_Adam Mancini

@adaamrancini4

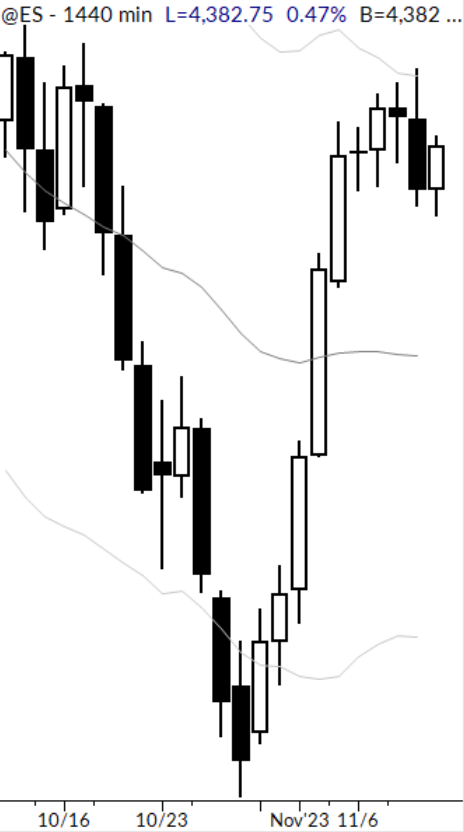

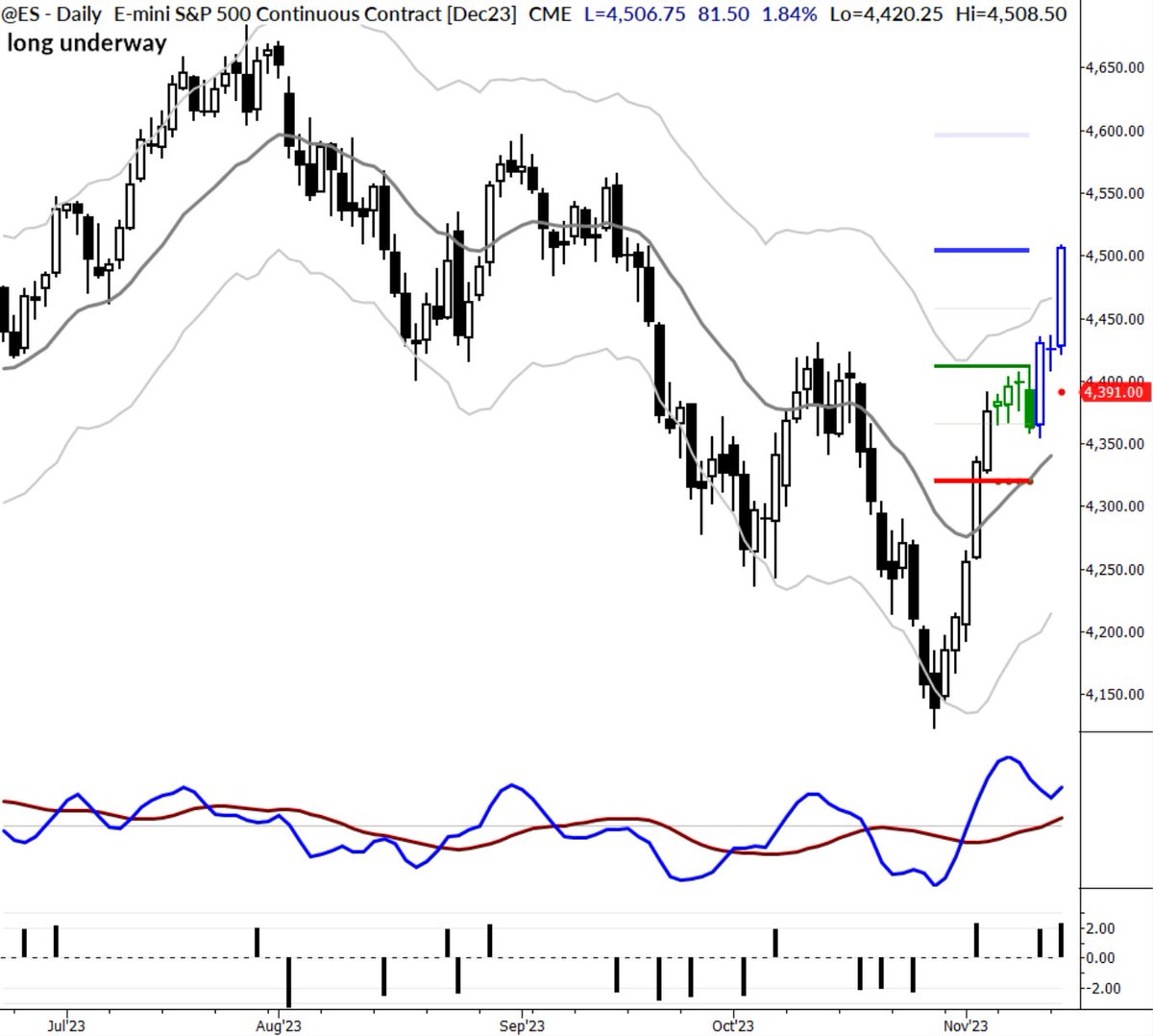

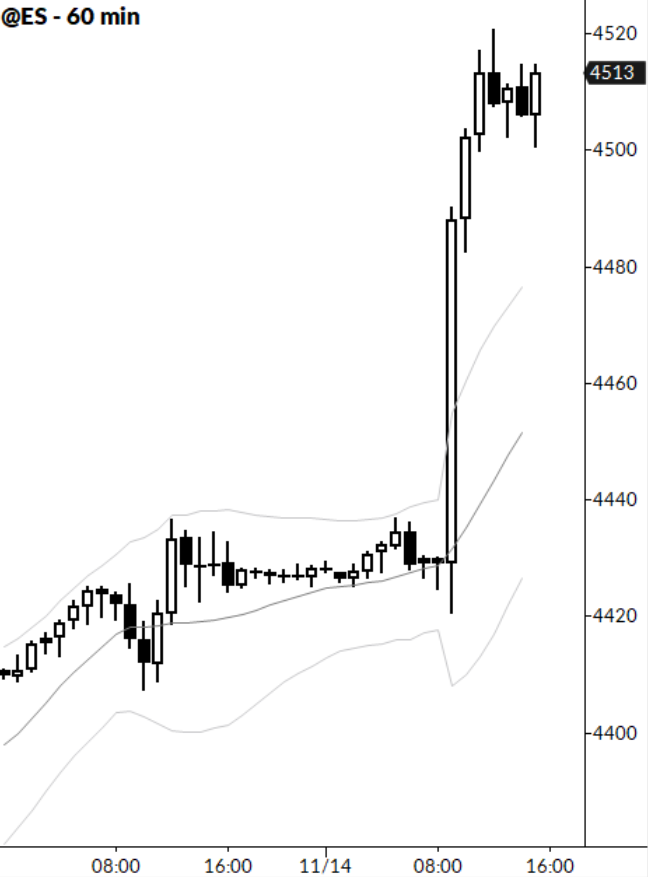

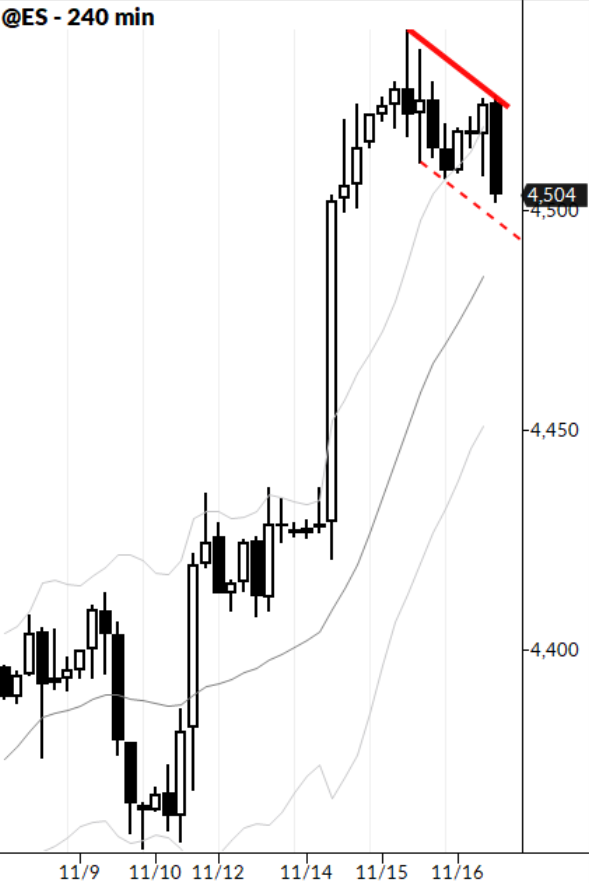

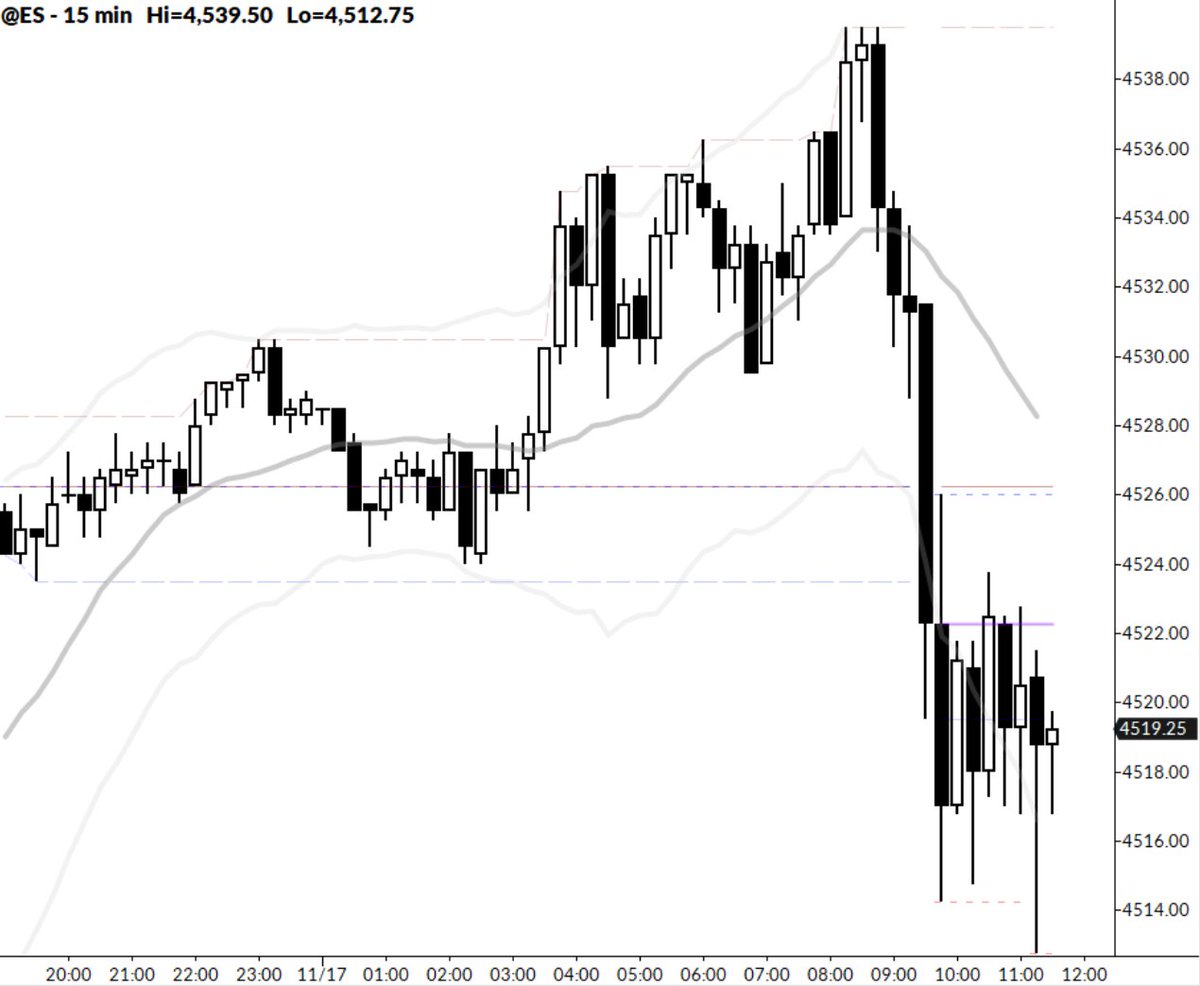

Full-Time Futures Trader ES intraday, also swing

trade ETFs 2-7 day holds. Fully transparent

approach. Posts for my notes only!

ID: 1630419284

http://tradecompanion.substack.com 29-07-2013 13:55:14

20 Tweet

230 Takipçi

1,1K Takip Edilen