USD Denominated

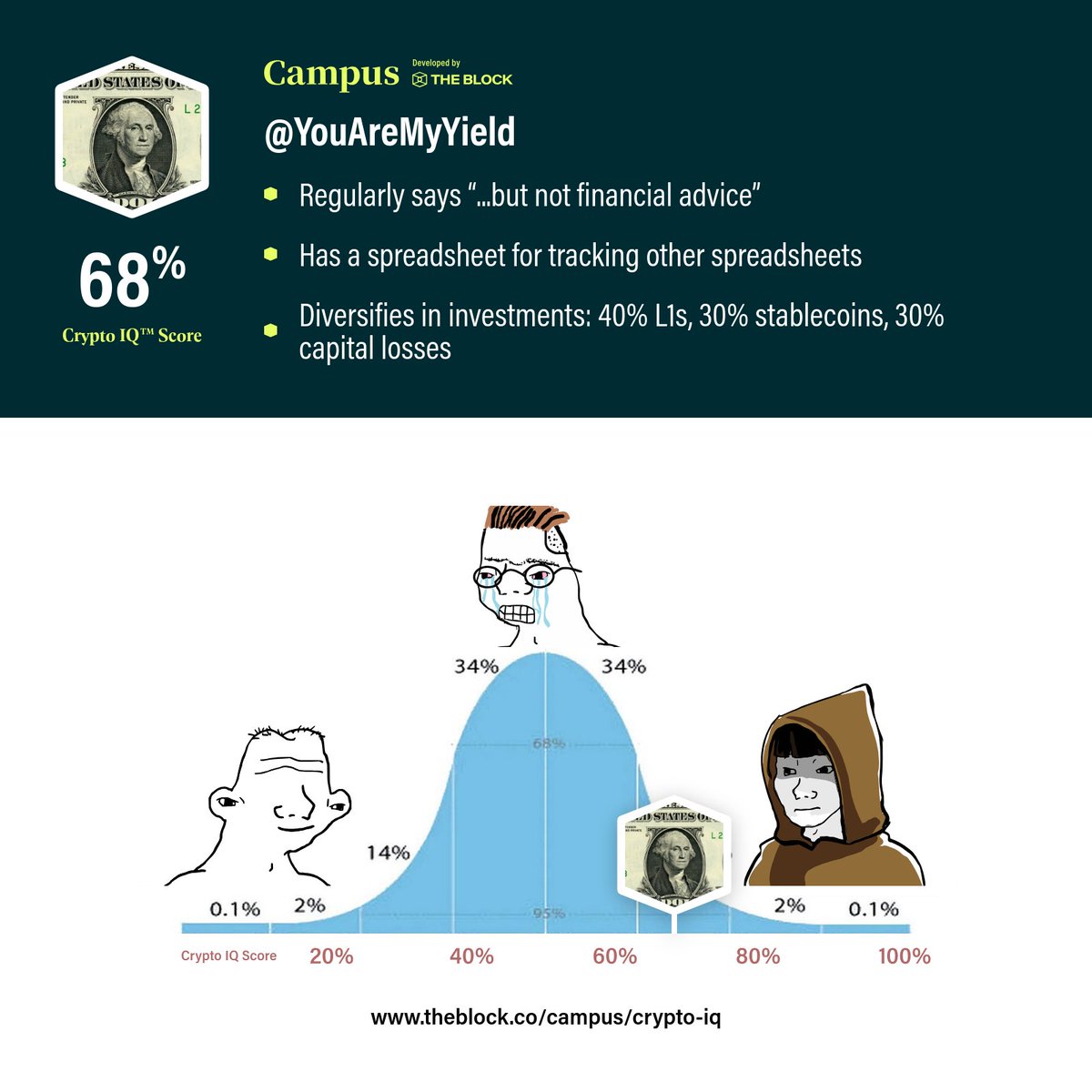

@youaremyyield

Looking for yield

ID: 1446091034799259658

07-10-2021 12:32:42

2,2K Tweet

3,3K Takipçi

697 Takip Edilen

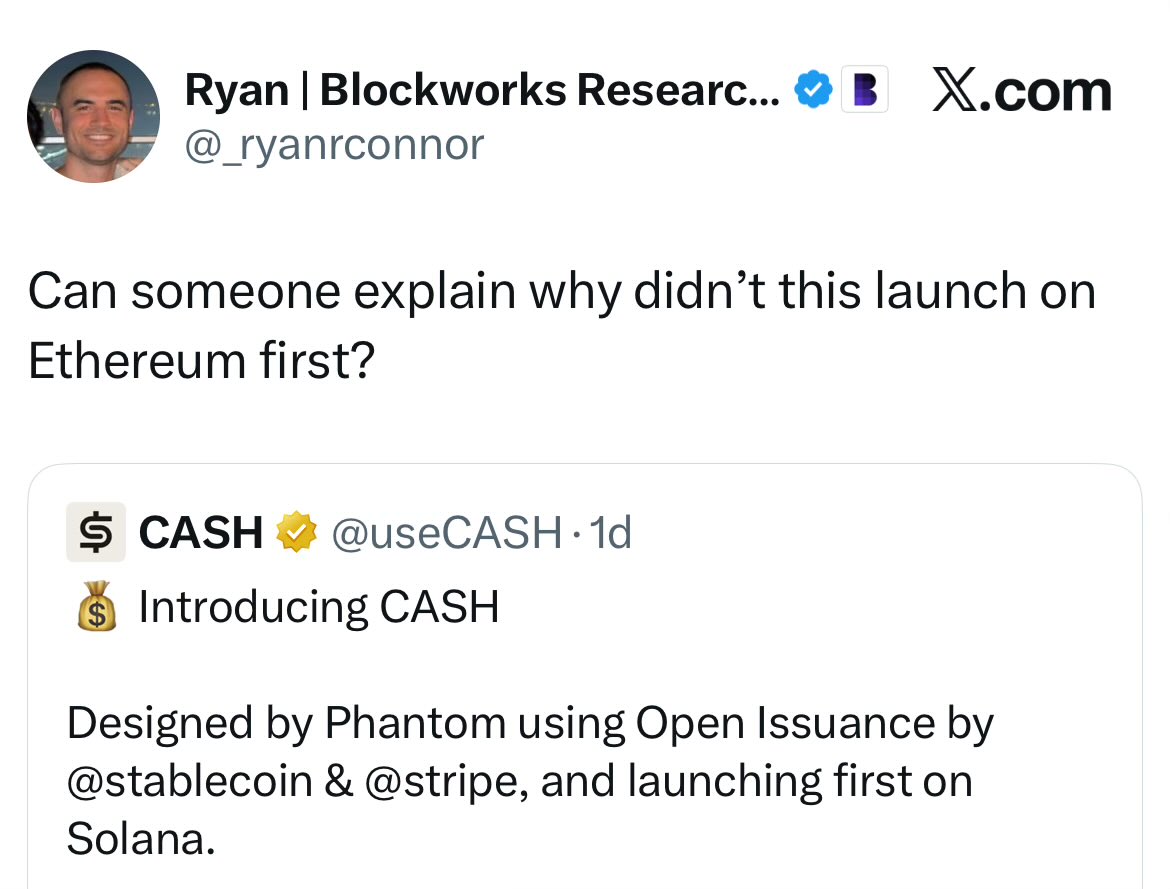

The grift has been going on for way too long, normalize calling out the responsible CEO Hayden Adams 🦄