Thomas M Mertens

@thomasmmertens

Economist @sffed with research on (international) finance, monetary policy, and the macroeconomics. All views are my own.

ID: 1292448669455675393

https://sites.google.com/site/thomasmichaelmertens/ 09-08-2020 13:12:42

23 Tweet

268 Followers

134 Following

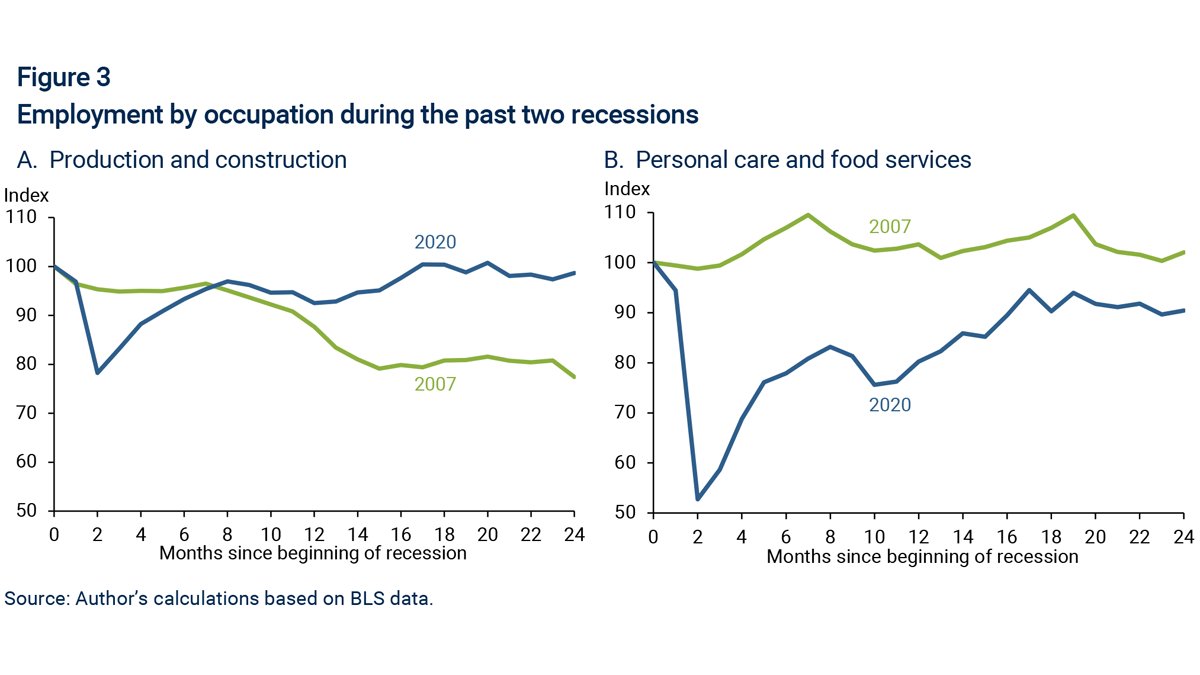

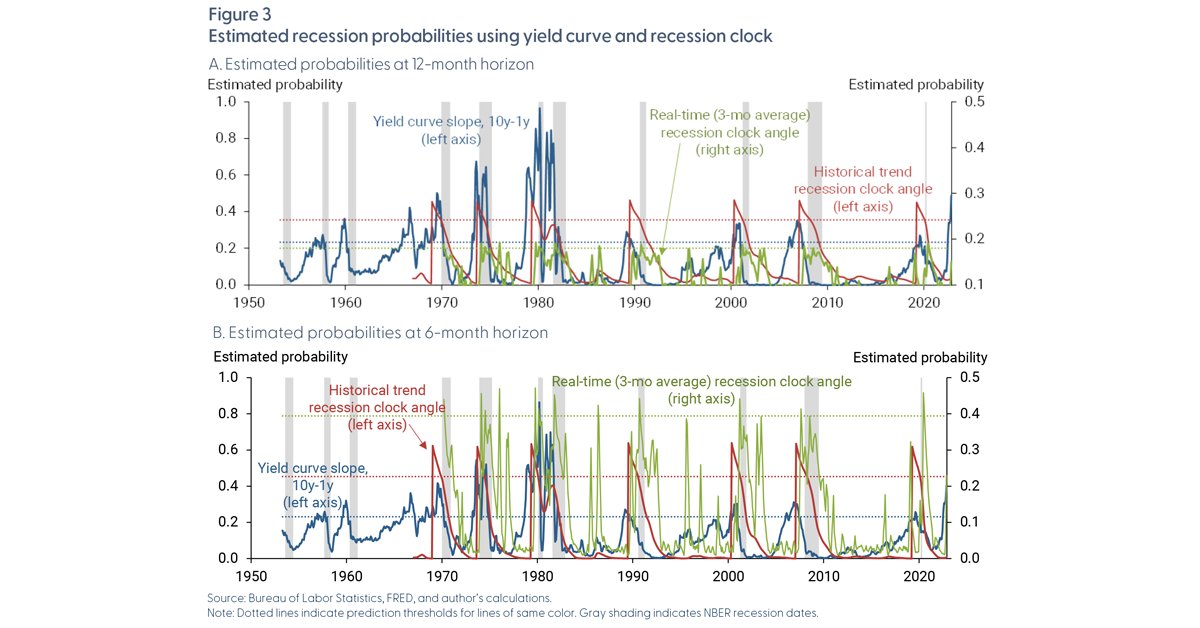

With the yield curve quite flat in some parts, here are links to SF Fed Economic Letters I wrote with Michael Bauer: frbsf.org/economic-resea… and frbsf.org/economic-resea…. Thanks to Mary C. Daly for highlighting our research.

Recession indicators from the yield curve are sending mixed signals. Michael Bauer and I are sorting through them in today's SF Fed EL: frbsf.org/economic-resea…. We argue in favor of the 10y-3m spread.

This has been a while in the making but now we're live! You can check out our research, events and data products at frbsf.org/CMR and subscribe to our mailing list to stay in the loop. Thanks to sylvainecon Thomas M Mertens and Pascal Paul for making this possible!

Call for Papers: 10th Annual West Coast Workshop in International Finance will be held at Santa Clara University. Submission deadline: January 13, 2025. Pdf here: sanjayrajsingh.github.io/CFP/Call_WCWIF… #EconTwitter Federal Reserve Bank of San Francisco Vito Cormun

I shared more of my thoughts today at Stanford University Hoover Institution - thanks to Senior Fellow John Cochrane for the terrific conversation. You can watch the event here: sffed.us/Hoover2024