Alan Smith

@alanjlsmith

Wealth Management for Entrepreneurs | Founder | Storyteller | Truth Seeker | Podcast 🎧 bulletproofentrepreneur.net 🏴☠️

ID: 24665667

http://www.capital.co.uk 16-03-2009 08:14:48

25,25K Tweet

18,18K Takipçi

2,2K Takip Edilen

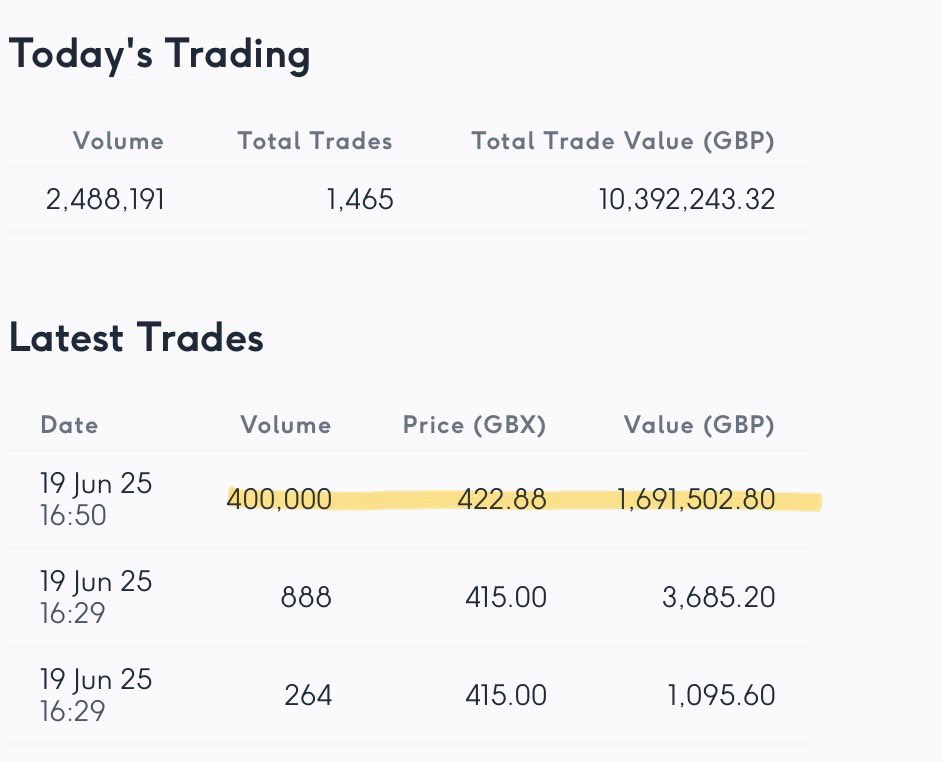

Amongst all the doom and gloom it’s great to see a small British company do so well. IPO’d recently at 2.5p - and almost at £2.00 now. Congratulations The Smarter Web Company Andrew Webley (Not advice)

The Financial Times don’t get it ft.com/content/80019d…

One week on; The Smarter Web Company is the most successful IPO in UK history - and fastest ever to unicorn 🦄 status (£1 billion valuation). Nice to end the week with some good news for British business. Enjoy the sunshine! 😎