Vincent Geloso

@VincentGeloso

Québécois Econ prof @MasonEconomics. LSE-trained TTU-proud, GMU-blood. I study #econhist, pol.econ & the measurement of living standards. Book harvester

ID:330597630

http://www.vincentgeloso.com 06-07-2011 21:24:08

30,9K Tweets

12,3K Followers

2,2K Following

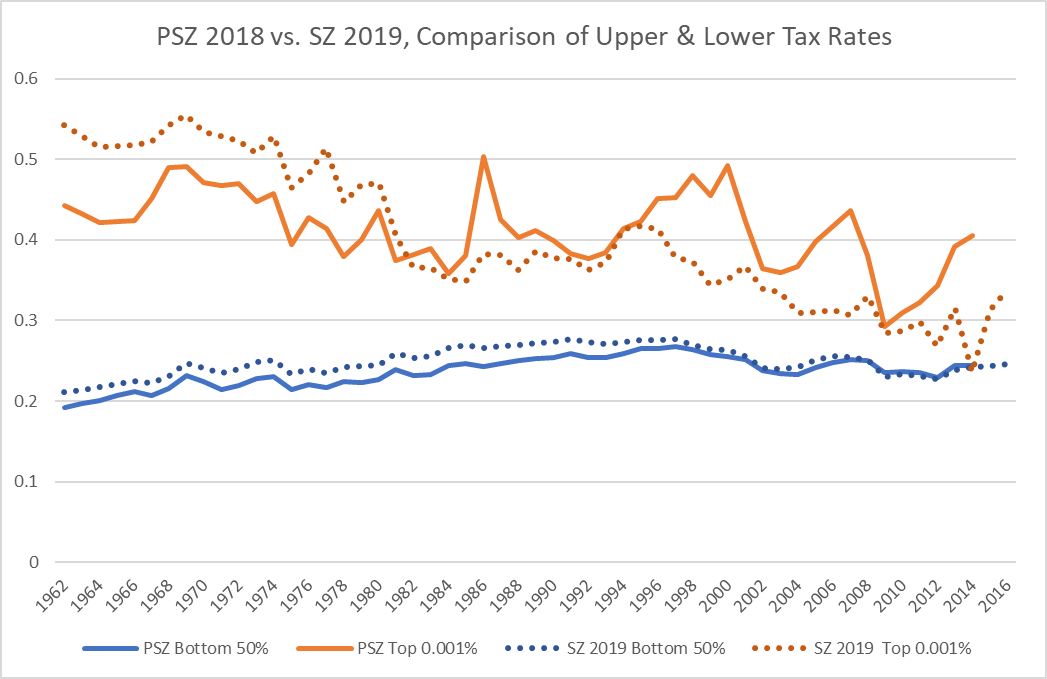

Morten N. Støstad Julia D Mahoney Gabriel Zucman Thomas Piketty Third issue is that PSZ's own stats from their 2018 QJE piece show almost no change in overall average tax rates (not just federal income tax) since the 1960s. Top 0.001% only drops from 44% in 1962 to 40% in 2014.

To get the regressive shift Zucman had to make several

The working paper I am working on right now with Alicia Plemmons and Pradyot Sharma. This was a small idea that ballooned into something quite fun.

#econtwitter

Le livre du mercredi soir de Ian Sénéchal sera animé par moi-même et Sam Rasmussen. Voici la banière d'invitation

'Les 'tax eaters' gonflent les coûts sans améliorer nos services! Il est temps de revoir la justification de chaque programme public avec des 'sunset laws'. Ne laissons pas la bureaucratie dévorer nos ressources sans rendre des comptes! #RéformeGouvernementale #EfficiencyFirst '

Pour un économiste, c'est un polluant. Quelque chose peut être jugé positif/négatif scientifiquement, mais la 'pollutuon', la pollution dépend uniquement de si un tiers parti souffre un coût qui n'est pas inclus dans le prix de marché.

Par exemple, les pesticides sont twitter.com/ppcmontreal/st…

Yes, it is either called 'Anything by Ronald Coase' or 'Cost and Choice' by James Buchanan

#econtwitter