WOWA.ca

@wowa_canada

Personal finance encyclopedia with over one million monthly page views

ID: 1060271328522092545

https://WOWA.ca 07-11-2018 20:42:38

1,1K Tweet

9,9K Takipçi

24 Takip Edilen

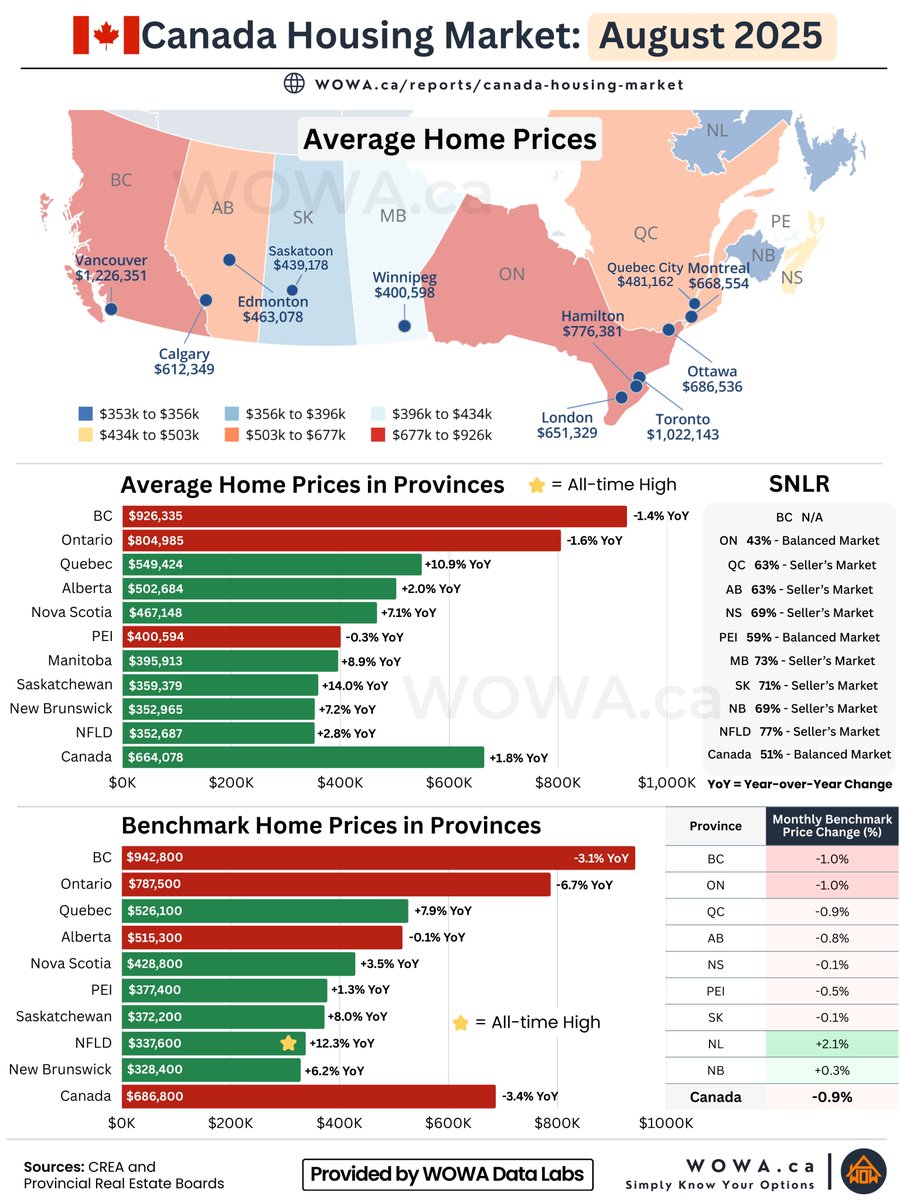

From boom to strain: Toronto area housing faces a wave of distressed sales via The Globe and Mail from my boy Hanif Bayat. Good stuff as always! theglobeandmail.com/investing/pers…

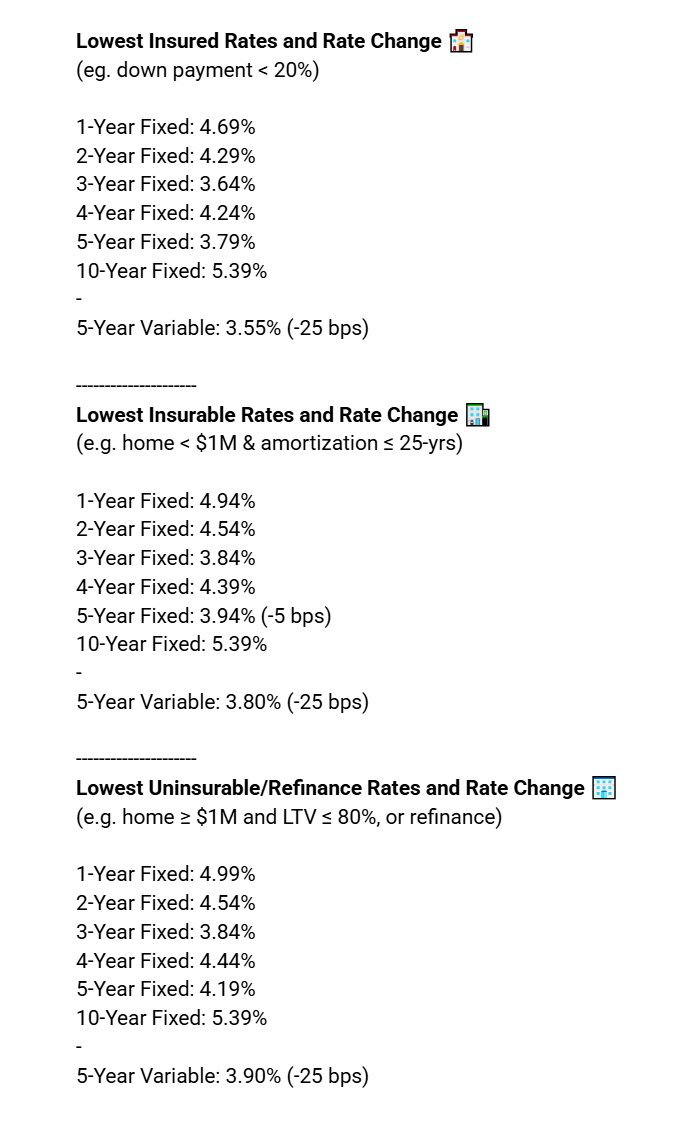

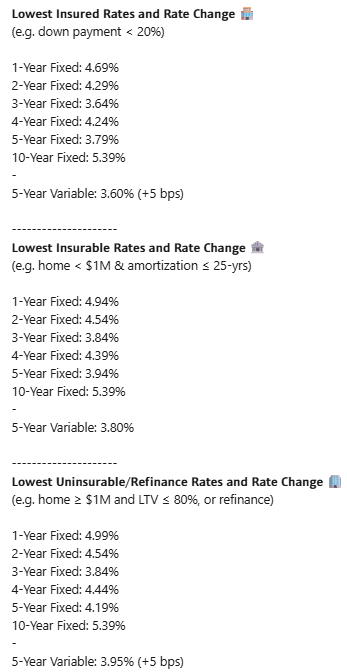

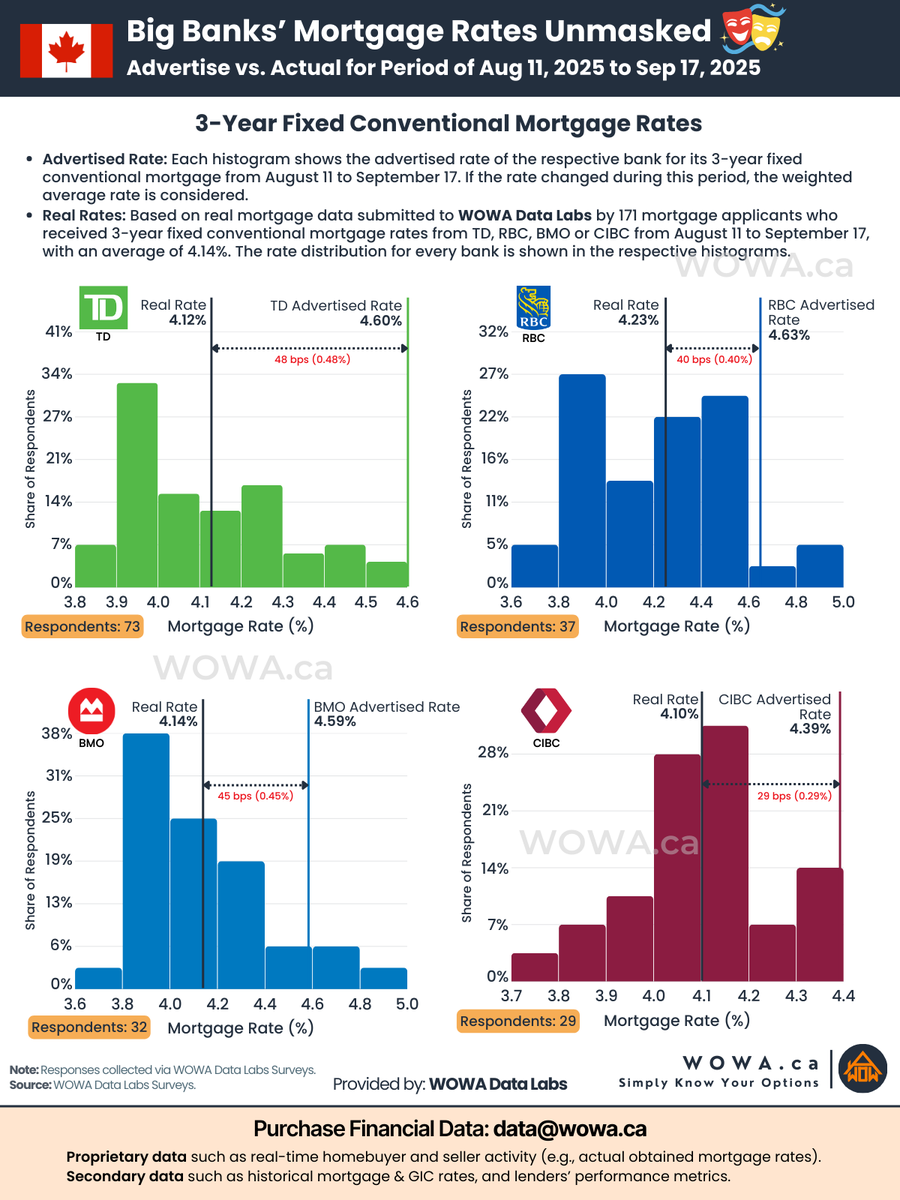

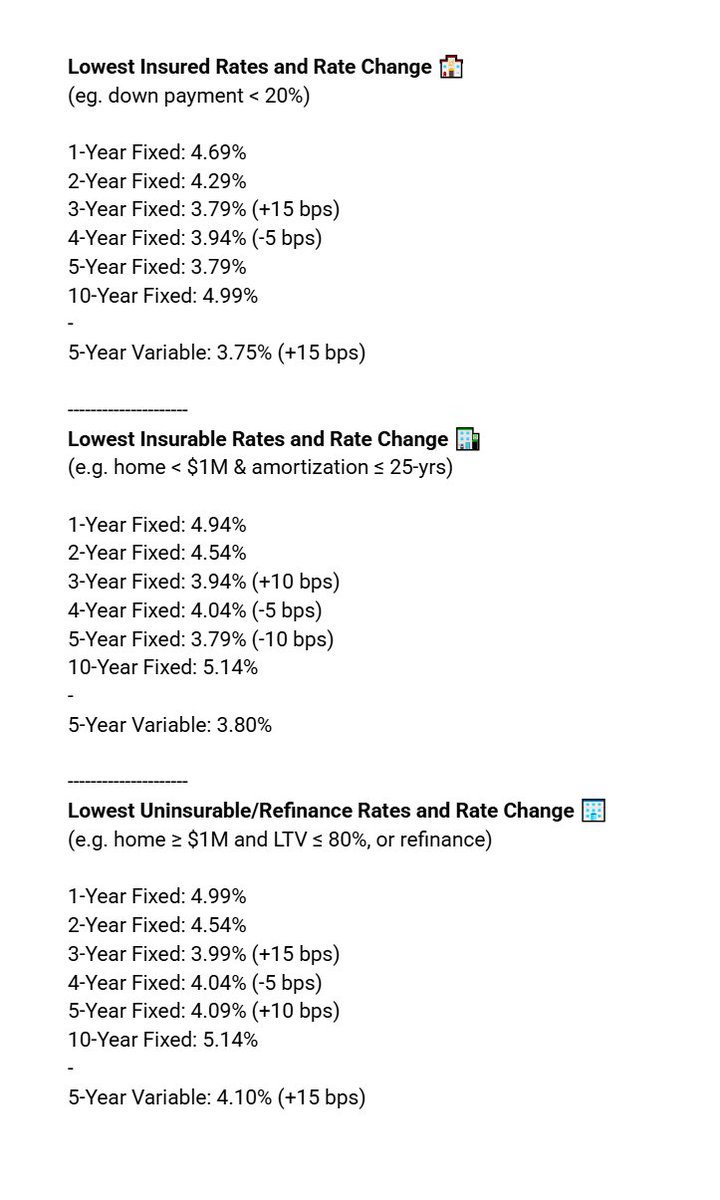

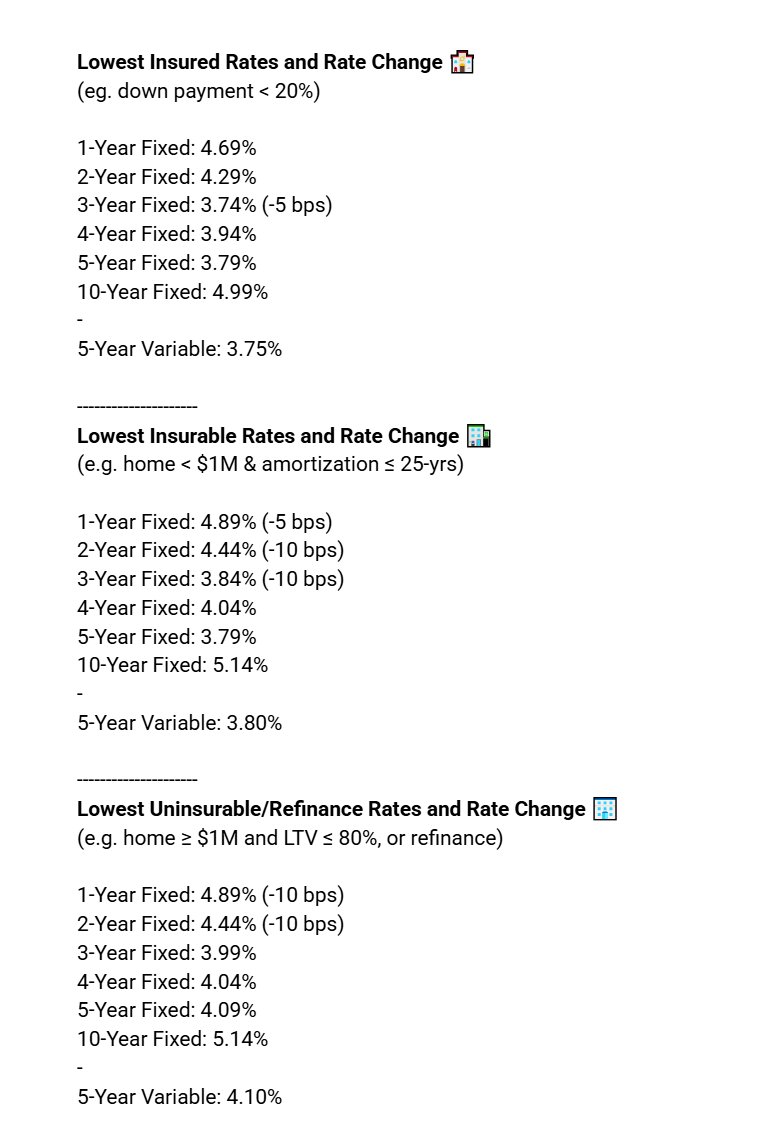

Fascinating stuff! You know there's room to negotiate off the advertised mortgage rate, but Hanif and the folks at WOWA.ca did the work to analyze actual borrower data. Key takeaway: ALWAYS negotiate Rob Carrick David Chilton

🎙️Thanks Daniel Foch Foch & mybuddynick for having me on The Canadian Investor Podcast Network! We discussed what’s driving 🇨🇦 housing prices — especially the supply & demand dynamics behind today’s unaffordability. Here’s a short 2-min clip on the BoC’s response to the GFC & its lasting impact.

I always learn something when I speak with Hanif Bayat Thanks for joining us on The Canadian Investor Podcast Network CC WOWA.ca mybuddynick

Good discussion here with 3 solid thinkers in the Canadian real estate space: Hanif Bayat Daniel Foch mybuddynick

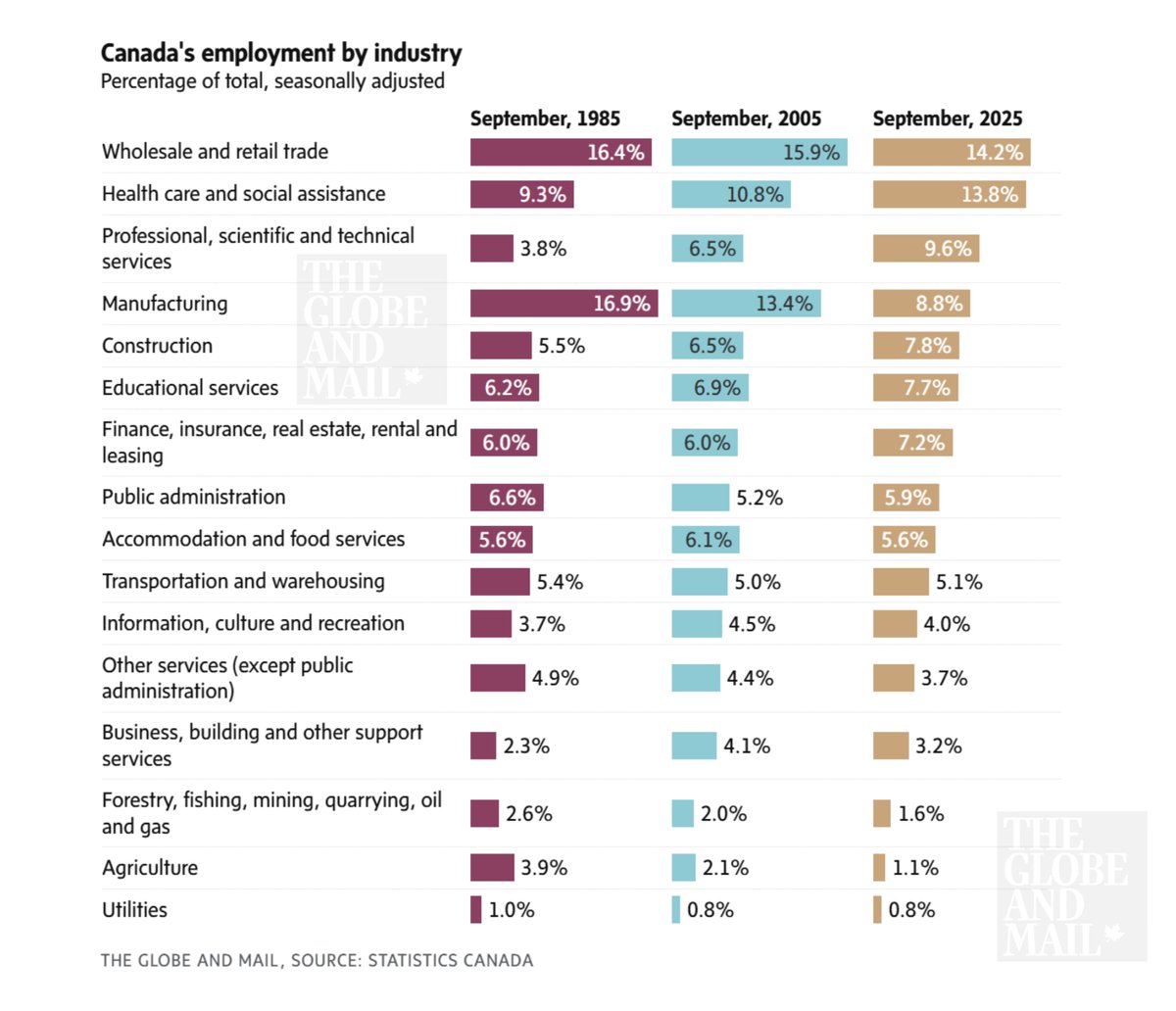

🇨🇦 From factory floors to office towers: A 40-year shift in jobs — my piece in today’s The Globe and Mail 1985 to 2025: The shift from goods to services is clear. 🛍Wholesale & Retail Trade remains the largest sector. 🏥Health Care & Social Assistance is rising fast, set to