Alibra Shipping

@alibrashipping

Alibra is a London-based shipbroking company, specialising in project business. Est 2006.

ID: 3039263939

http://www.alibrashipping.com/ 15-02-2015 16:09:54

1,1K Tweet

2,2K Takipçi

564 Takip Edilen

The start of something sweet, or will it all turn sour as per... Cape prospects with thoughts from JM Radziwill, Alibra Shipping, @BIMCO_PS, Braemar ACM, Lorentzen & Stemoco and Fearnleys splash247.com/cape-resurgenc…

Capesize prosperity may be short-lived. Our analyst in TradeWinds today tradewindsnews.com/bulkers/capesi…

Capesize period rates at the highest levels seen this year and up 17% month-on-month. Alibra quoted in TradeWinds tradewindsnews.com/bulkers/rare-c…

Capesize spot rates sail in to correction territory. Alibra in TradeWinds tradewindsnews.com/bulkers/capesi…

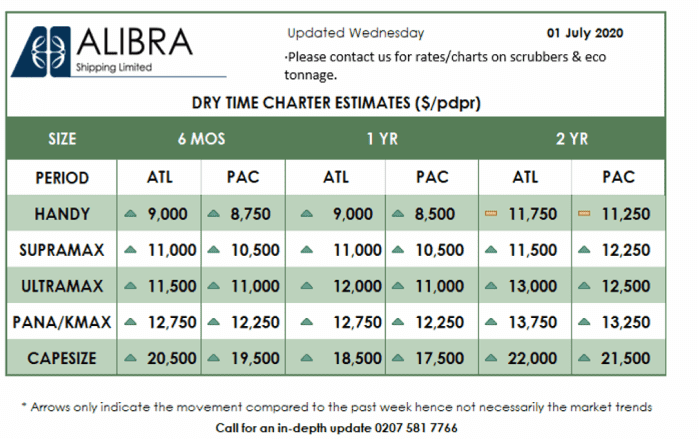

The #capesize market has entered into a period of self-correction following the bullish sentiment of the past few weeks, rates have moved slightly lower. The estimated rate for a cape for 6mths is currently $20,500/pdpr. For more wet&dry TC estimates see: alibrashipping.com/timecharter-ra…

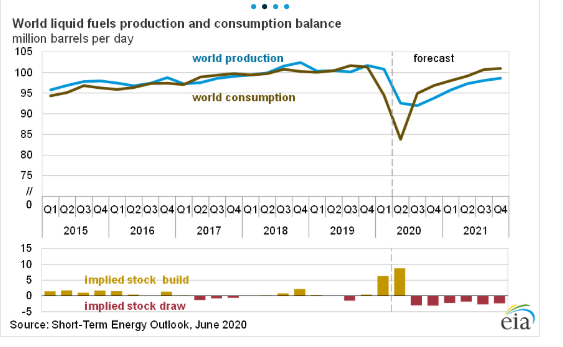

The crude market has been quiet overall with the summer season underway, some activity has been reported in the Aframax sector mainly focused on short-term. The clean market has been quiet with few period fixtures reported this week.For more TC rates see: alibrashipping.com/timecharter-ra…