Anand Kalyanaraman

@anandg_kalyang

Finance Editor at The Ken. ✍️ long-form stories & Ka-Ching! a finance newsletter. Past bylines at The Hindu BusinessLine. Have a thing for rhymes & poor jokes.

ID: 881856510900318208

03-07-2017 12:45:51

2,2K Tweet

4,4K Followers

1,1K Following

In today's longform, Anand Kalyanaraman explains why. the-ken.com/story/in-hexaw…

Hexaware’s second coming: an IPO that’s more exit than entry. Its Rs 8,750 crore IPO—the biggest IT services listing since Tata Consultancy Services raised Rs 4,700 crore nearly 20 years ago—is a matter of cheer as well as caution argues Anand Kalyanaraman the-ken.com/story/in-hexaw…

In this week's Long and Short, Anand Kalyanaraman explores. the-ken.com/long_and_short…

Was the market veteran's hand forced, and were his words censored? Anand Kalyanaraman reports: the-ken.com/story/icici-pr…

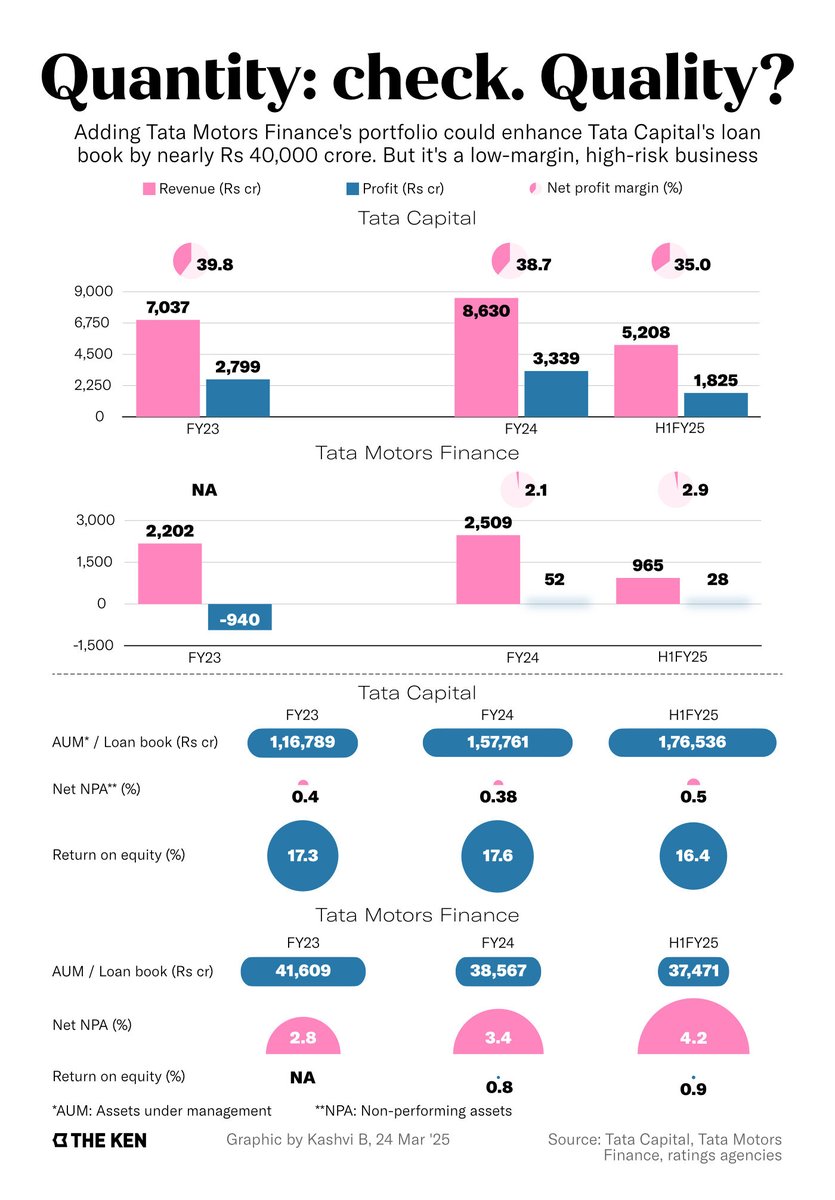

Tata Capital’s IPO has a Tata Motors problem. A merger with the automaker's finance arm adds Rs 40,000 crore to Tata Capital’s book—but will dent its financials. How come? Anand Kalyanaraman reports.

How is the BSE scrip racing ahead of its larger unlisted rival? Thanks to peppy tidings and a little help from Sebi, writes Anand Kalyanaraman in this week's Long and Short. the-ken.com/long_and_short…

It’s a big risk that retirees need to be aware of and manage if they don’t want to run out of money in their silver years. So, how should one deal with this? Anand Kalyanaraman explains with the help of a new paper in this week's Ka-Ching! the-ken.com/kaching/trumps…

However, RBI restrictions prevent investors from using the mutual-fund route to invest overseas. And the alternative is sub-optimal. Anand Kalyanaraman reports: the-ken.com/story/buy-the-…

And with it, it gives the market something it desperately wants—hope, writes Anand Kalyanaraman in this week's Long and Short. the-ken.com/long_and_short…

In this week's Long and Short, Anand Kalyanaraman explains why the asset manager’s idea of disruption seems impractical. zurl.co/ry0eO

The ultra-secretive hedge fund, known for discouraging even Linkedin profiles, is now under Sebi’s scanner for potential rigging. While retail traders bled, Jane Street is said to have raked in up to $3 billion in India. Anand Kalyanaraman reports: the-ken.com/story/is-jane-…

Read Anand Kalyanaraman's investigations here: 1. 'The mystery fund playing God and wreaking havoc on the stock market '- the-ken.com/story/the-myst… 2. 'Is Jane Street the all-powerful hidden hand in India’s stock market?' - the-ken.com/story/is-jane-…

In this week’s Long and Short, Anand Kalyanaraman explores why the stock exchange became the watchdog that didn’t bark. the-ken.com/long_and_short…

What's the motive behind Prudential's choice? Anand Kalyanaraman reports: zurl.co/Cjt34

In this week's Long and Short, Anand Kalyanaraman explains why. the-ken.com/long_and_short…

In this week's Two by Two, Rohin Dharmakumar and Praveen Gopal Krishnan decode the Jane Street saga with Anand Kalyanaraman—who broke the story for The Ken—and Mayank Bansal, the source who brought the information to him. Apple - podcasts.apple.com/in/podcast/the… The Ken - the-ken.com/podcasts/two-b…