STU ⬡

@voyager4ir

ID: 370165856

08-09-2011 15:32:03

4,4K Tweet

2,2K Followers

1,1K Following

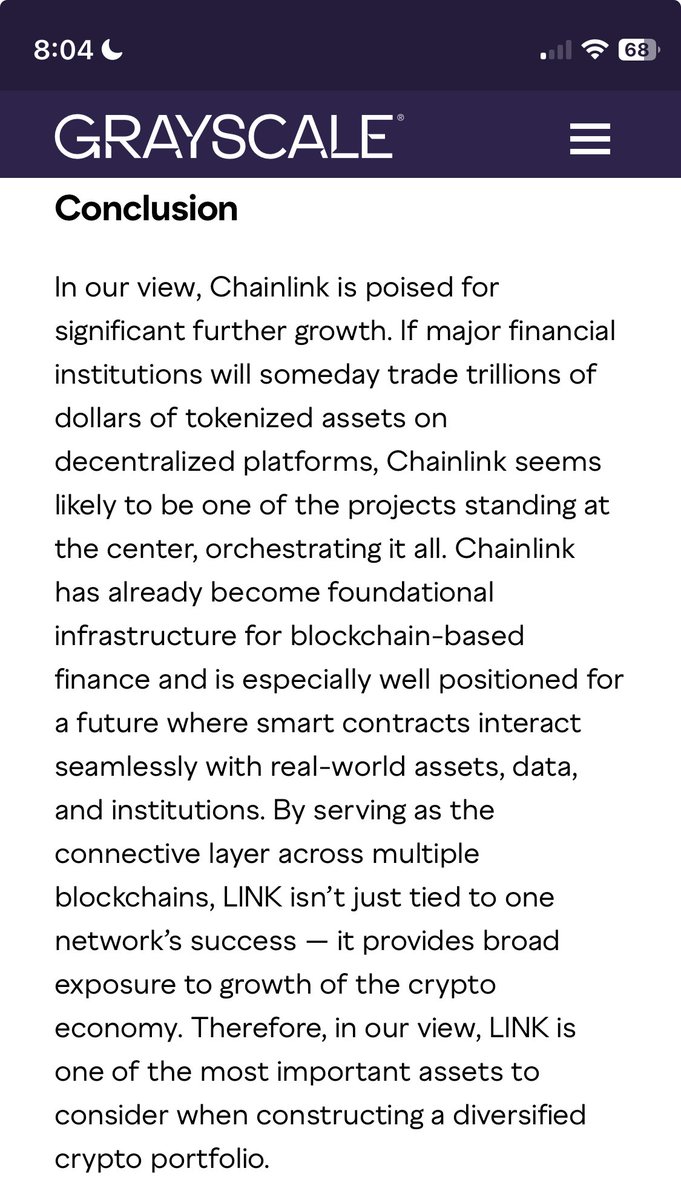

So Jake Claver, QFOP are you willing to take a public escrow bet? Tell me why no one has built an $XRP competitor over the last 10 years Oh right, they're called stablecoins