Simon Baptist Econ

@baptist_simon

Ex Chief Economist @TheEIU, now working in finance. Passionate about the optimal allocation of scarce resources.

ID: 128505500

http://www.eiu.com 01-04-2010 09:46:47

1,1K Tweet

9,9K Takipçi

1,1K Takip Edilen

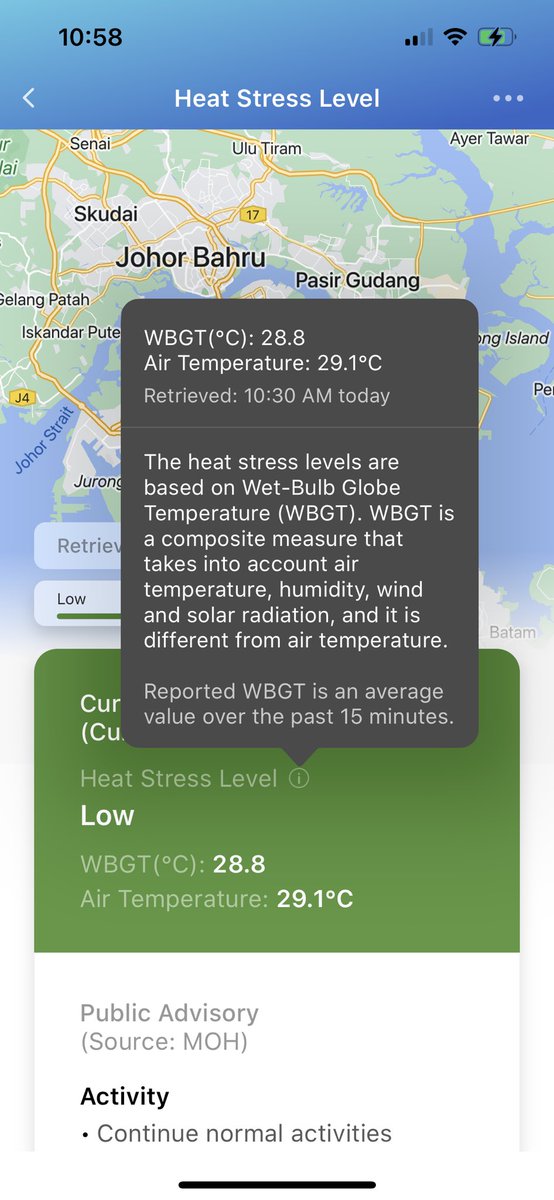

Interesting update to the Singapore Government weather app: wet bulb temperature now added. Quite looking forward to seeing how useful it is for timing runs! Not looking forward to the #ClimateCrisis #climatechange it reflects

Hear how China's economic slowdown could hurt and benefit other countries from Simon Baptist Econ cnn.com/videos/busines…

#OnCNBCTV18 | Higher rates are going to persist till the end of 2024 says Simon Baptist Econ, Chief Economist Economist Intelligence: EIU. Tells Pavitra Parekh & Reema Tendulkar that he sees inflation inching closer to 2% in developed markets by the end of 2024 WATCH: youtu.be/23Fd1oWgbrk