E.J. Antoni, Ph.D.

@RealEJAntoni

@Heritage & @Comm4Prosperity economist

@VinceCoglianese Show, @Richzeoli Show, @dbongino Show in-house economist; I may be wrong, but it’s highly unlikely; VAMO

ID:1609617100175196160

https://www.heritage.org/staff/ej-antoni 01-01-2023 18:26:52

4,4K Tweets

41,7K Followers

497 Following

Jim Grant, in an interview just this morning with Maria Bartiromo, said 'the Fed itself regards a potential second term for Donald Trump as a clear and present danger to the country.'

Grant was right about the Fed and this undercover video proves it:

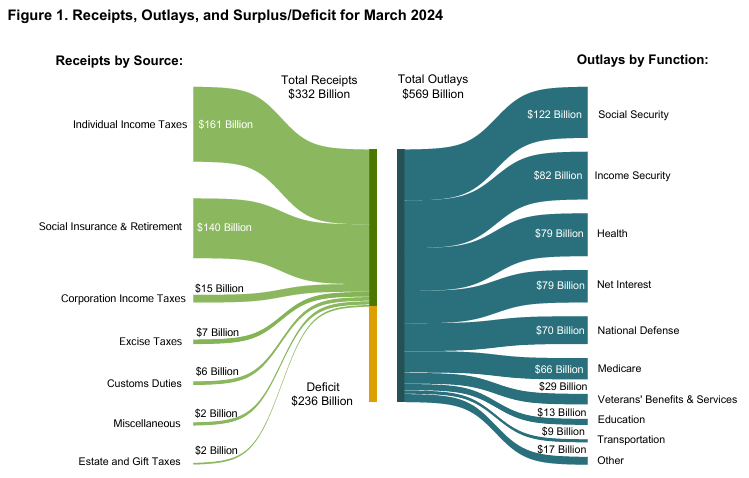

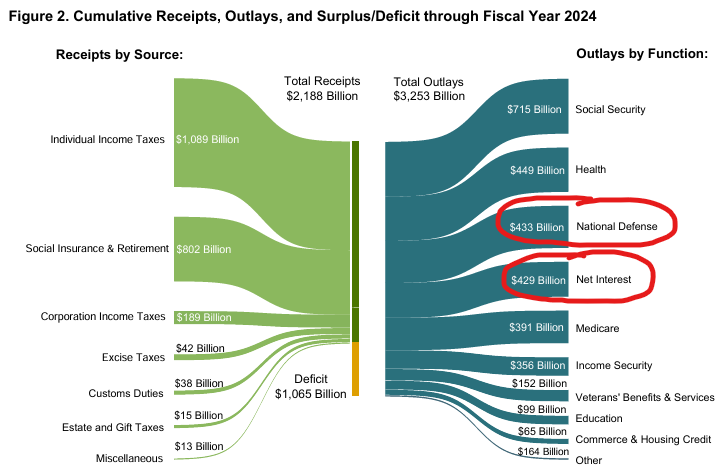

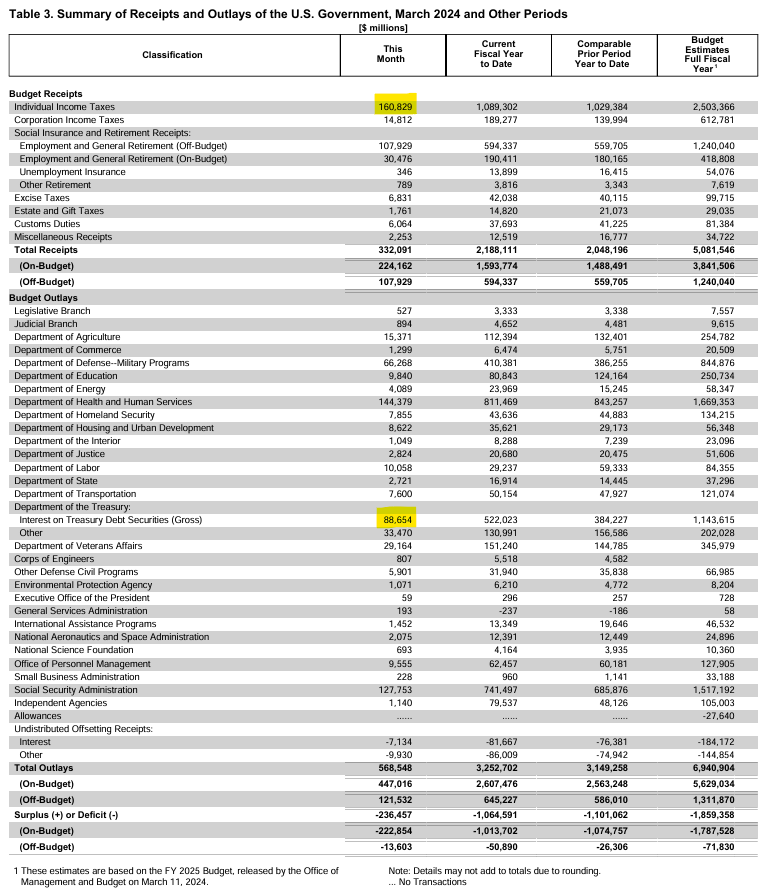

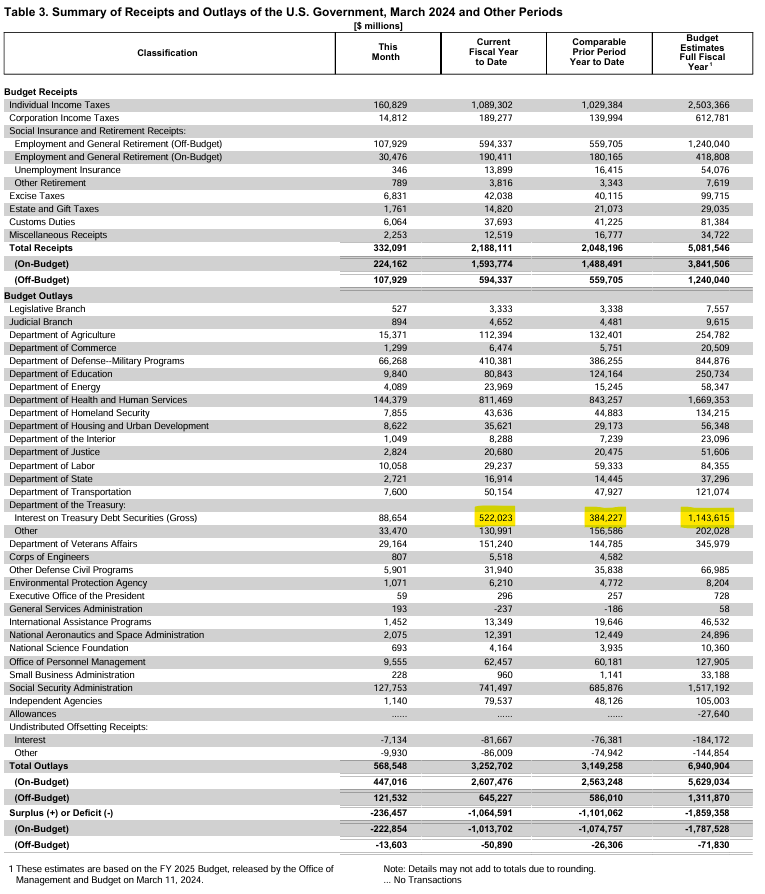

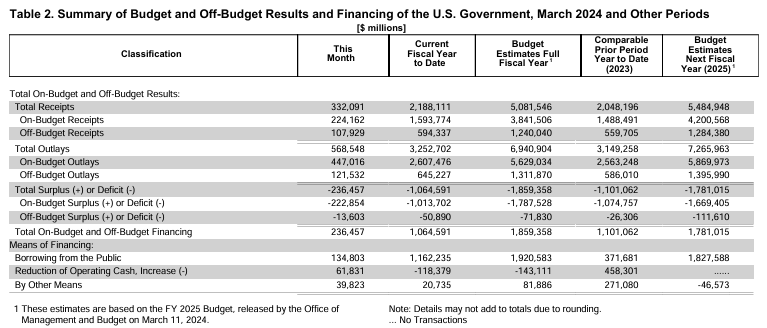

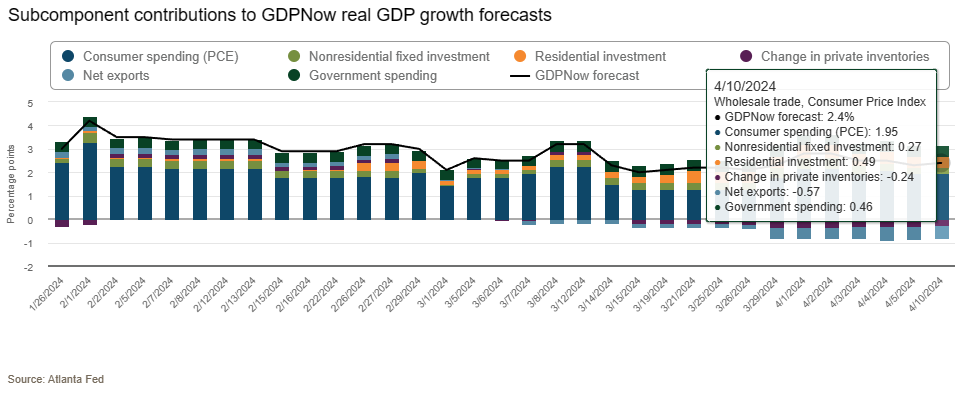

10-year bond auction was horrific. E.J. Antoni, Ph.D. tells The Big Money Show we may have a big problem financing our debt if people aren't buying Treasuries at 4.5% yield