Anugrah Shrivastava

@anugrah_shrivas

Changing how India invests @smallcaseHQ @TickertapeIN @windmillcapHQ @ZerodhaAMC. Views are personal

ID: 27628792

http://smallcase.com 30-03-2009 12:42:40

2,2K Tweet

10,10K Followers

245 Following

I have a piece with Manas dhagat and Pranjal in today’s Economic Times on the proposed changes on insider trading regulations. These proposals with have the disadvantage of 100% false negatives AND 100% false positives. In other words it will only catch the innocent in a

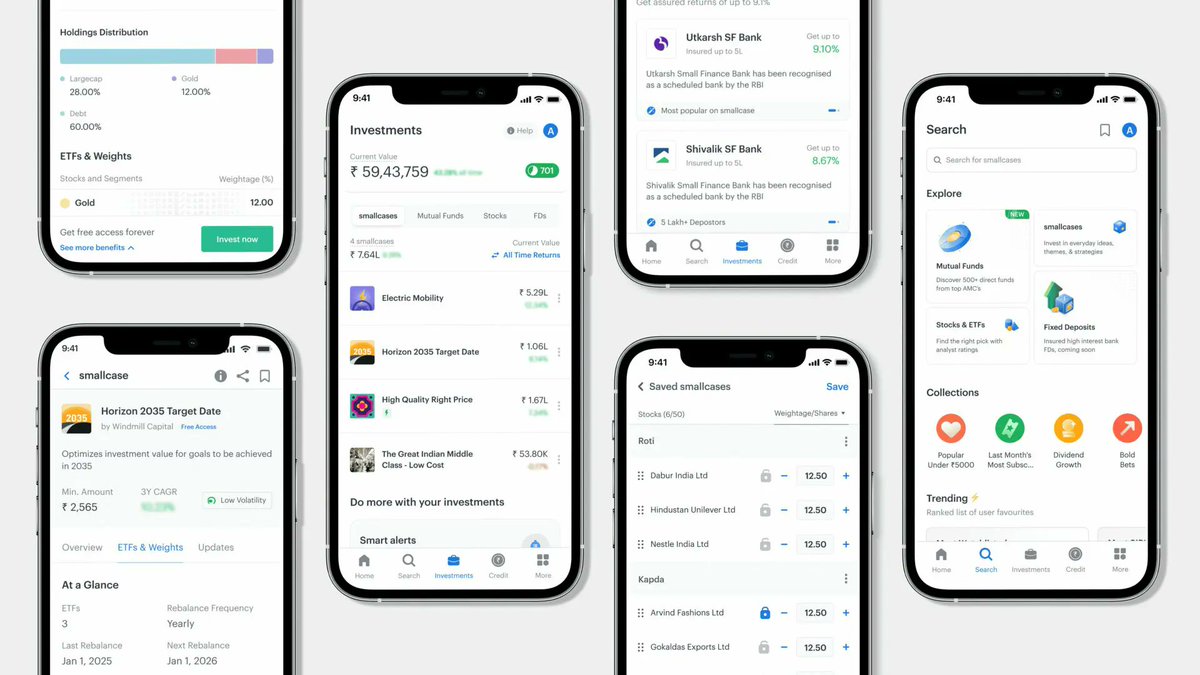

Thanks Financial Express Anant Goenka & jury for awarding smallcase Best Fintech - Investments for the year. Was an honour to receive it from Hon FM Nirmala Sitharaman on behalf of the entire smallcase ecosystem. V proud of the team & grateful to all our partners for their support 🙏🏻

I have a piece in today’s Financial Express with Navneeta Shankar and Manas dhagat ‘Brokers get a side hustle’ on the important reform brought by the Finance Ministry - which increases the regulatory perimeter allowed to brokers, who can now do more allied businesses (without