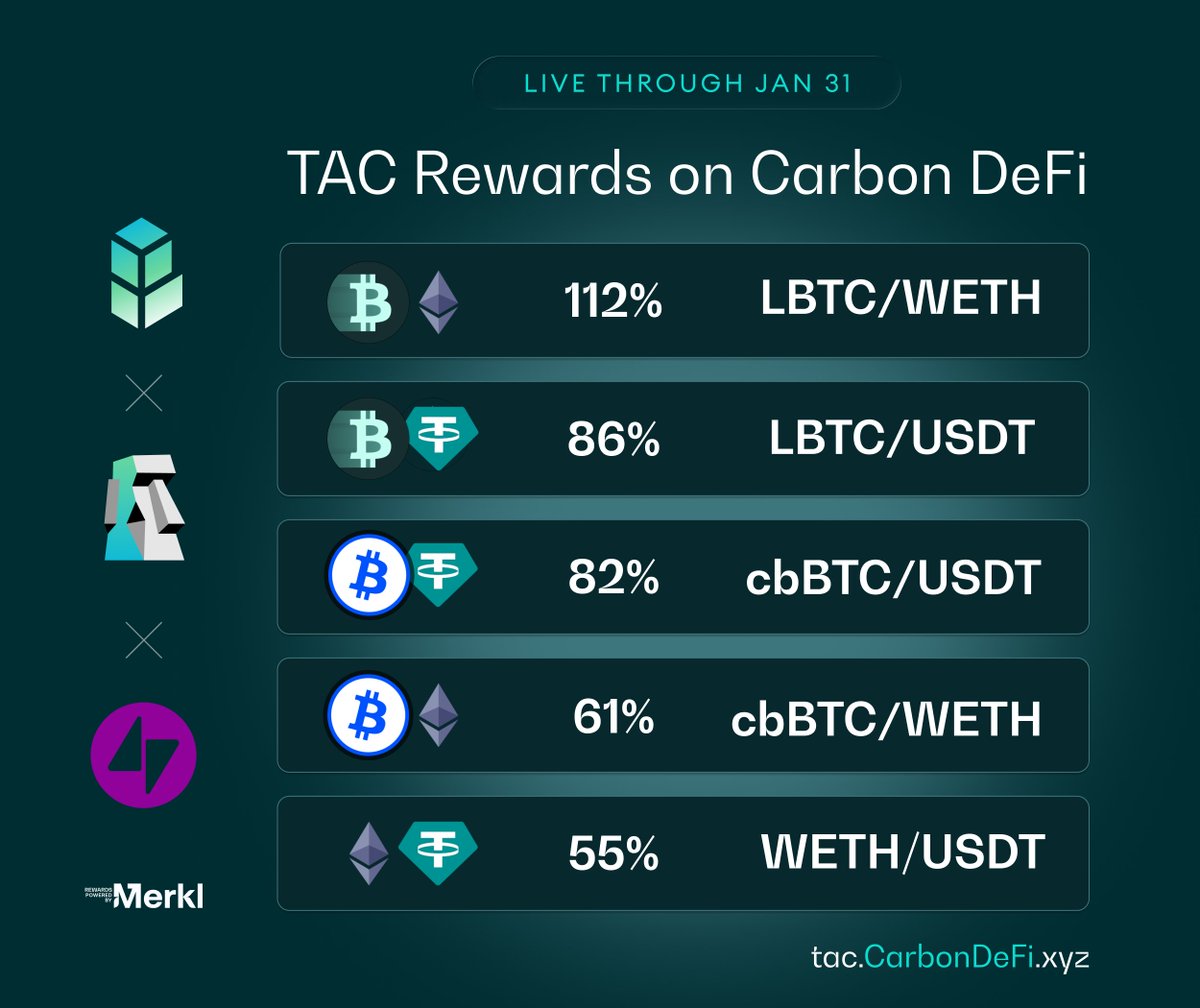

Live for 4 more weeks – rewards up to 74% on Carbon DeFi on TAC (🫰,✨️)🫰,✨ $LBTC • $WETH • $USDT • $cbBTC ✅ No pre-set fee tier ✅ No tick constraints ✅ Native auto-compounding ... all without withdrawing or recreating your position Rewards distributed via Merkl

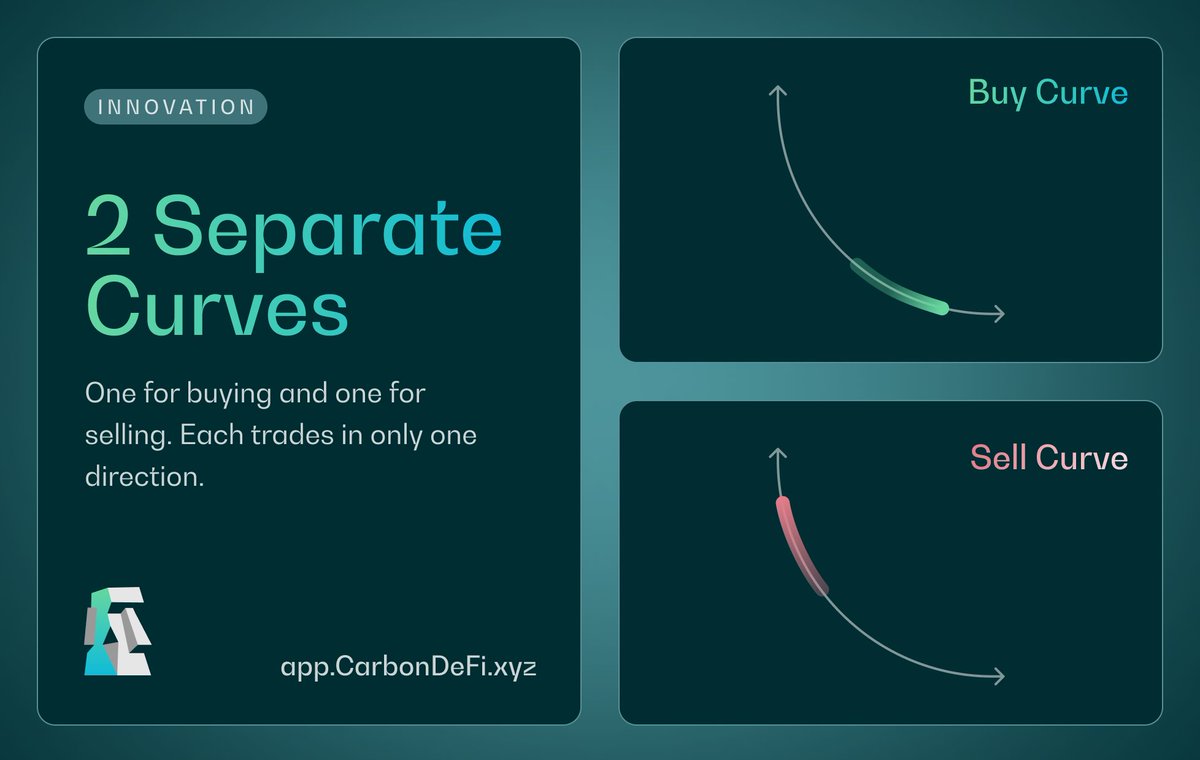

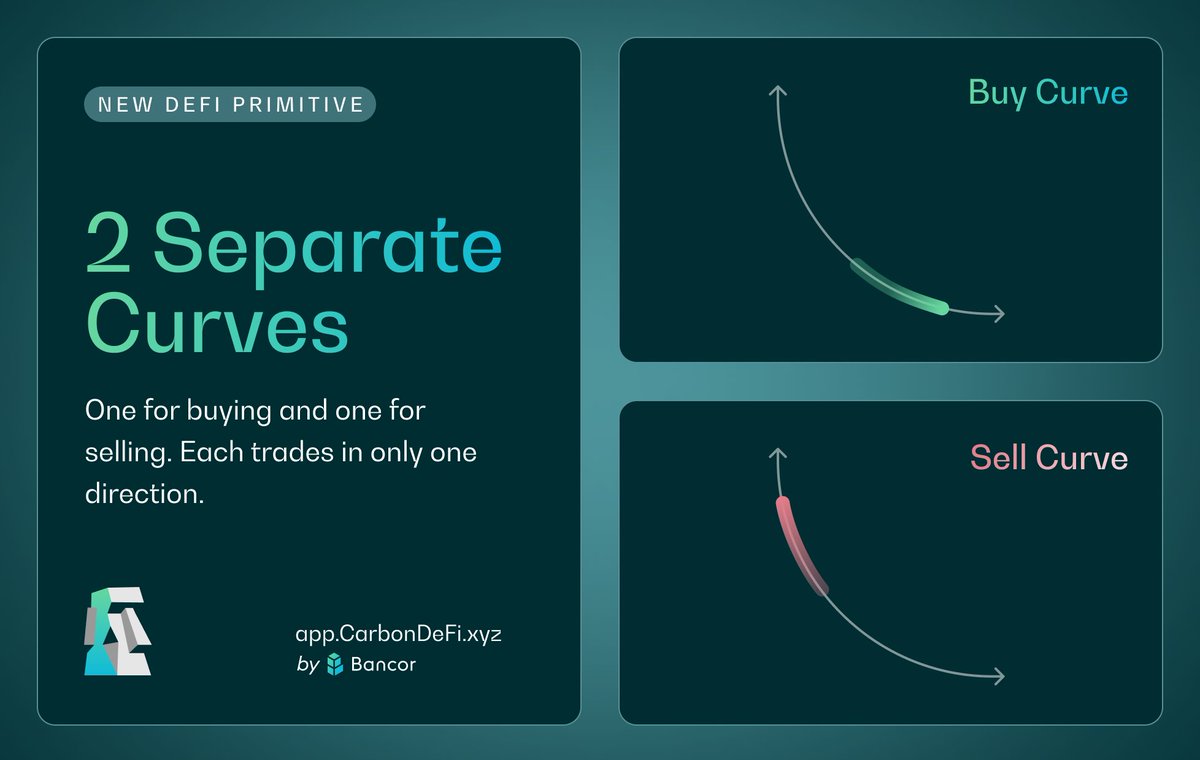

Attractive prices to sell a token, and attractive prices to buy a token, are not the same thing. 2 separate curves, 2 separate prices. Only on Carbon DeFi and licensed deployments: Ethereum, Sei, Celo, COTI, TAC and Base with Alien Base Limit and Recurring Orders.

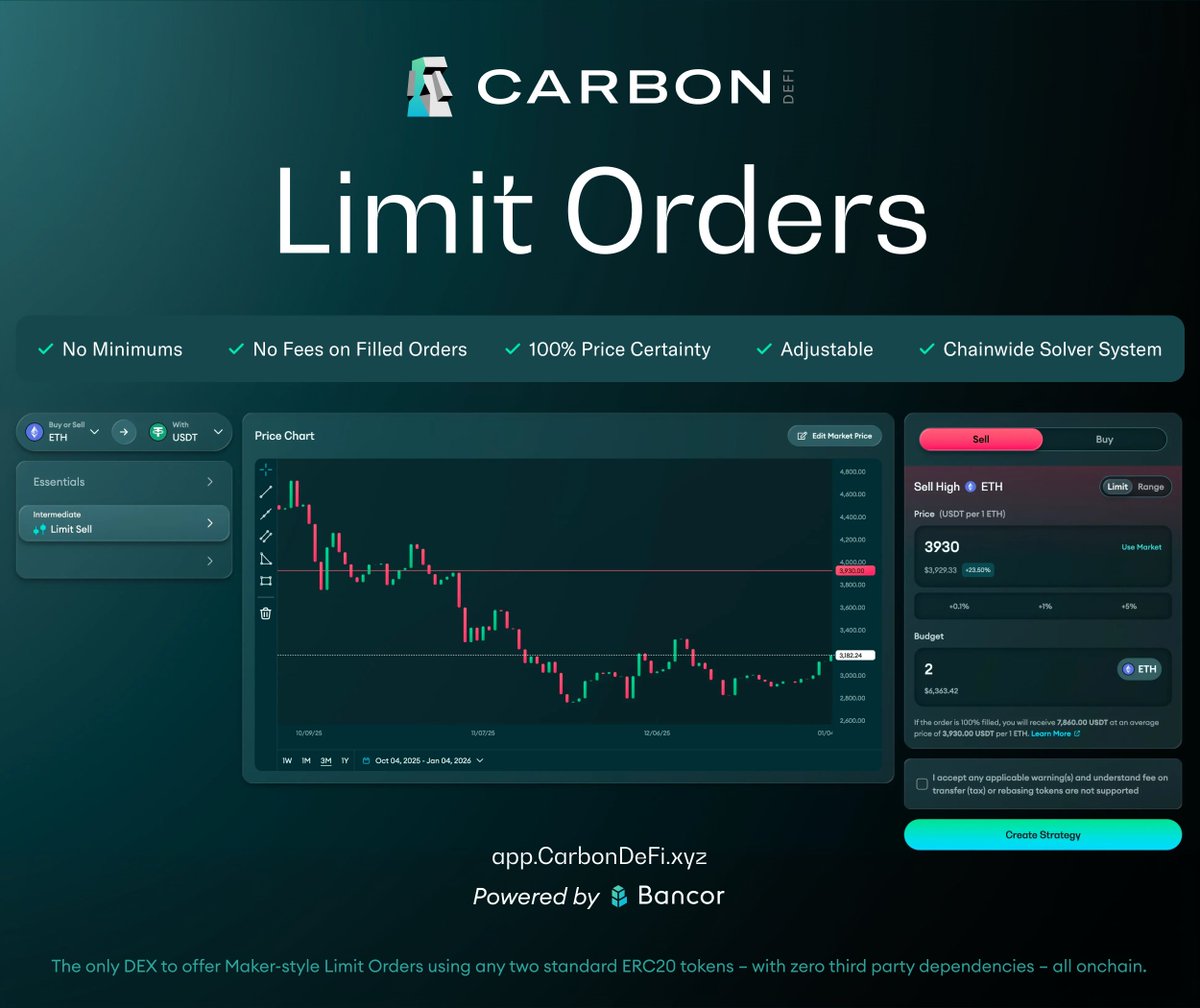

The only DEX to offer Maker-style Limit Orders using any two standard ERC20 tokens – with zero third party dependencies – all onchain. ☑️ 100% price certainty ☑️ Adjustable orders ☑️ Built-in chainwide solver system ☑️ Zero gas/trading fees for Makers 🗿 Carbon DeFi

Before logging off for the weekend, make sure you’re not leaving rewards on the table. Liquidity Mining continues on Carbon DeFi on TAC (🫰,✨️) — distributed via Merkl. $cbBTC | $WETH | $LBTC | $USDT

On Carbon DeFi, the fees (AKA spread) earned through liquidity provisioning are automatically added back into a user's strategy, with zero third party dependencies – no keepers, no oracles, no hooks.

Be your own onchain market maker. On Carbon DeFi, every strategy is independent by design: Every position → Its own "pool". Every token → Its own curve. • Limit Order for exact price execution. • Range Order for scaling in or out of a position. • Linked Recurring

🎉 Kicking off 2026 with a new round of rewards on Carbon DeFi on TAC (🫰,✨️). Incentives are live and distributed via Merkl. $LBTC • $WETH • $cbBTC • $USDT

Edit prices, add or withdraw funds, change strategy type, or pause trading — without canceling and recreating your position. Carbon DeFi 🗿

8 days remain in COTI Earn — Season 2! Create Carbon DeFi strategies on COTI Foundation with any one of the following: $USDC • $wBTC • $wETH • $COTI • $gCOTI and collect daily Token Points (TPs) — convertible to $COTI at season’s end.

Limit orders on Carbon DeFi are filled using chainwide liquidity, and makers receive the exact price they quoted — with full immunity to MEV sandwich attacks. Choose your tokens. Set your price and budget. Create your trading strategy.

Eliminate the need for stacked orders, countless swaps, unpredictable outcomes, and missed opportunities. Create your trading strategy on Carbon DeFi — the only DEX to offer Range Orders native to the protocol, with zero third-party dependencies.

A sandwich attack occurs every 36 seconds on Ethereum. 30 days. 72,283 sandwich attacks. 26,597 victims. Carbon DeFi offers users sandwich attack immunity. 🔗 blog.bancor.network/how-to-gain-im… 🧠 For a deeper dive, see the Sandwich Attack blog series by Project Lead, Mark Richardson

Arb Fast Lane on Celo.eth/acc 🦇 🌳 continues picking up momentum, with a 21% increase in week over week activity. The Arb Fast Lane serves two main purposes: • Serving as Carbon DeFi’s built-in solver system, sourcing liquidity from major DEXs on Celo to fill orders and keep strategies

Bancor is proud to collaborate with Token Engineering Academy Academy and EthCC - Ethereum Community Conference on the TE Research Symposium (TERSE) at EthCC[9] 2026 in Cannes. TERSE provides a technical commons to benefit builders, reviewers, and users alike, helping translate research into deployed systems with fewer

A Range Order on Carbon DeFi allows users to define a custom price range to buy or sell within, without requiring multiple stacked orders or manual swaps. As the market price moves through that range, Carbon DeFi’s built-in solver system (the Arb Fast Lane) sources available