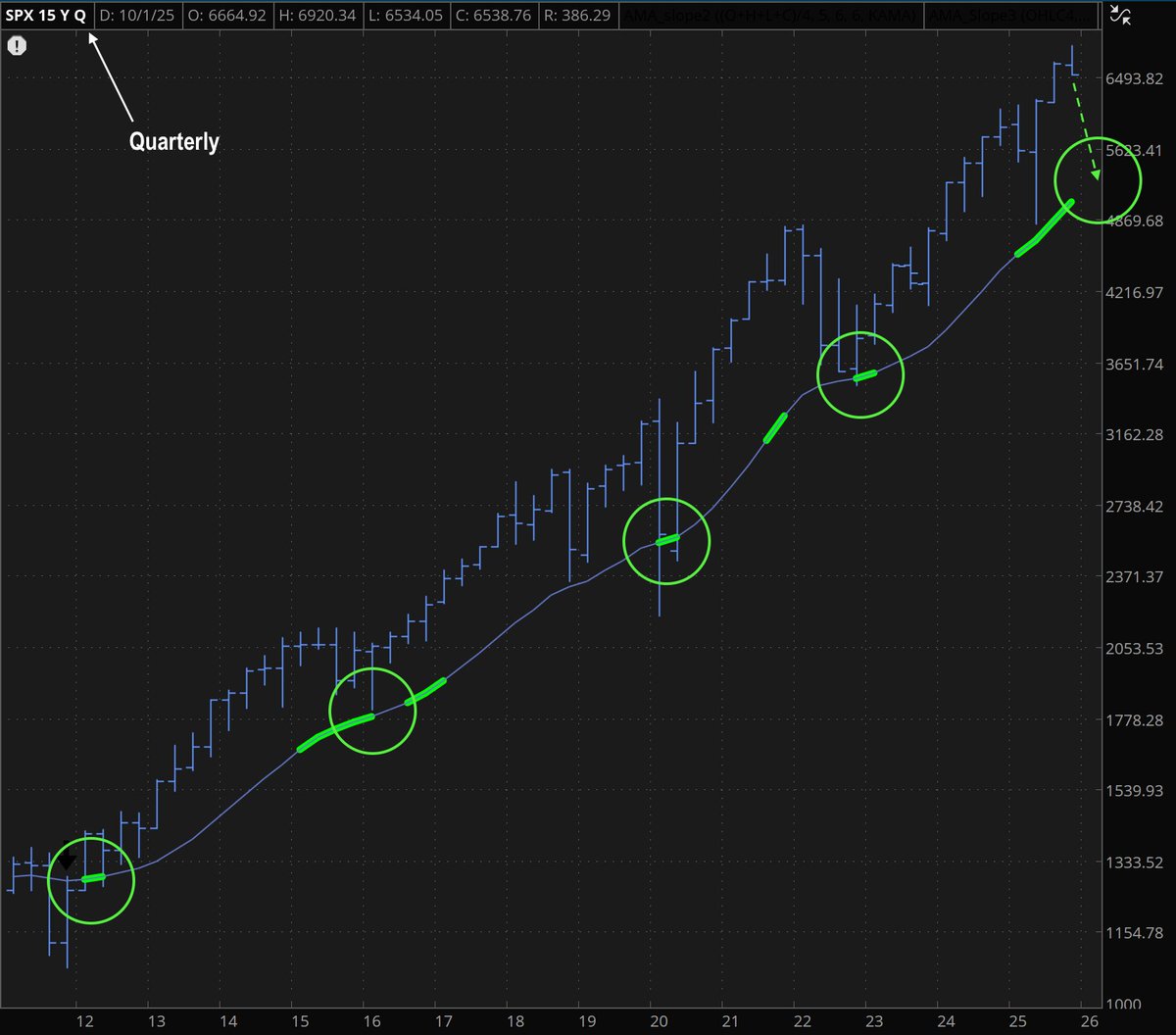

The Tail That Wags The Dog

@tailthatwagsdog

The function of a financial market is to transfer risk. I design and develop decision support tools for AI-human hybrid investing. Medium-term horizons.

ID: 1828497894598467584

http://www.nextSignals.com 27-08-2024 18:21:17

1,1K Tweet

4,4K Followers

13 Following

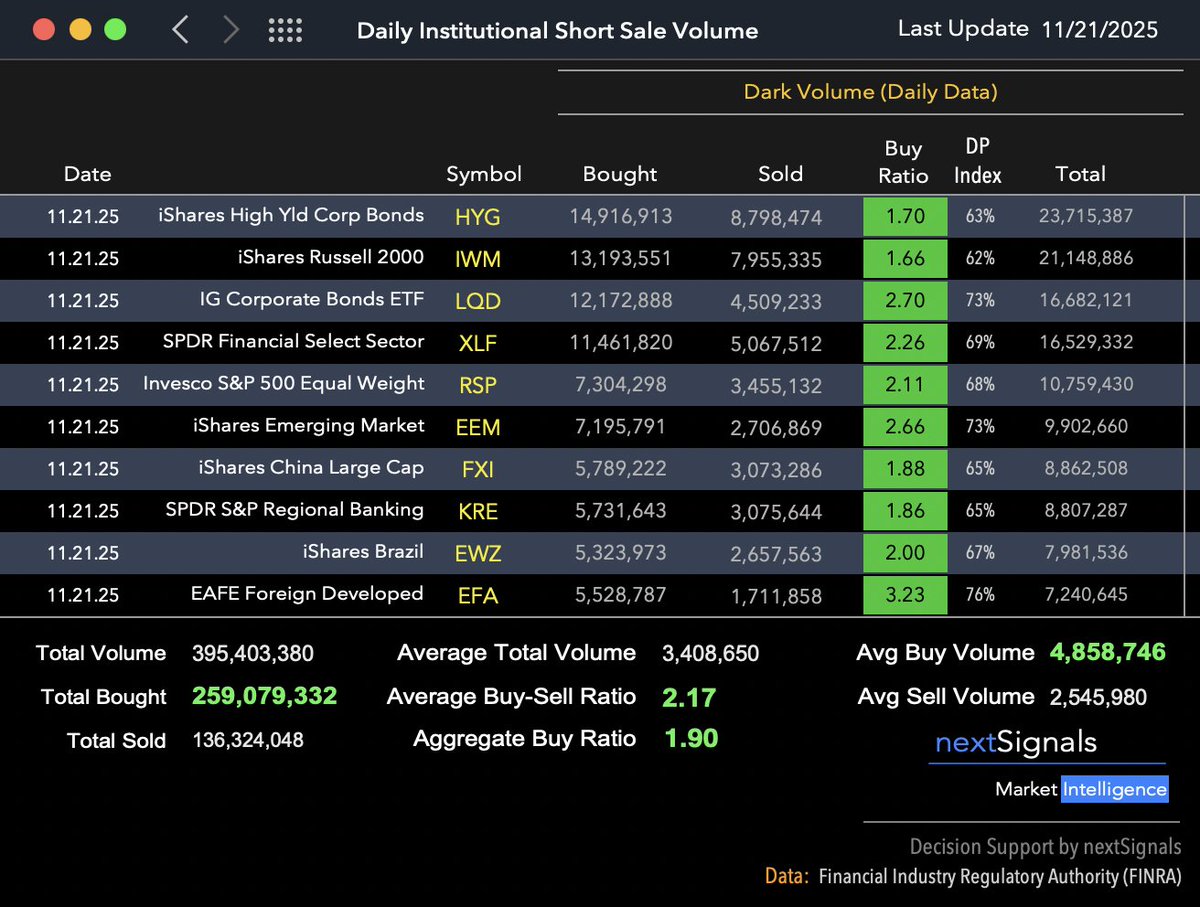

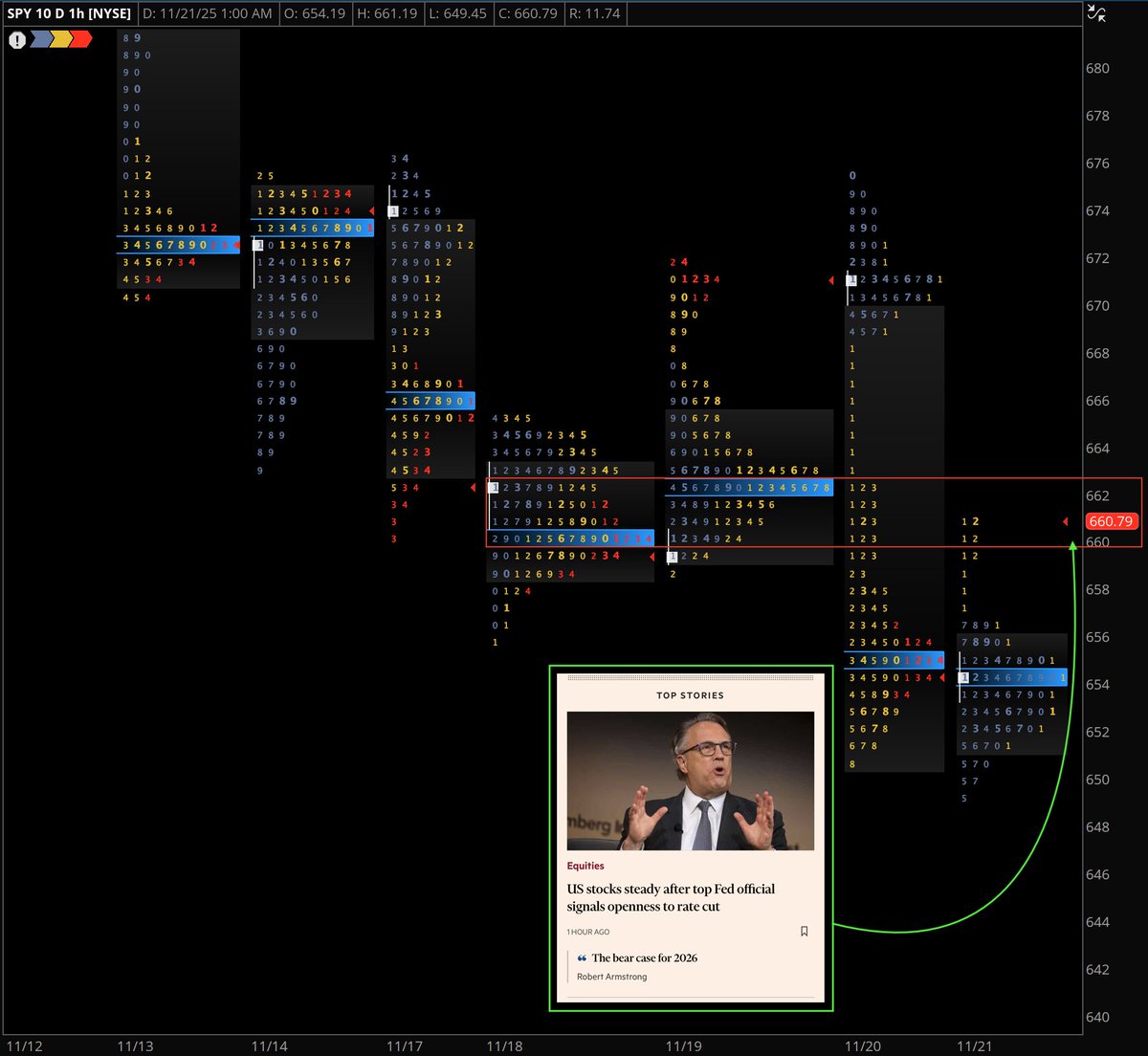

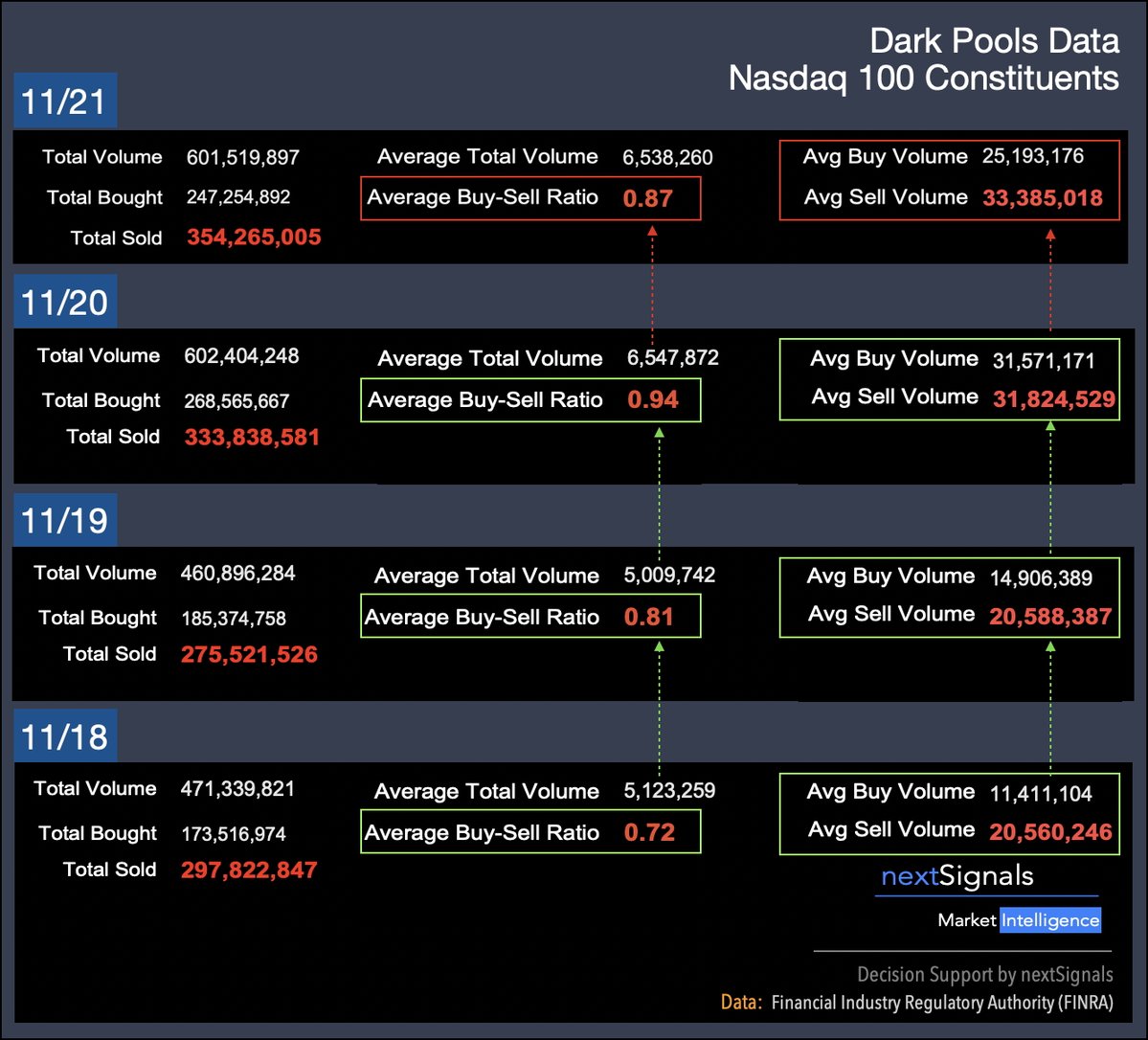

![The Tail That Wags The Dog (@tailthatwagsdog) on Twitter photo Fri Nov 21

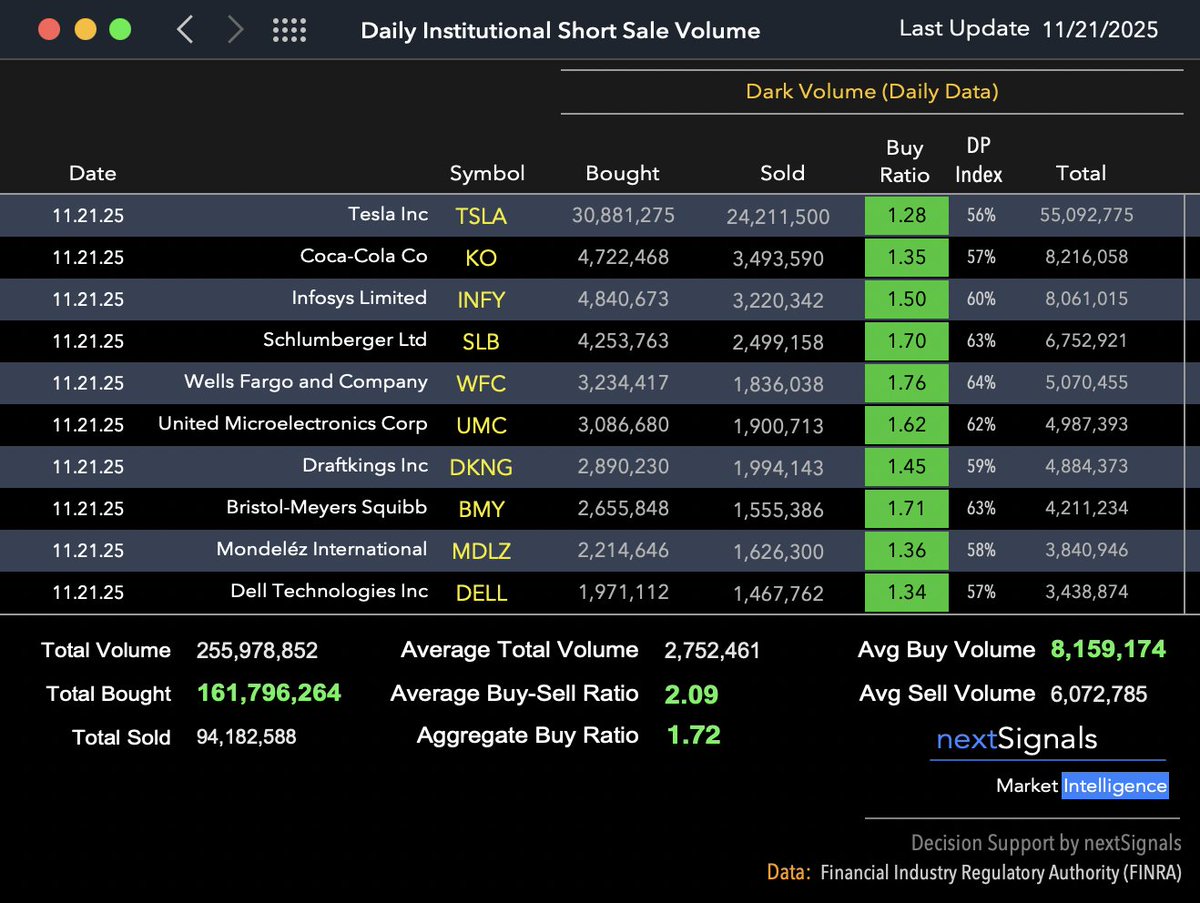

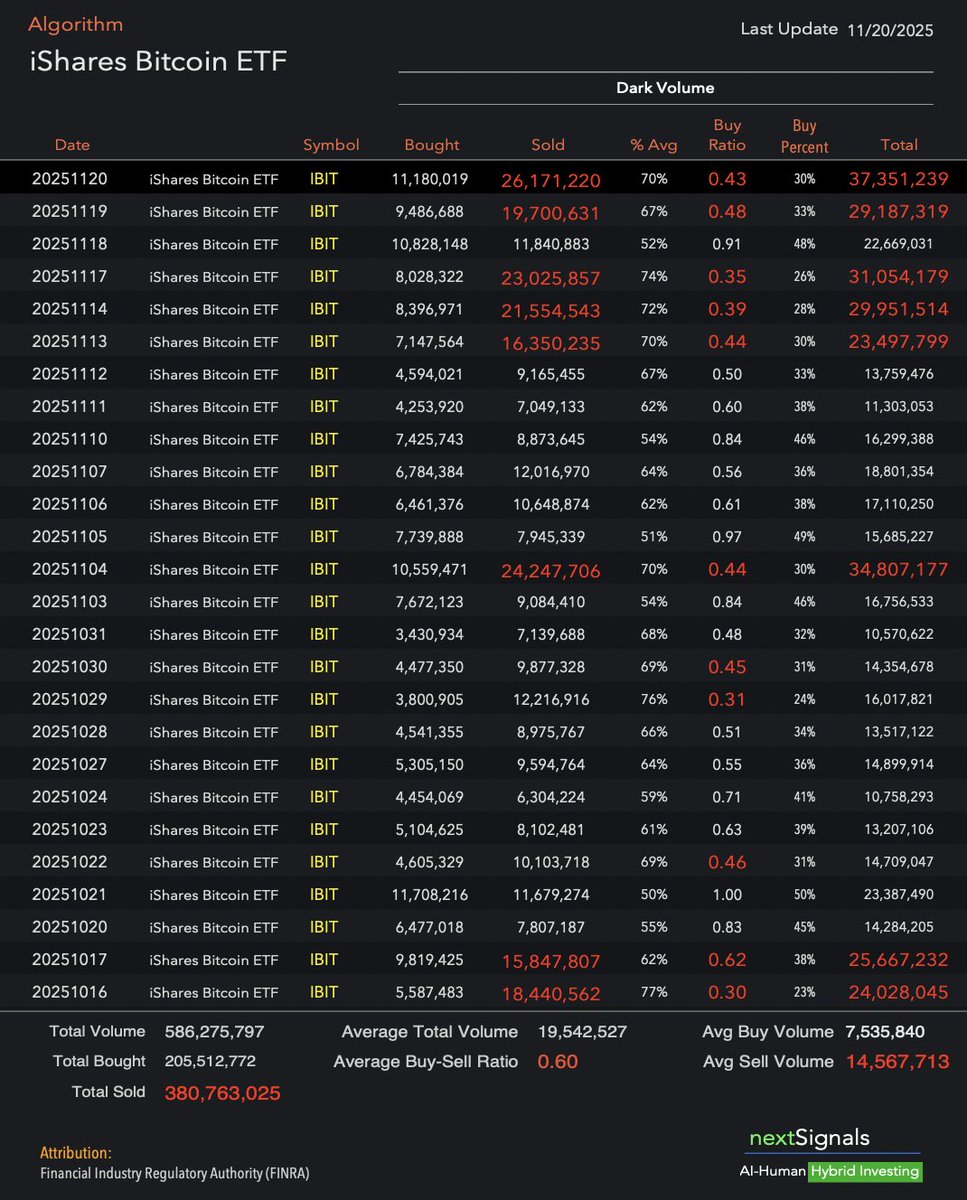

Dark Pools: Top Ten Stocks in Distribution

[sorted descending by Total Volume] Fri Nov 21

Dark Pools: Top Ten Stocks in Distribution

[sorted descending by Total Volume]](https://pbs.twimg.com/media/G6VWqhBWcAAbXnH.jpg)