GemX Network

@gemxnetwork

A SocialFi platform for blockchain enthusiasts. Build value from your network.

More Infomation: bio.link/gemxnetwork

ID: 1815646443602075648

https://gemx.io/ 23-07-2024 07:13:51

621 Tweet

11,11K Takipçi

112 Takip Edilen

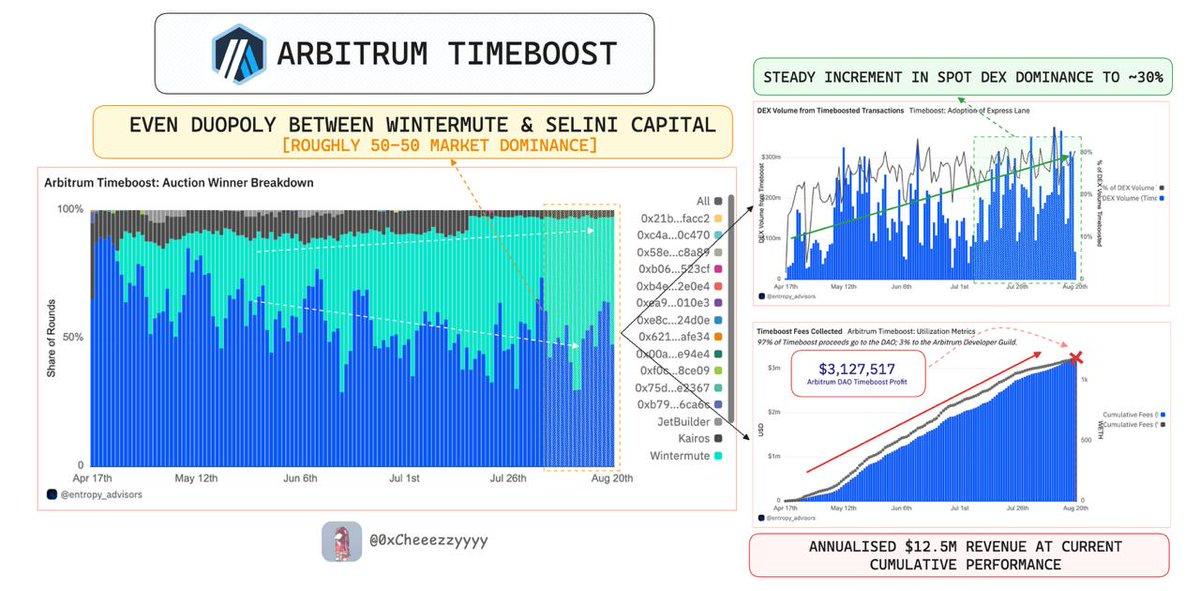

Interesting dynamics around Arbitrum’s Timeboost (MEV mechanism) 4 months post-launch. The auction breakdown is no longer one-sided as Wintermute is now toe-to-toe with Selini Capital, which previously dominated. Meanwhile, ecosystem spot DEX volumes are steadily rising,

I'm supporting Lombard to build the onchain Bitcoin Capital Markets through its Community Sale on Buidlpad Now! @lombard Buidlpad 🧩 $BARD x.com/buidlpad/statu…