Ronit Kanwar

@ronitkanwar

Building @RenPhil21 and @BritishProgress | Formerly @SchmidtFutures, CEO @empowerNRG Social Entrepreneur | Forbes 30 Under 30 |

ID: 344813355

29-07-2011 16:40:19

1,1K Tweet

872 Followers

1,1K Following

This is exciting. Excited to see what Kanishka Narayan MP will achieve in his new role!

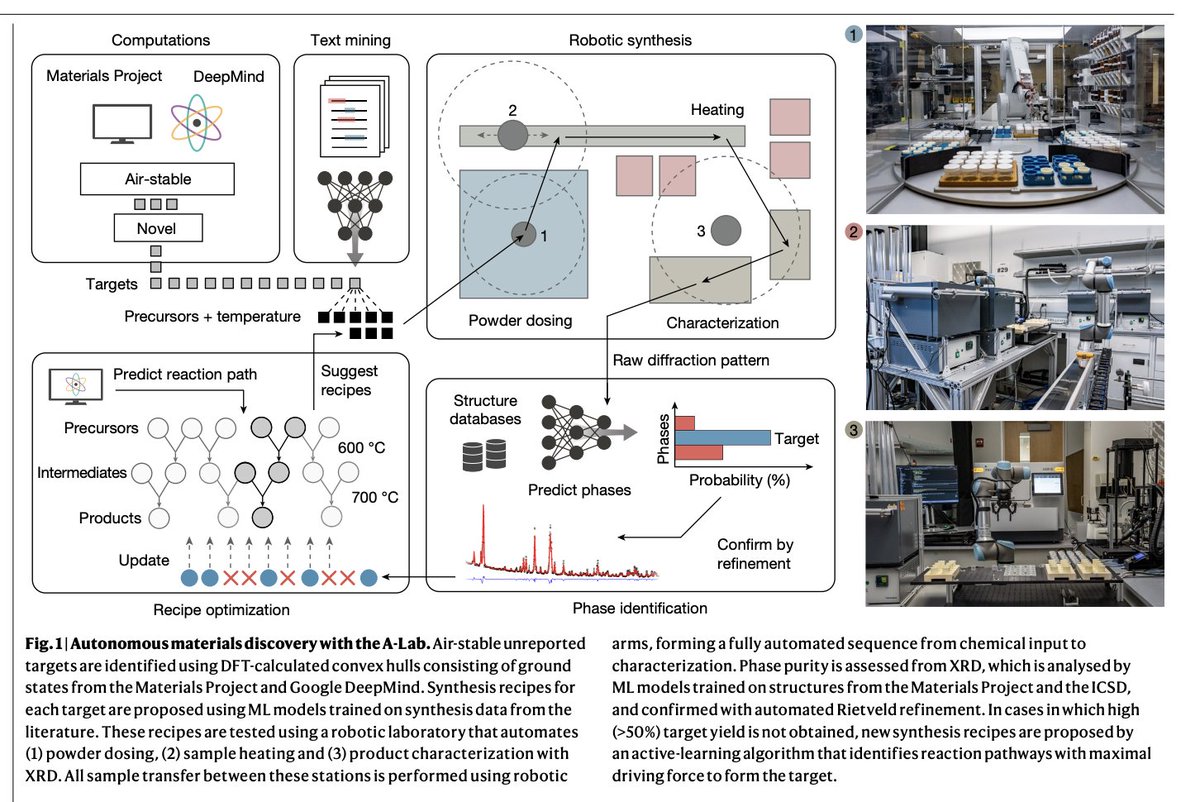

Congrats to our grantees accelerating the discovery of AI tools for mathematics! A great example of how time-bound, thesis-driven philanthropic funds can advance fields. The ideas were so strong that XTX Markets doubled the fund size!

One coffee with Samuel Hughes, one meeting with Kane Emerson… suddenly there’s a new town on the map. Feeling pretty proud.

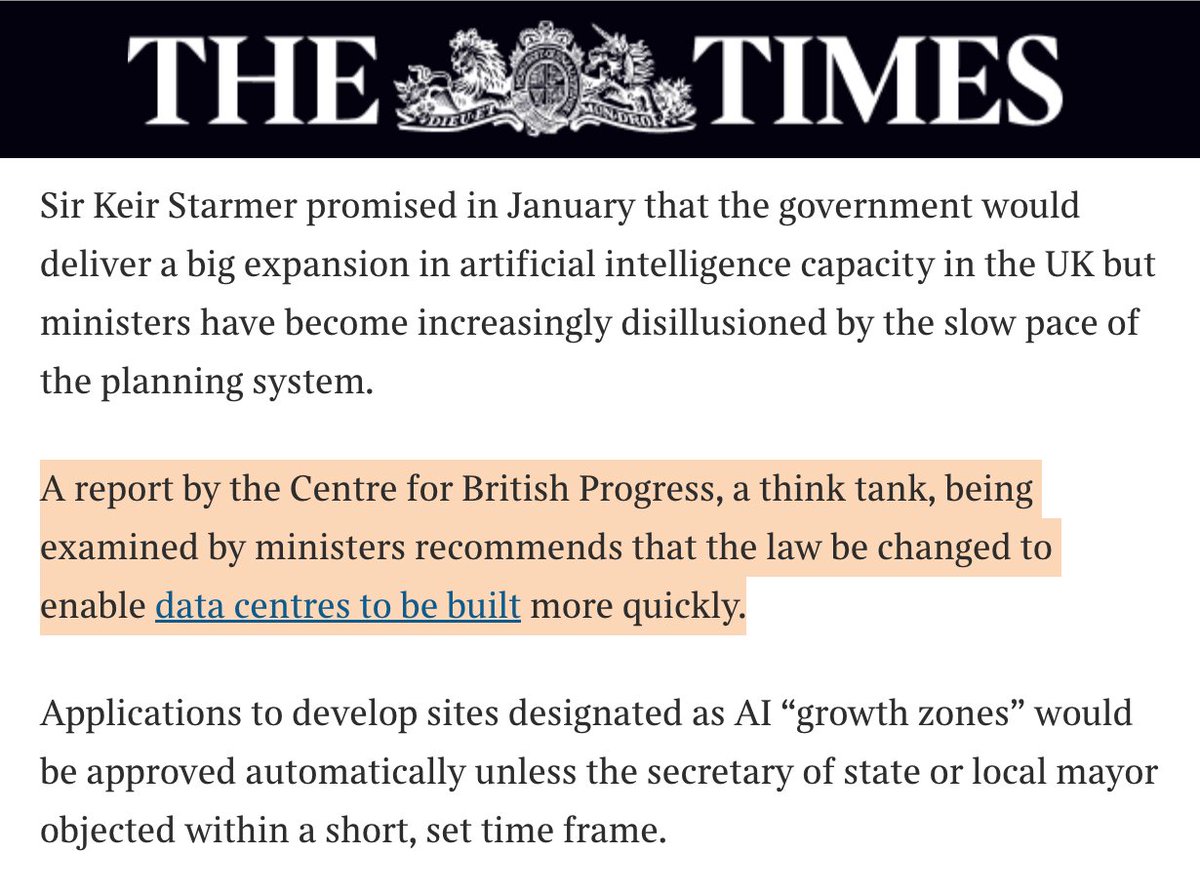

What’s the biggest threat to building AI in Britain? Turns out it’s our planning system We're in a global race, but we've made it almost impossible to build Our NEW REPORT for @britishprogress (in The Times and The Sunday Times w/ Max Kendix) is a plan to build quickly whilst protecting nature 🧵

Please apply for this fantastic role and send your reccs! Centre for British Progress gives me hope for turning the UK around. Just have a look at the quality of reports released in the last week to understand how great and implementation-ready the ideas are!

Agree with John Arnold. It is partly why we created Renaissance Philanthropy: to give donors additional ways to bet on science/tech outside of the 3 major options that exist today: (a) building a large expert foundation they oversee, (b) mega-gifts to universities, or (c) “decide later.”

Congratulations Lauren Gilbert on all that you achieved at RenPhil and excited for your next chapter!

On 30 Sep 2024, the UK closed its last coal plant. This was the day we should have ended carbon price support – an extra tax to get coal off the grid. In the Budget, Rachel Reeves has the chance to cut bills for millions + boost electrification, by ending CPS Here’s how:

you've heard about The Alan Turing Institute (~£30m/yr), but do you know the issues with the British Business Bank (£25b), the closest thing we have to a sovereign wealth fund? or how VC incentives costing £1b a year don't help scale or sovereignty? to fix this chart, we need to fix *them*: