Stable Future

@solstablefuture

solana's first stablecoin conference

ID: 1958704220904849408

22-08-2025 01:34:23

0 Tweet

4 Takipçi

3 Takip Edilen

Stablecoins are moving from theory to everyday payments🪙 We brought together danielmongexyz (Head of Partnerships interlace.money ), Kyle | Amp Pay (Founder/CEO Amp Pay ), and Sam Kerrins (COO KAST (old) ), moderated by Dirichlet (CEO of Sphere ), to explore how

The Bet Was Always RWAs 🌐 In his keynote, Carlos Cano (Ecosystem lead Particle Network) showed why Real World Assets are core to Web3, taking tokenization to a permissionless, global economy while opening new opportunities for builders to create, innovate, and bring assets

Stablecoins are reshaping payments from serving the unbanked to enabling instant, programmable money. interlace.money has processed $6B+ transactions and issued 6M cards, bridging Web2 and Web3 for the Gen Z and AI-driven economy. Shared by danielmongexyz (Head of

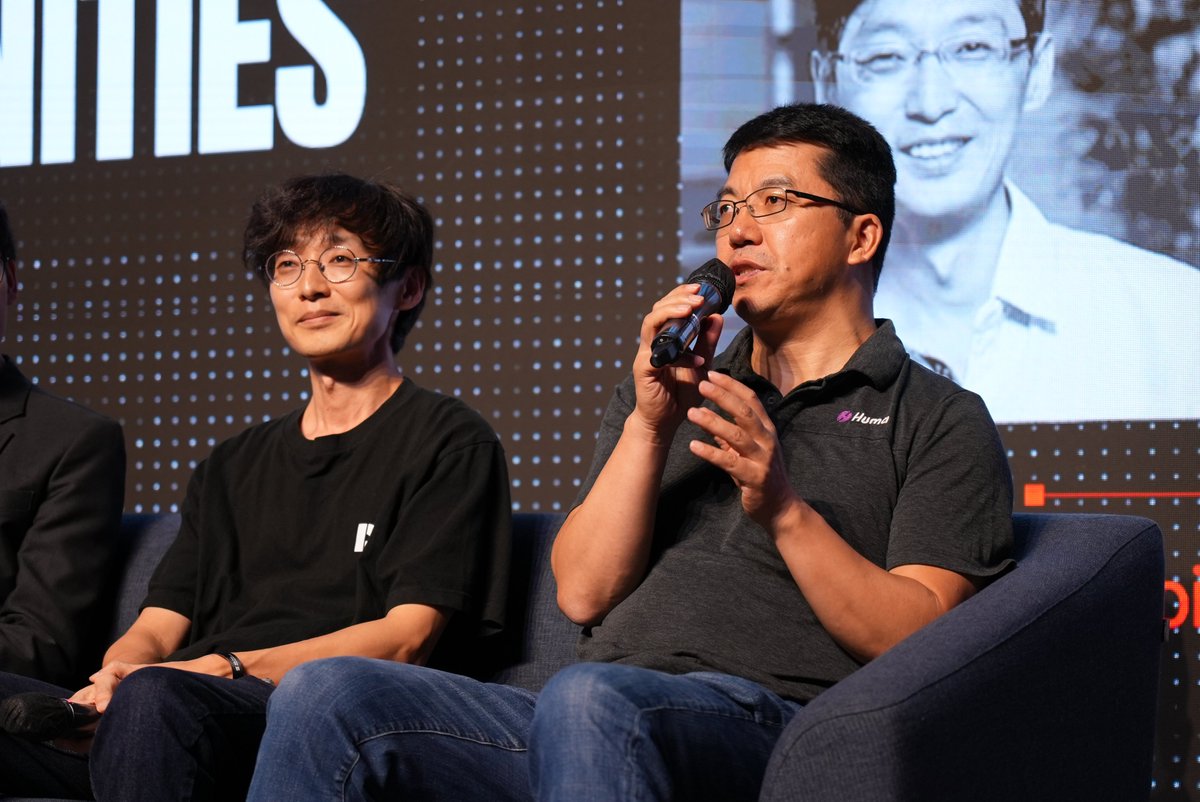

How will stablecoins shape Korea’s institutional finance? A powerful panel featuring Alan Ang (Woori Venture Partners), Vincent Chok (First Digital ), Hyung-Kyu Choi (DSRV ) & Richard Liu (Huma Finance 🟣) joined Daniel Kim (@Tiger_Research_ ) to explore how institutions can

Stablecoins are moving from retail into institutional finance with big implications for efficiency, compliance, and global access. Sam MacPherson (CEO, Phoenix Labs & contributor to Spark) shared his perspective in conversation with Alessio Quaglini 🏊 (CEO, Hex Trust) on why this

User acquisition is broken high costs, low-quality data, and fake users. simon | solana.id 🪷 (blkn/acc) (Co-founder, Solana ID 🪷 ) shared his perspective on how identity-powered insights can help projects to get real users,use better data and reduce acquisition costs

Real-world assets are becoming the backbone of the stablecoin economy. li xiaozhou (CEO & Co-founder, Asseto Finance) explained how building yield infrastructure for RWAs can unlock a projected $2–4T market by 2030.

Institutional-grade RWAs are becoming a cornerstone for DeFi. Eli Cohen (GC, Centrifuge ) joined Daniel Kim I Tiger Research (CEO, @Tiger_Research_ ) to discuss how real-world assets can unlock deeper liquidity, compliance-ready infrastructure, and sustainable yield, paving the way for

Stablecoins that succeed are transparent, compliant, and built for scale. Zurab Kazhiloti | Bitscale capital (Founding Partner, Bitscale Capital) shared that VCs and LPs look for strong teams, regulatory readiness, simple designs, and clear distribution strategies

Exploring how hardware acceleration can reshape blockchain design, Joshua (svm/acc) (CPO, Solayer (mainnet arc)) shared Solayer’s vision of integrating infrastructure, payments, and yield into one ecosystem

Solana’s staking landscape is evolving fast. James Hanley (Head of Strategy, Sanctum ☁️) shared how building a full-stack staking infrastructure can unlock new yield opportunities, improve validator performance, and bring liquid staking closer to mainstream adoption

Institutional payments and settlements are being redefined through stablecoins with compliance, custody, and speed at the center of adoption. Sergio Mello ⚓ (Head of Stablecoins, Anchorage Digital ) shared his perspective in conversation with Richard Liu (Co-Founder, Huma Finance 🟣 ) on how

The summit closed with an energy-packed panel on why founders are choosing Solana 🌐⚡️ simon | solana.id 🪷 (blkn/acc) (Co-founder, Solana ID 🪷 ), Ryot 📕 (Co-founder, Xitadel ), and Daniel de Lophem 🐡 (Founder, Nomu) moderated by Eno Eno | DAT growth strategist (Chief Vibes Officer, Sanctum ☁️ )