Austin Clark

@ac_trades_yt

Army Veteran | Funded Trader using excel spreadsheets and being dumb to 90% of everything else | VERY boring content here: youtube.com/@ACTrades

ID: 1478895265541234695

https://discord.gg/packtradegroup 06-01-2022 01:04:52

12,12K Tweet

12,12K Takipçi

171 Takip Edilen

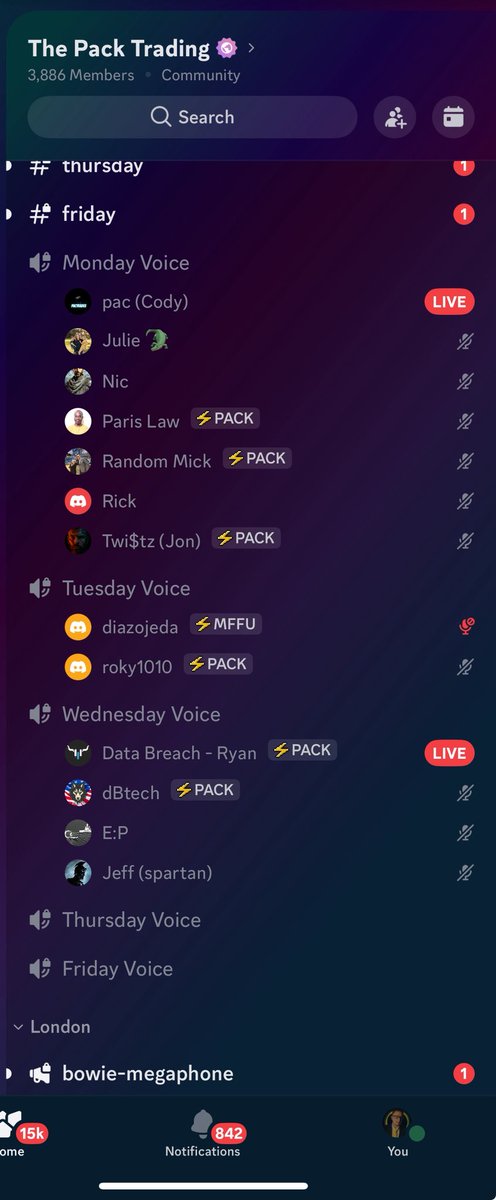

I’m telling you all, Random Mick & I are building an absolute empire of professionals. Saturday and the bootcamp members are grinding getting after what they want. Viewing price from an objective, repeatable, & measurable lense. So proud of these people