Andrew W. Miller

@andrewwmiller2

Legal Analyst @BLaw | #TransactionalLaw | Opinions mine | RT not endorsements

ID: 1577720118183956481

05-10-2022 17:59:44

14 Tweet

97 Takipçi

65 Takip Edilen

2023 is coming! In my first piece for Bloomberg Law, I delve into the state of venture capital investing and the consequences associated with a company's decision to raise funds at a lower valuation than in a prior round. Hope you enjoy! Bloomberg Law news.bloomberglaw.com/bloomberg-law-…

🆕 VC people, especially lawyers in the VC space, don't miss my colleague Andrew Miller's Bloomberg Law 2023 outlook analysis 👇 #VentureCapital #lawtwitter

Venture-backed companies are facing the reality that a future fundraising round may spotlight their diminishing value. Reputational concerns aside, what harm can a down round cause and what alternative options are out there? Andrew W. Miller takes a look. news.bloomberglaw.com/bloomberg-law-…

Credit investors see opportunity on the horizon. Venture-backed companies shouldn't fret too much though, as they have a chance to demonstrate how both sides benefit from the revisions they'd like to see themselves. Bloomberg Law #venturecapital news.bloomberglaw.com/bloomberg-law-…

The #IPO market was down big in 2022–but how does that decline compare to past market downturns? Also, how might a changed rule for direct listings affect IPOs? Bloomberg Law news.bloomberglaw.com/bloomberg-law-…

2022 put a damper on private investments around the world. I considered investment trends and identified who dominated the market. From diversity among business founders to deal terminations, see what happened: #privateequity #venturecapital #diversity news.bloomberglaw.com/bloomberg-law-…

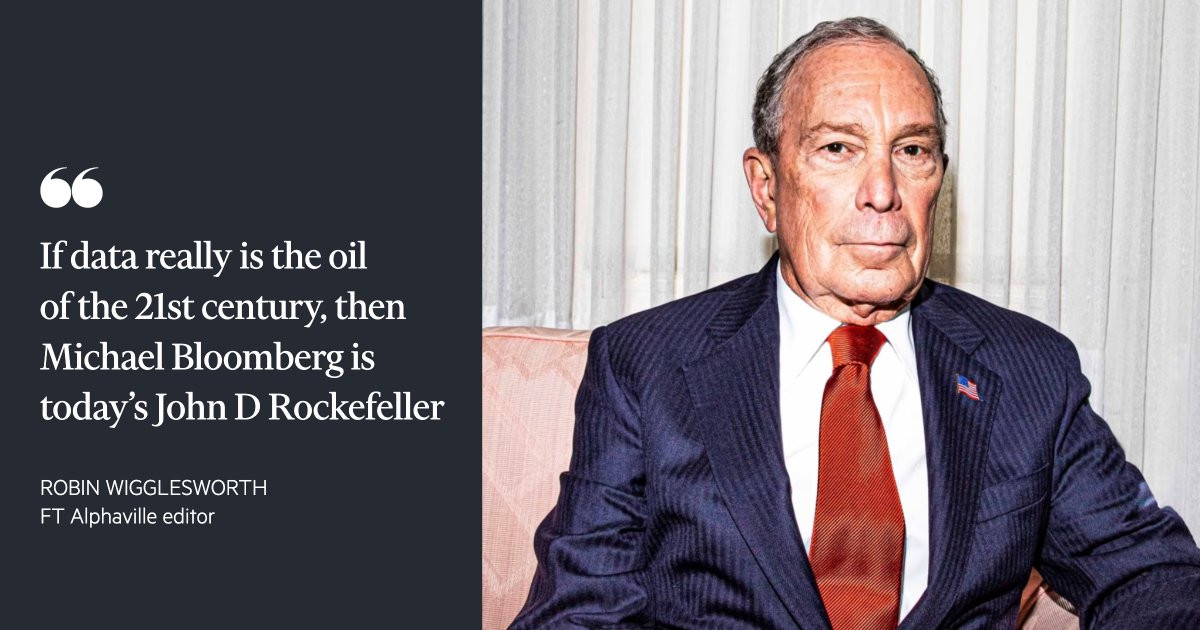

Bloomberg after Bloomberg: Robin Wigglesworth on the machine that Mike built and who stands to inherit it on.ft.com/3ov4uUp

Saudi investment firms are growing their international holdings and global influence. The steady stream of investments abroad, especially in promising startups, will be something for US-based entrepreneurs to watch closely. #innovation #privateequity news.bloomberglaw.com/bloomberg-law-…

Some in the private equity industry are frustrated by policies they say give existing banks an unfair advantage at failed-bank auctions. My piece challenges whether material drawbacks make the enhanced terms they seek undesirable. #PrivateEquity #fdic news.bloomberglaw.com/bloomberg-law-…

Thematic ETFs are slated to stay in vogue-spurred on by investor intrigue as focus shifts to a newfangled type of crypto ETF. I'd wager that thematic ETFs will benefit from increased interest in funds tapping into emerging trends in compelling fashion. news.bloomberglaw.com/bloomberg-law-…