Yash Jain

@YashJain88

Special Correspondent @CNBCTV18News. Financial journalist by profession, dancer & swimmer by passion

Instagram: https://t.co/j4m2ebkgd3

ID:748158793205219328

https://www.cnbctv18.com/anchor-hub//yash-jain-39/ 29-06-2016 14:18:51

7,9K Tweets

23,7K Followers

232 Following

Follow People

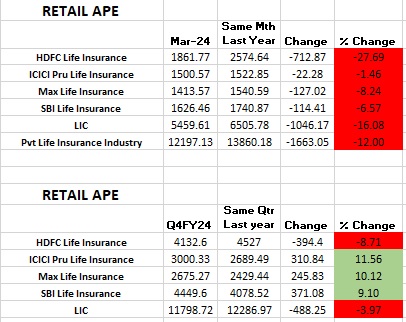

Life Insurance Data | Life insurance data for the month of March shows all life insurers have registered growth except HDFC Life with SBI Life Insurance, LIC India Forever exhibiting strongest growth. Yash Jain with the details

WATCH:

youtu.be/lxCYpqmsrdQ

#4QWithCNBCTV18 | #Q4 net operating profit grew 14% on an unadjusted basis says Vibha Padalkar of #HDFCLifeInsurance . Tells Yash Jain that Tier-II & III premium grew by 30% in #Q4 FY24

Watch:

youtu.be/H9uwTkks0pw?si…

#4QWithCNBCTV18 | ICICI Lombard GIC buzzing in trade on strong Q4 earnings. The company reported strong growth of 36% in the health portfolio. Yash Jain gets us the details

Watch👇

youtube.com/watch?v=usllDj…

Macquarie On ICICI Lombard

Reiterates Underperform With Target Price Of Rs 1,110

ALL EYES ON COMBINED RATIO

Mgmt Guided For Combined Ratio Of 101.5 Vs 102 Earlier

Valuations Look Expensive At 6.1X FY25 P/B Vs Target Multiple Of 4X

#ICICILombard #Macquarie #Brokerage #Results

HDFC Life Opens Higher In Trade!

Q4FY24 Results Today During Market Hours

Also, Citi Upgraded HDFC Life To BUY With Target Price Of Rs 720

CNBC-TV18 CNBC-TV18 Prashant Nair

#HDFCLife #LifeInsurance #Insurance #Market #Stocks #Results #Earnings

#4QWithCNBCTV18 | ICICI Lombard GIC reports #Q4Results

▶️Combined Ratio at 102.2% vs 104.2% (YoY)

▶️Net profit up 19% at Rs 520 cr vs Rs 437 cr (YoY)

▶️Gross premium up 22% at Rs 6,073 cr vs Rs 4,977 cr (YoY)

▶️Return on Average Equity at 17.8% vs 17.2% (YoY)

.Aditya Birla Group launches #ABCD , a financial svcs app, marks a mega B2C bet.

- Also anounces plans to start jewellery retail biz with an outlay of ₹5,000 cr

Rachna Dhanrajani Yash Jain

#NewsFlash | Zee Entertainment to withdraw the merger implementation application from NCLT against Sony.

Decision taken by the Board after seeking appropriate legal advice, says Zee Entertainment

#zeeentertainment

Here's more👇