Varlamore Capital

@varlamorecap

ID: 1898985614869188608

10-03-2025 06:33:54

0 Tweet

4 Takipçi

6 Takip Edilen

New stablecoin 3pool just launched on Beets! 🔋 Boosted by yield vaults from Silo Labs 🔐 Curated by Varlamore Capital & Re7 Capital 🎁 Co-incentivized by dTRINITY, Beets, Silo & Trevee (Prev. Rings Protocol) ——— In the name of the Stablecoin, the DEX, and the Lending Protocol (▲)

My current source to farm Falcon Finance 🦅🟠 at KBW🇰🇷 Miles with a 30x multiplier is on Silo Labs. In Varlamore Capital’s managed vault you can currently earn up to 28.6% APR, one of the highest returns available right now. If you’re asking what managed vaults are, here’s a short definition:

Silo Avalanche has long since cleared $100m TVL. It's now time to take things to another level. Supercharged with a fresh grant from the Avalanche🔺 Foundation, there's no better place to lend or borrow on the Red and White Chain. New markets and vaults available for deposit. 👇

1 little vault. 5 layers of rewards. The Varlamore Capital $S vault on Silo Sonic earns optimized yield on powered by blue-chip collateral. Deposit and earn 8% APR from interest, $S, and xSILO rewards on top of 12x Sonic Points and 3x Silo Points.

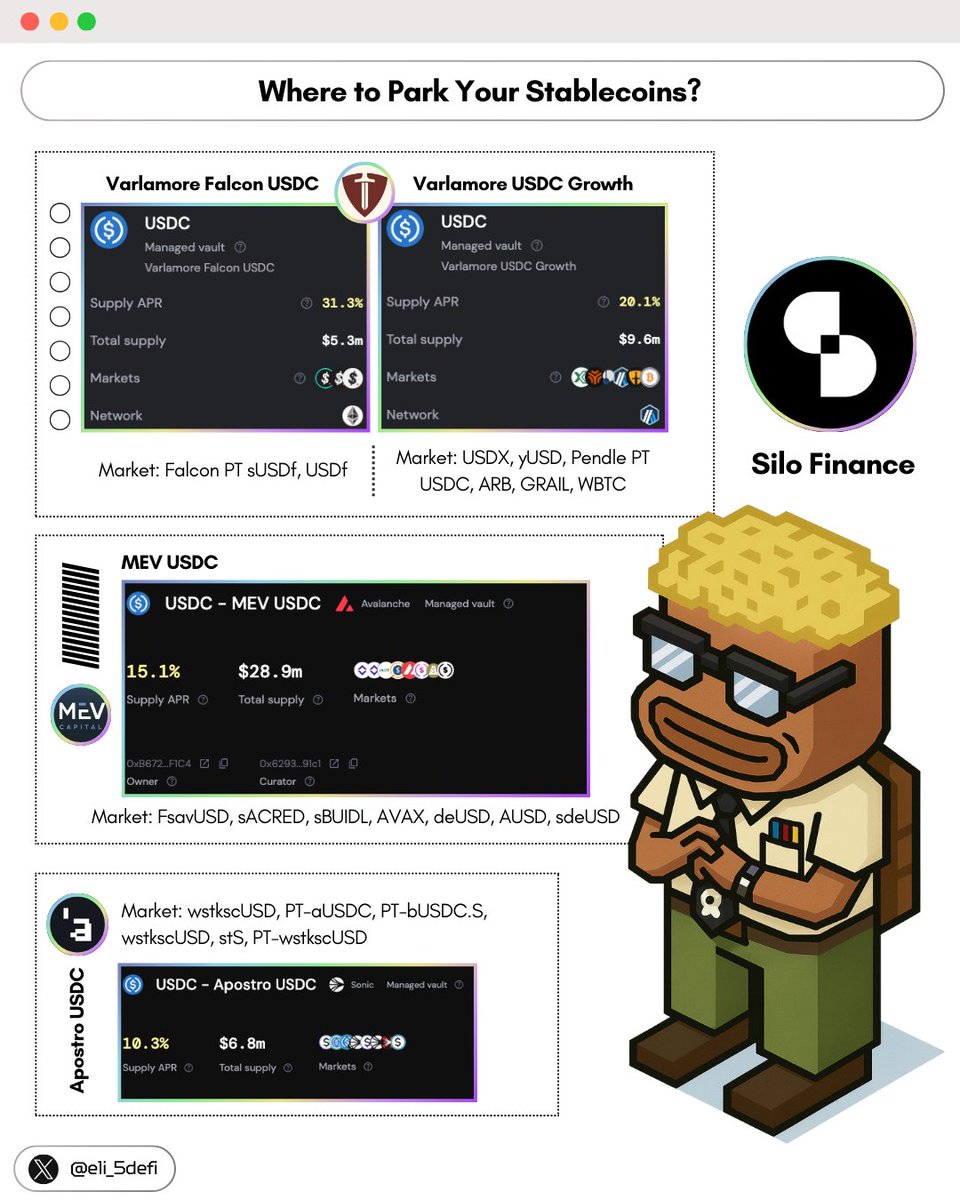

![Silo Intern (@silointern) on Twitter photo Today your boy tasked himself with a simple goal:

Find >15% APR on USDC for his beloved followers.

Here is his fine selection:

1. Varlamore Falcon USDC → 17.1% APY

2. Varlamore USDC Growth [Arbitrum] → 18.1% APY

3. MEV USDC [Avax] → 28% APY

Job's done. Today your boy tasked himself with a simple goal:

Find >15% APR on USDC for his beloved followers.

Here is his fine selection:

1. Varlamore Falcon USDC → 17.1% APY

2. Varlamore USDC Growth [Arbitrum] → 18.1% APY

3. MEV USDC [Avax] → 28% APY

Job's done.](https://pbs.twimg.com/media/GwjeF0oakAA1A70.png)