KBC Securities

@kbcsecurities

Official twitter account of KBC Securities

ID: 3683485407

https://research.kbcsecurities.com/ 17-09-2015 07:54:40

834 Tweet

2,2K Takipçi

118 Takip Edilen

We published a Company Note on Kinepolis België titled “Postponements of blockbusters”. We maintain our Buy but lower our Target Price to € 49 as we think Kinepolis will be able to cope with the Covid-19 impact for a considerable time to come.

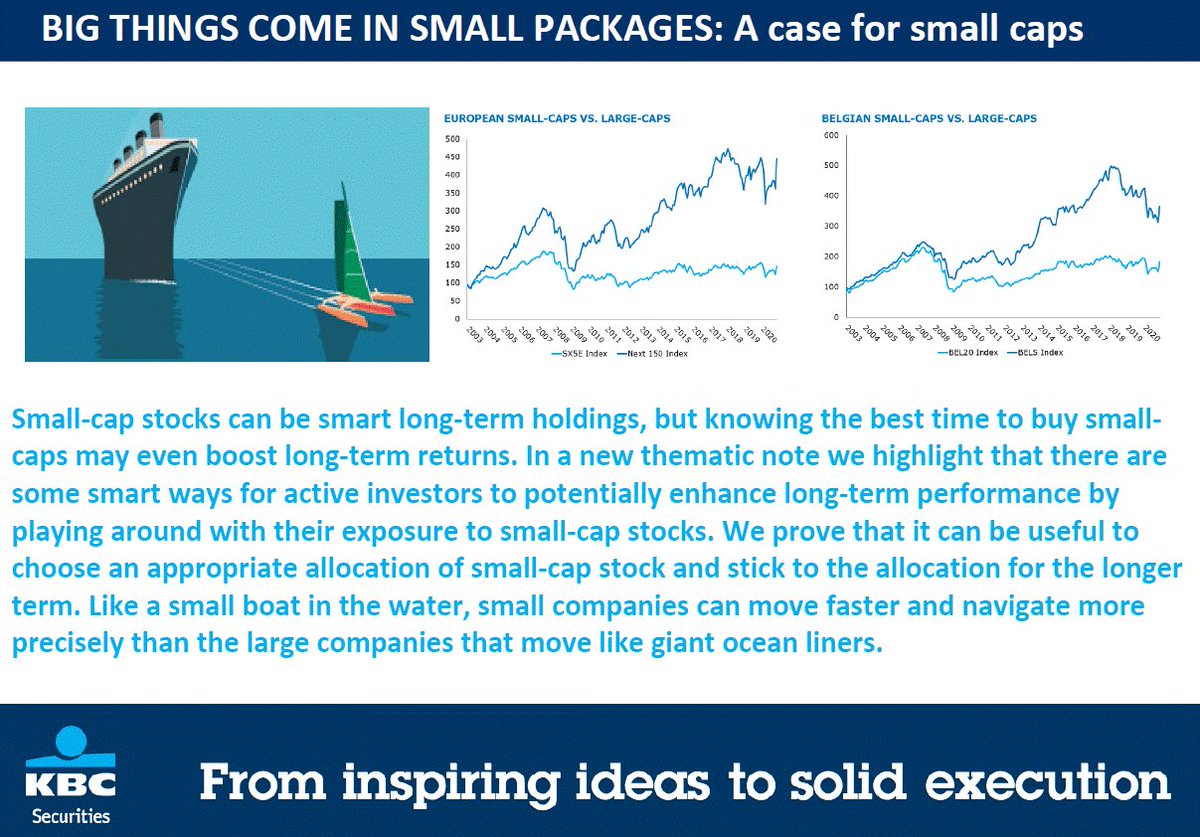

Our last conference of ‘20 started under the loving motto ‘big things come in small packages’. Thanks management teams of #Agfa Barco #Deceuninck EVS Broadcast Equipment Gimv #Greenyard Kinepolis België Materialise Nedap #Recticel #Sipef and smartphoto_be and investors from 8 countries.

Bolero werd door Spaargids.be uitgeroepen tot Beste Beleggingsbank 🙌 Onze collega’s van KBC Bank&Verzekering mochten dan weer voor het tweede jaar op rij de award van Beste Bank en Beste Digitale Bank in ontvangst nemen! Bedankt voor het vertrouwen! 👉 bolero.be/nl/lp/beste-on…