RosarioTechLaw

@rosariotechlaw

Rosario Tech Law, LLC is a boutique law firm focused on companies building the new economy and changing the world. #crypto #web3 #NFTs #privacy #property #power

ID: 1446595282192551942

http://www.rosariotechlaw.com/about 08-10-2021 21:56:24

179 Tweet

540 Followers

999 Following

Those who know me well would describe me as a crypto optimist/realist. TY to TechCrunch for publishing my reflections on #crypto in 2023 & the challenges we need to take on in 2024 to bring the industry to its full, incredible potential. techcrunch.com/2024/01/04/cry…

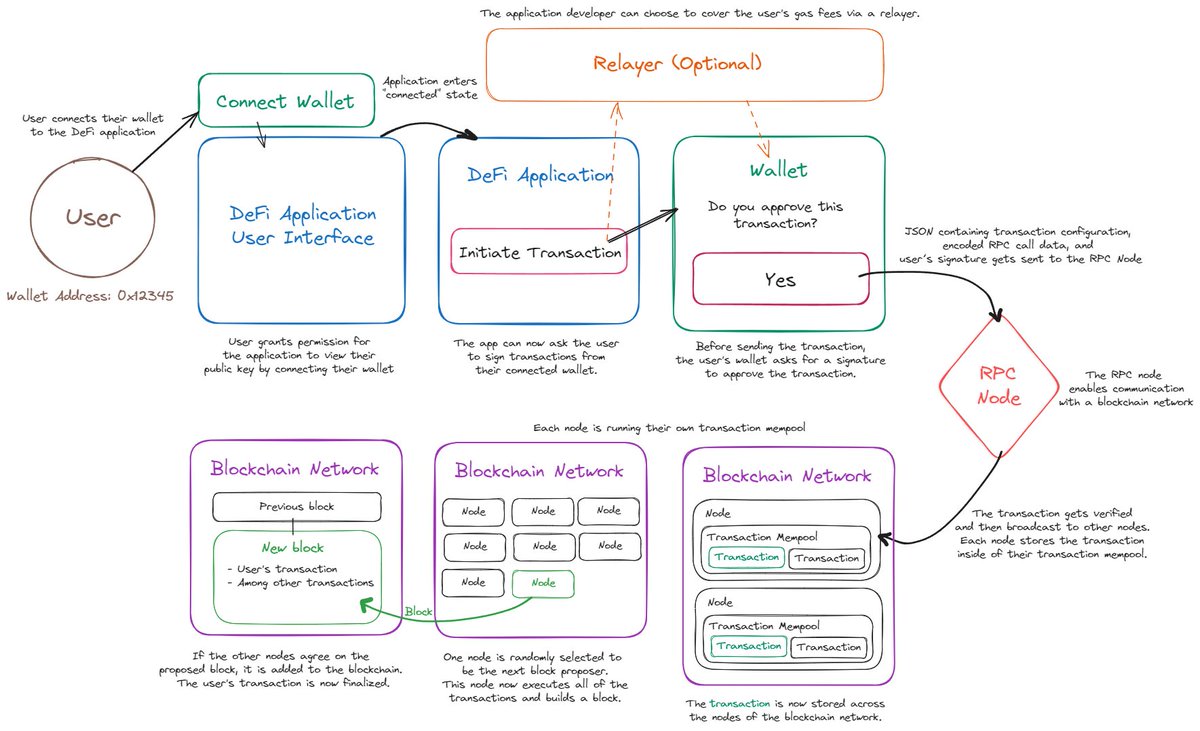

4/ We also explain what DeFi really is & is not, as well as the sources of illicit finance risk in DeFi which are very different than in traditional finance--cyber risk, system management risk & usage risk. (Sec II.) h/t Jarrod Watts for the DeFi graphic (incl in the paper)

7/ Tech systems w ppl who have "independent control" over them are "on-chain CeFi" as noted in an article by Schuler, Ann Sofie Cloots & Schar (link 👇). They likely regulation incl for illicit finance, but this requires examining "facts & circumstances". papers.ssrn.com/sol3/papers.cf…

9/ The "critical infrastructure" framework is coordinated by CISA Cyber, which oversees network tech & physical architecture "critical" to U.S. national & economic security in 16 sectors, incl in financial services. CISA & its coordinating arms (incl OCCIP) are not regulators.