Safe Investing SA

@SafeInvestingSA

PGD:Financial Planning Law🎓

Safe Investing SA by Mbini, personal finance author, speaker, coach. I teach SAns to create wealth.

https://t.co/AhM1js98Rt

ID:802290631

http://www.safeinvestingsa.com/ 04-09-2012 11:46:02

636 Tweets

3,5K Followers

192 Following

Land! I deserved to be a trust fund baby. Hay cha nee.

#property #financialfreedom #financialindependence

The one area that a real estate investor needs to master is taxes. I have been reducing my tax bill every year. A lot of cash is hidden there.

Tax avoidance is a necessary skill.

#safeinvesringSA #RealEstate

My real estate investing model revolves around change in land use. We typically buy residential & rezone. A slow kind of process but it enabled me to build a strong team.

We just got approval for small cluster development. Not the first approval.

#safeinvestingSA #realestate

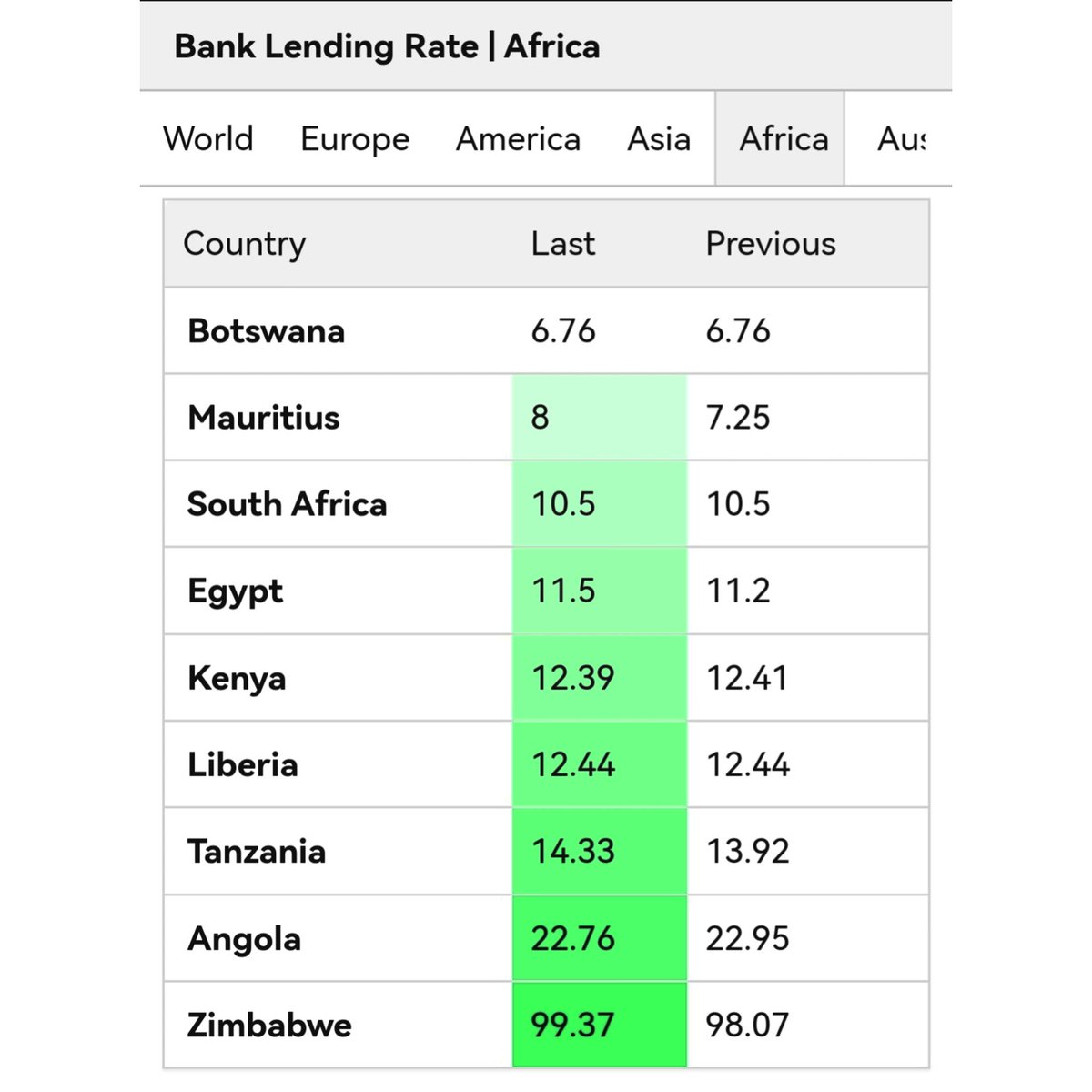

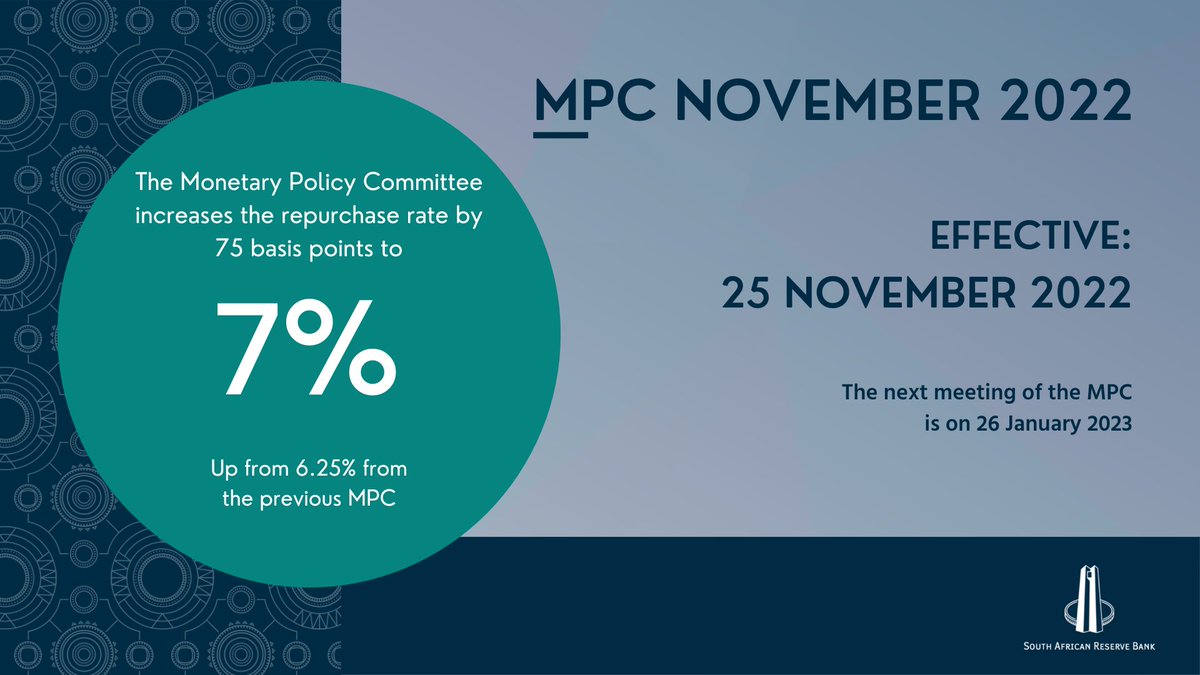

'Lending Rate in South Africa averaged 12.04% from 1957 until 2022, reaching an all time high of 25.5% in August of 1998'

Trading Economics, Dec'22

Heights that IR can reach. Also interest rates in other parts of the continent. Get out of debt.

#MbiniKutta

👩🏽🎓Financial Planner

'The best time to plant a tree was 20 years ago. The second best time is now.'

Chinese Proverb

#safeinvestingSA #firemovement #financialfreedom #financialindependence

The MPC decided to increase the repurchase rate by 75 basis points to 7%, with effect from the 25th of November 2022. Three members of the Committee preferred the announced increase. Two members preferred a 50 basis point increase. #SARBMPCNOV22

Surround yourself with people who talk about their goals and visions. People who push you out of your comfort zone. Fiind your tribe.

#firemovement #financialfreedom #financialindependence