Shane Oliver

@ShaneOliverAMP

Head of Inv Strategy & Chief Economist, AMP. Into boats, pop music, economics, investing, my family..& being nice. I don’t solicit funds/spruik trading schemes

ID:335728282

15-07-2011 04:13:30

35,6K Tweets

32,6K Followers

126 Following

Follow People

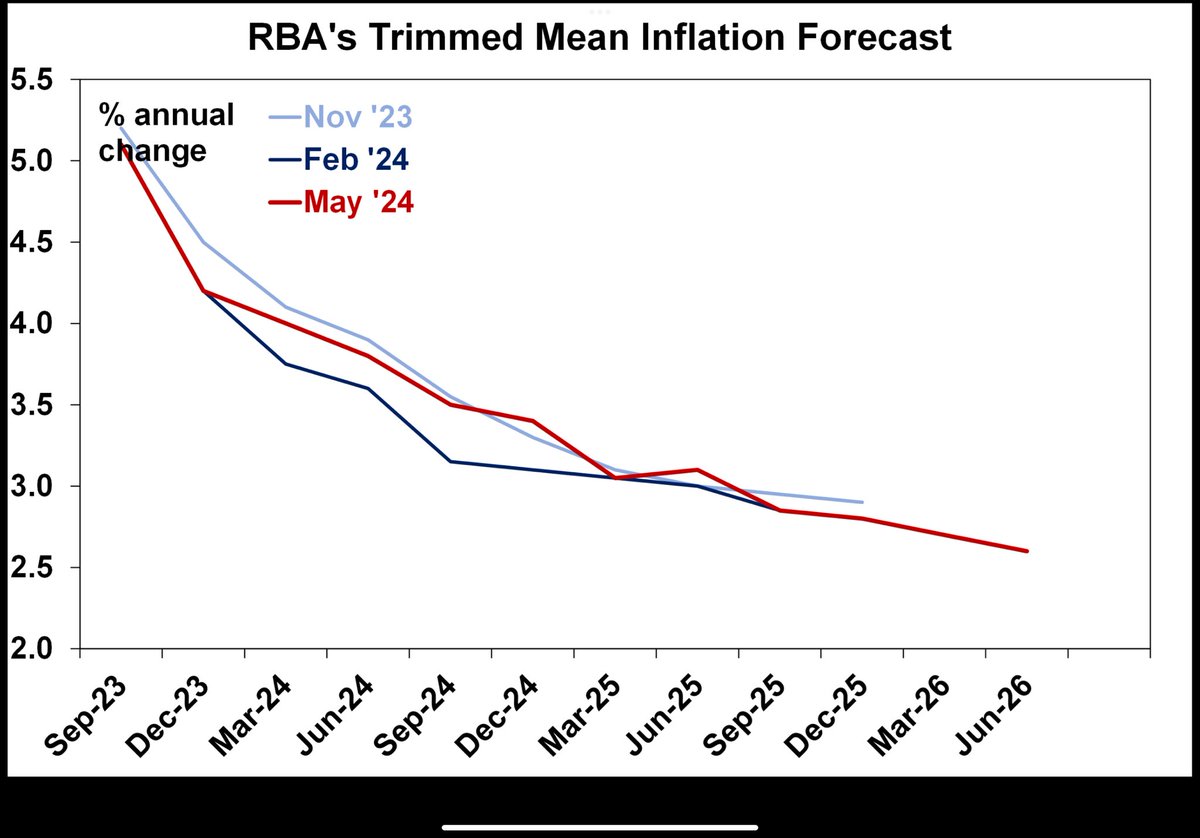

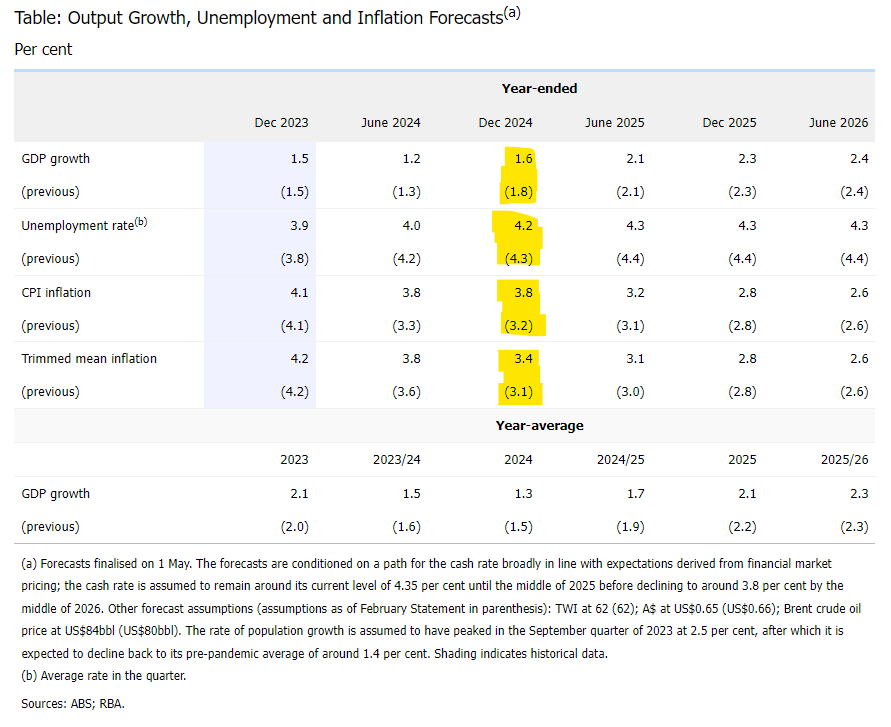

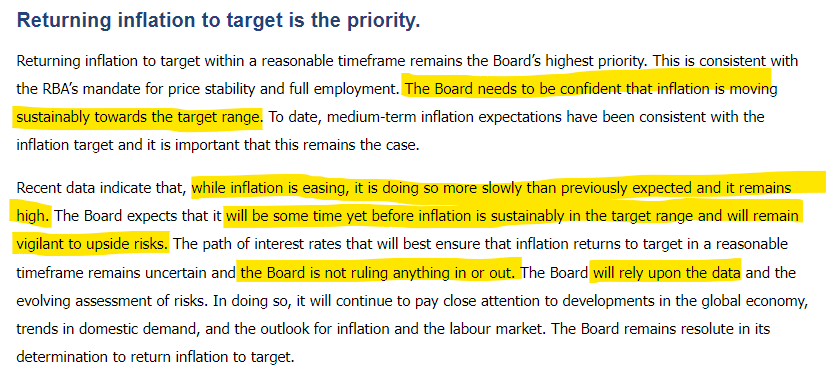

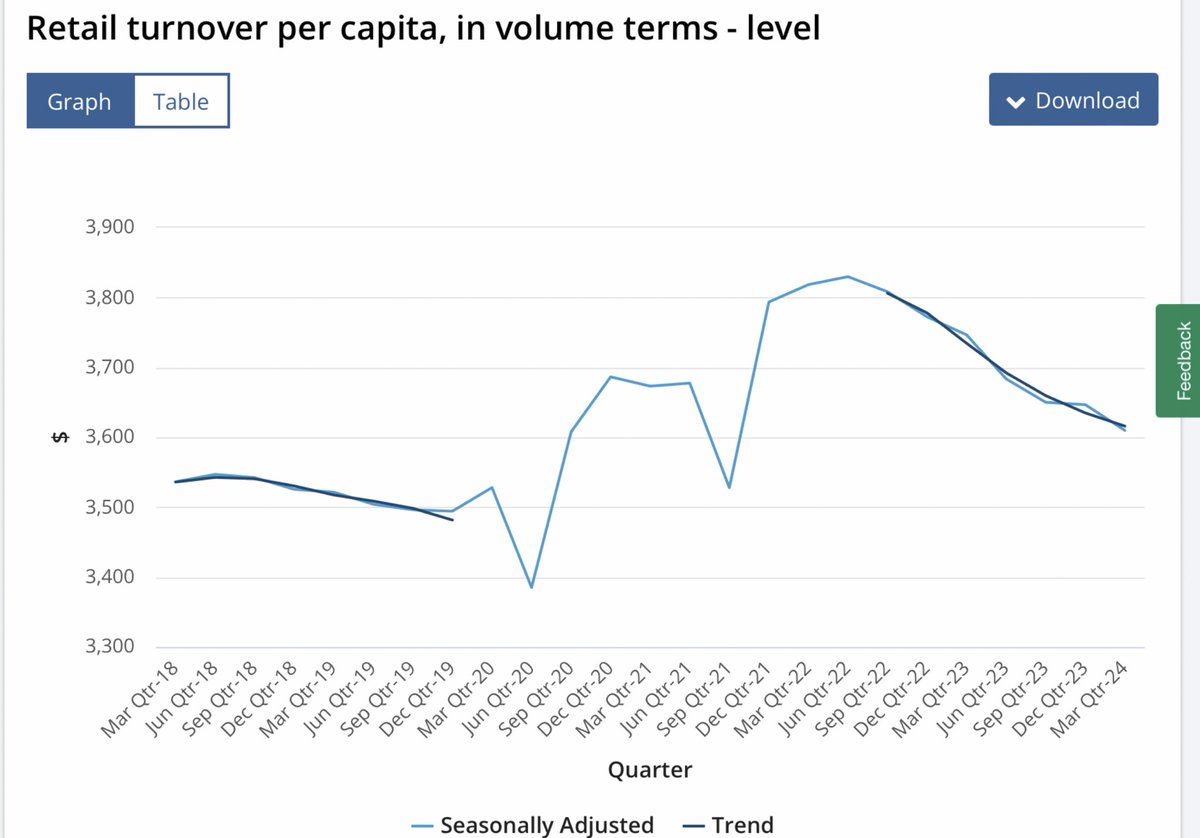

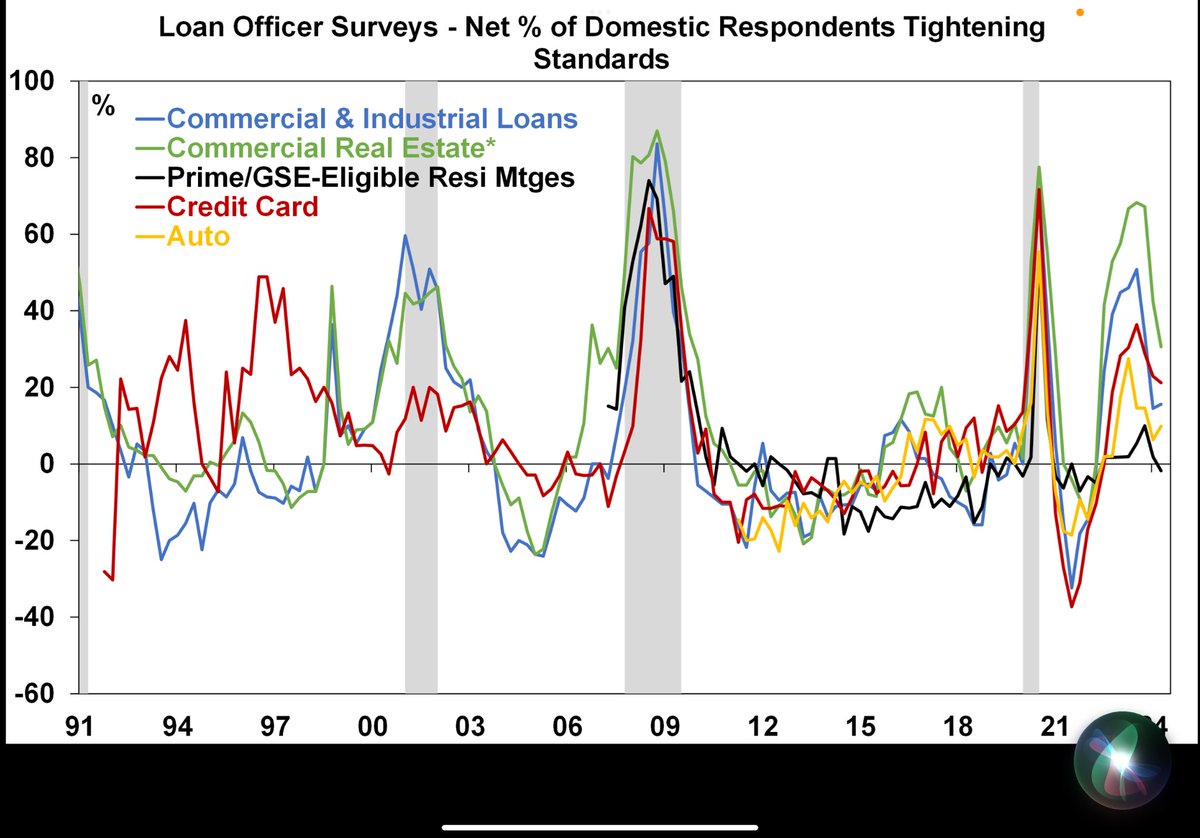

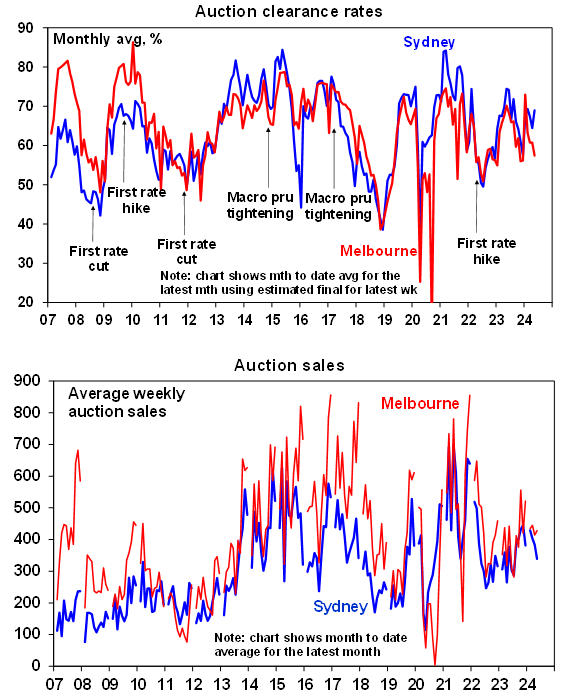

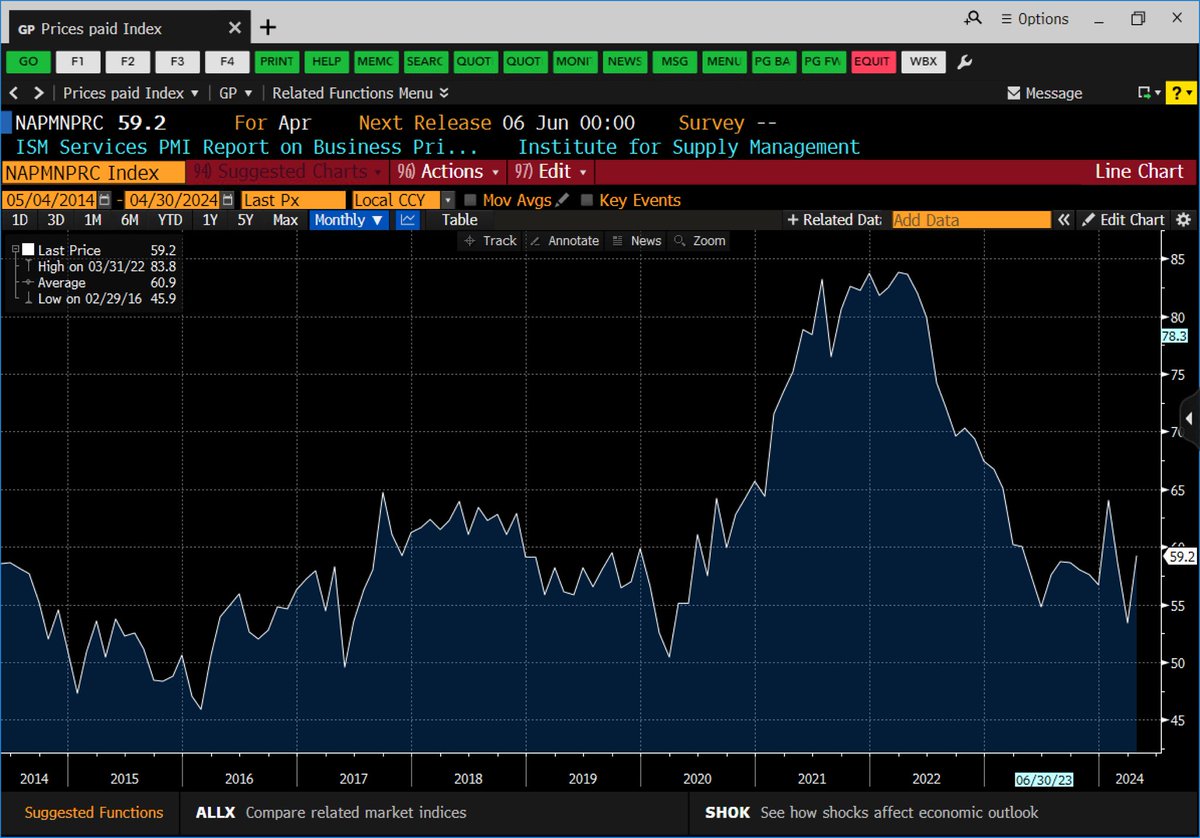

Simplifying Investing Podcast: Ep 120 Revisiting retail and home prices: will we see another rate hike?

And does more money = more happiness?

Full ep on:

🎙 Spotify: open.spotify.com/episode/7kpkEU…

📺YouTube: youtube.com/watch?v=QojP45…

Shane Oliver Diana Mousina