Frederico

@fredgbianco

Co-founder @GlueXProtocol @otex_tools

ID: 896901402399821829

http://gluex.xyz 14-08-2017 01:08:52

515 Tweet

2,2K Takipçi

823 Takip Edilen

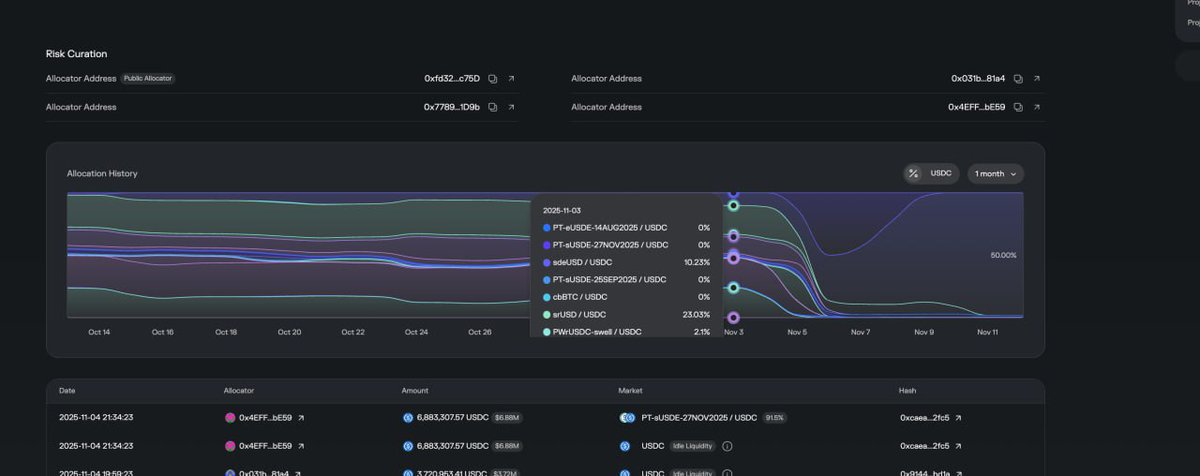

7. This was a huge slap in the face — and a wake-up call. It reinforced why we’re building GlueX Terminal: - to make protocol- and portfolio-level risk visible, - to quantify exposure, - to show what backs every position, and to help users preserve their hard-earned capital.

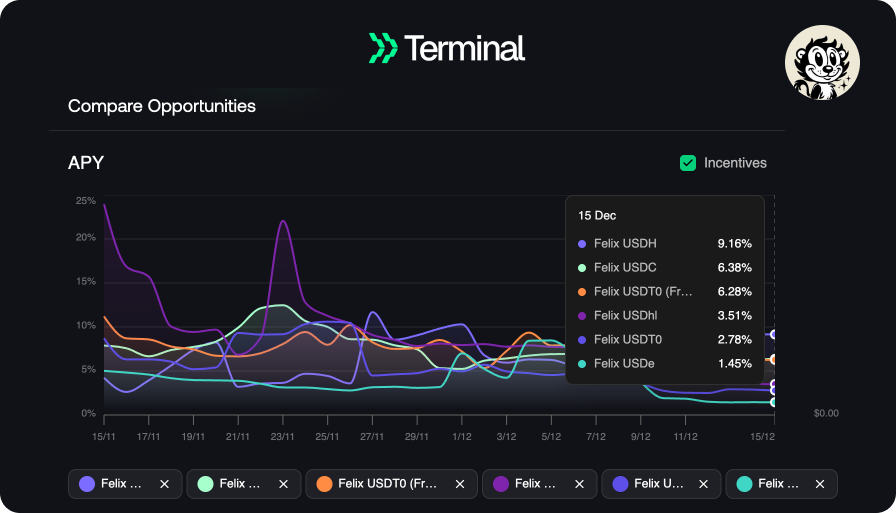

The GlueX Terminal team is shipping quickly. Among the upgrades of today's release: » Consistent date gaps on Invest history chart » Cached results for Invest history. » Interpolation for Invest history. » Pool address in response of Invest options for history. » Underlying

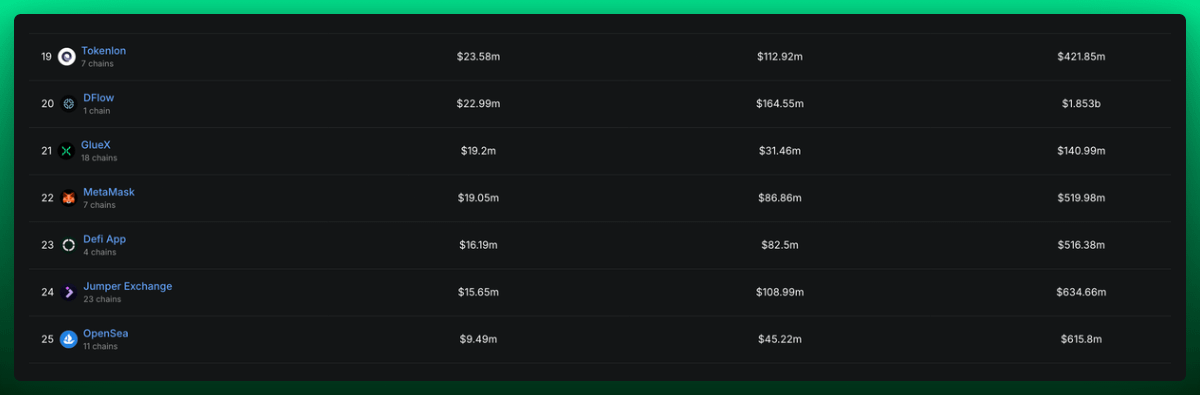

New milestone unlocked: $19.2M+ routed in 24 hours 🚀 That's more than both MetaMask 🦊 and Defi App. This is our biggest day yet on HyperEVM and it's gonna continue getting bigger with the GlueX Terminal Back to shipping. Numbers will follow.

@DefiAndree Pendle Pendle Intern Vu Gaba Vineb TN | PendleBoros RightSide Neo Nguyen Cheeezzyyyy I think you will like what we are cooking with the Terminal. All HYPE-based PT-token in a single bird's eye view.