Tim Quast

@_timquast

Founder/CEO of ModernIR and Market Structure EDGE LLC. Invented Market Structure Analytics for IR. Expert on equity market structure.

ID: 3438009095

http://modernir.com 24-08-2015 14:22:56

3,3K Tweet

3,3K Followers

194 Following

As the Market Structure EDGE mob knows, new options for August expiration traded today. Stocks started strong and finished weak on less demand for leverage than anticipated. Tomorrow is #CounterpartyTuesday when the books on these and the ones expiring last week are squared.

Round of applause for The Wall Street Journal Heard writer Spencer Jakab for today's great piece: Why are stock up? Nobody knows. wsj.com/finance/stocks…

Weave Tour de France 2025 Live Stream into weekly blog: Check. The market has been like Mont Ventoux - a big climb. There's also a big descent off Ventoux. modernir.com/does-anybody-k…

As we await the open and later today Federal Reserve chair Jay Powell's comments, ponder this. Multiples aren't what you should watch for market signals. Watch the gaps. modernir.com/human-nature/

Wrote this today for the Interactive Brokers #quant blog. interactivebrokers.com/campus/ibkr-qu…

My last post was a joke. Jocularity. This is serious, you great economic minds like Mark Zandi Nick Timiraos Steve Liesman: Jeff Gundlach (I have funds at DoubleLine via managed accounts) notes oil has not rallied on a weak dollar. Are #oil, #copper, etc., incipient #deflation?

Still think active management beats the markets? Larry Swedroe out with another strong piece demolishing the idea that active managers can outperform indexes over time. He notes: 1) 97% of active funds underperformed on a risk-adjusted basis over 20 yrs; 2) "the winner's game

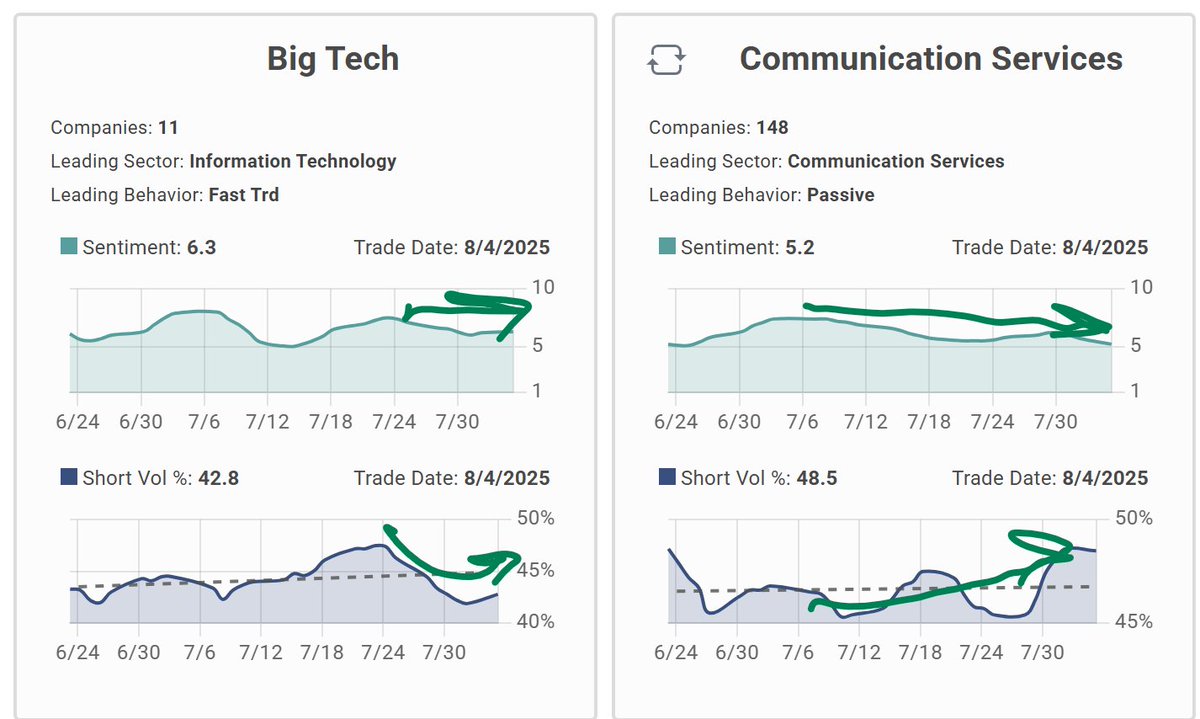

Here's Demand/Supply in the Mag 7+, and Comms Svcs (they're next to each other on my Market Structure EDGE dashboard). Nothing wrong, but there's a change Aug 1 in fund cycle. Slow convergence. Without a shift, that will bring a slow bleed.

I'll be yammering about #marketstructure with Joel Elconin Dennis Dick, CFA today in a few minutes. Come heckle! youtube.com/live/ZJ4DBj3o6…

I shared this view with the Market Structure EDGE mob today. A snippet of my dashboard showing Demand/Supply divergence abounding into Aug #optionsexpirations (save crypto -- both up, Energy with flat Demand). But. Every single Supply trend is up. That will come around.

Demand and Supply in $SPY Jul 2017 to now (full Market Structure EDGE data set). Demand troughs to 1.0 in $SPY have always had another leg or more. Until now. Or it's coming yet. Supply 6/25 hit 73% and was only ever higher once, 12/15/21. But who knows? Just #marketstructure.