E.J. Antoni, Ph.D.

@RealEJAntoni

@Heritage & @Comm4Prosperity economist

@VinceCoglianese Show, @Richzeoli Show, @dbongino Show in-house economist; I may be wrong, but it’s highly unlikely; VAMO

ID:1609617100175196160

https://www.heritage.org/staff/ej-antoni 01-01-2023 18:26:52

4,7K Tweets

44,1K Followers

499 Following

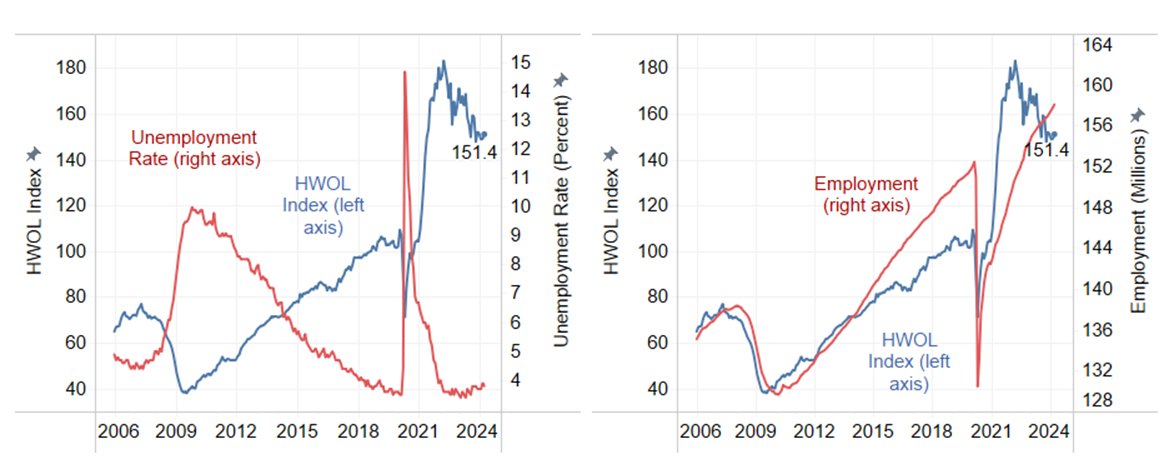

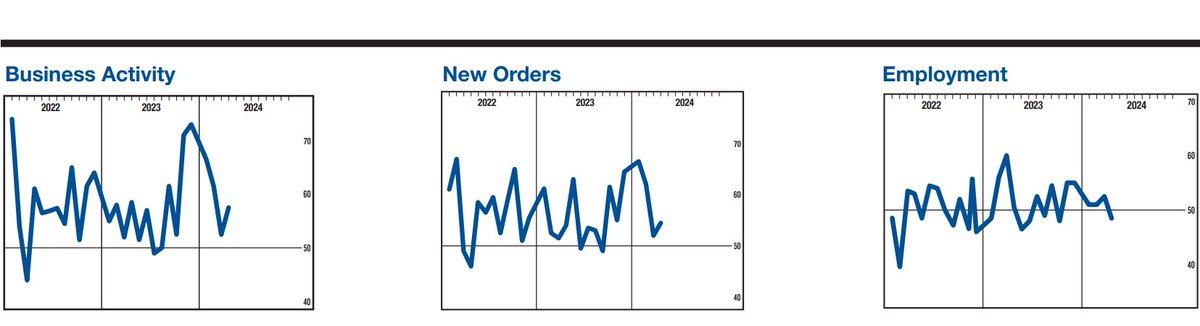

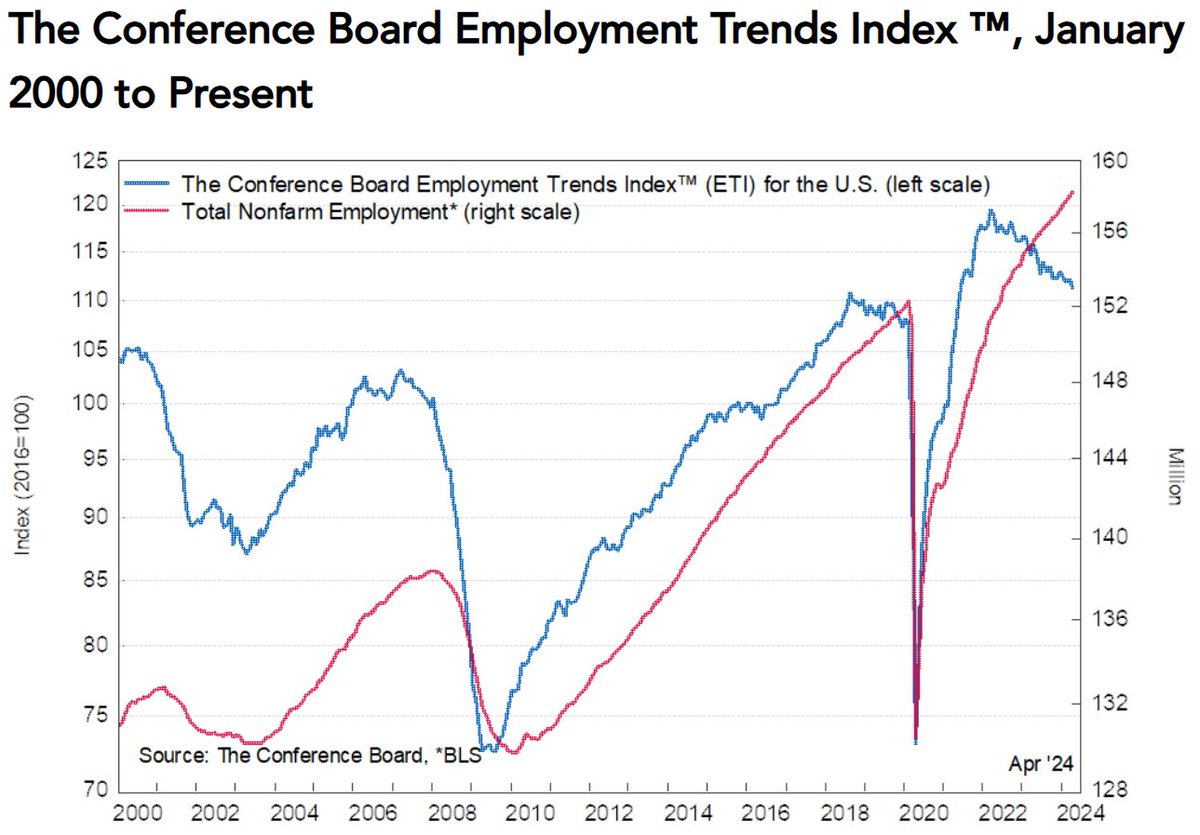

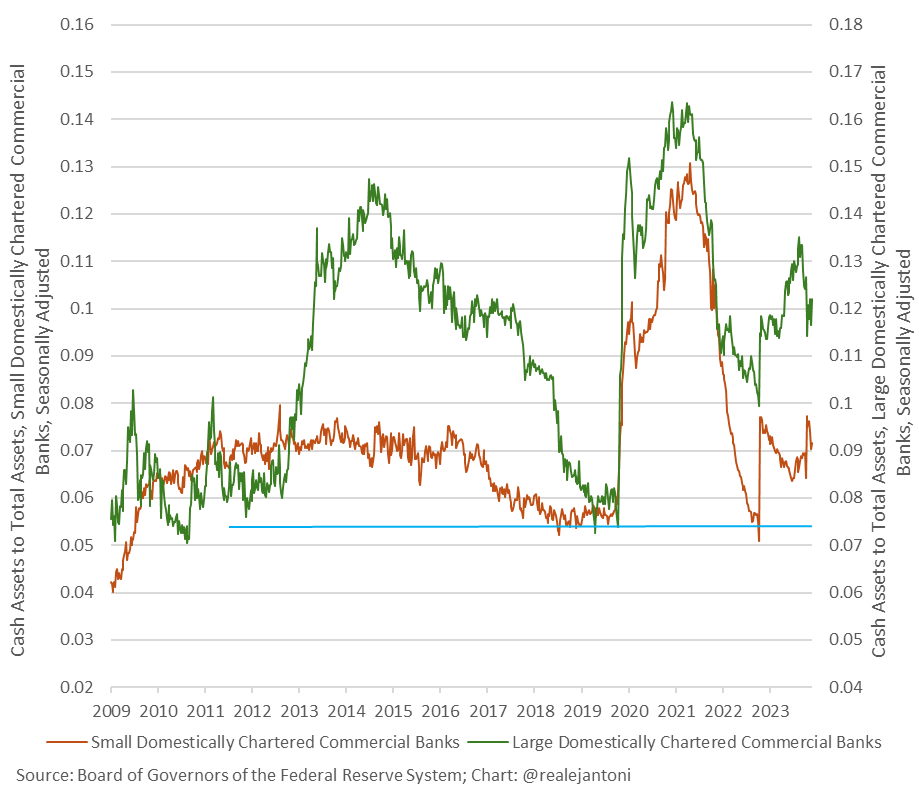

This was a tremendous conversation with the great Charles V Payne in Feb, but the labor market trends which we discussed then are still present in the economy today, as evidenced by Friday’s job report: