Alex Johnson

@alexh_johnson

Writing and podcasting from the 🏔️ | @FintechTakes

ID: 38740096

https://fintechtakes.com/ 08-05-2009 20:42:58

18,18K Tweet

25,25K Takipçi

3,3K Takip Edilen

Is Chase going to be the only bank charging for API access? I put that question to Bloomberg Law's Evan Weinberger on the Fintech Takes podcast. Short answer: Unlikely. Longer answer: Just ask PNC’s CEO, who gave Chase a standing ovation on an earnings call and said they’re

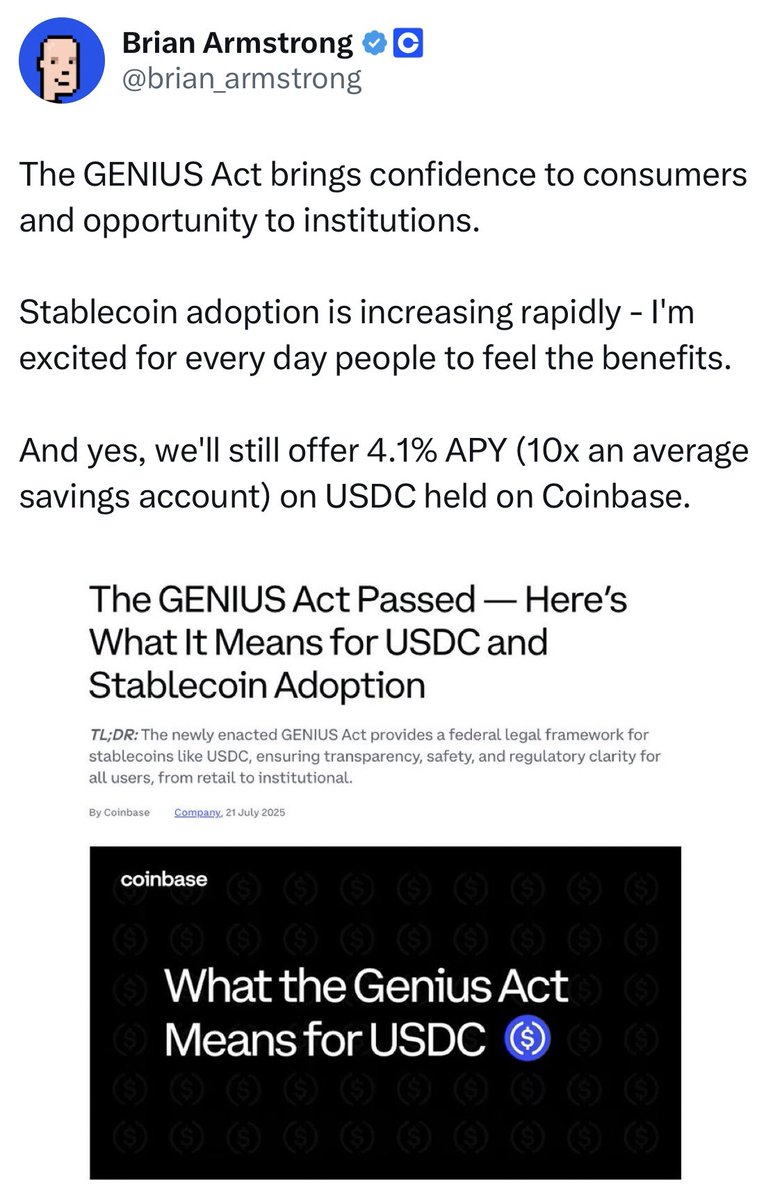

Stablecoins, Tokenized Deposits and the Race to Win the Future of Money. An absolute must-listen podcast with Alex Johnson. With GENIUS Act now law, will stablecoins replace banks? Or do banks secretly have the upper hand? Link in the replies:

New podcast just dropped 🎙️ It’s called Model Citizens, and it’s a six-part miniseries I’m doing with the team at FairPlay AI. The idea behind it is pretty simple: We’re at a weird moment in financial services where AI is accelerating, regulation is … wobbly, and compliance