Thomas Hayes, CFP®

@cedarhillfg

Financial Advisor and Planner. Helping individuals & families pursue their goals.

Securities offered through LPL Financial, Member SIPC sipc.org

ID: 1651952426205806593

http://CedarHillFinancialGroup.com 28-04-2023 14:12:18

266 Tweet

161 Takipçi

164 Takip Edilen

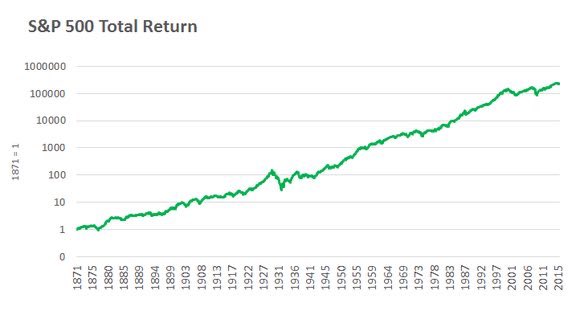

If you spent a day scrolling through social media, you would probably develop an expectation of success that meant being a millionaire by your 30s. I recently finished reading Nick Maggiulli new book The Wealth Ladder, and he’s done some amazing work digging into the data on