Peapods Finance

@peapodsfinance

Unlocking sustainable yield on any asset through Volatility Farming.

Live @ethereum @base @arbitrum @soniclabs @modenetwork | Soon @berachain

bit.ly/PeapodsFi

ID: 1728371500531494912

http://beta.peapods.finance 25-11-2023 11:14:40

1,1K Tweet

14,14K Followers

2 Following

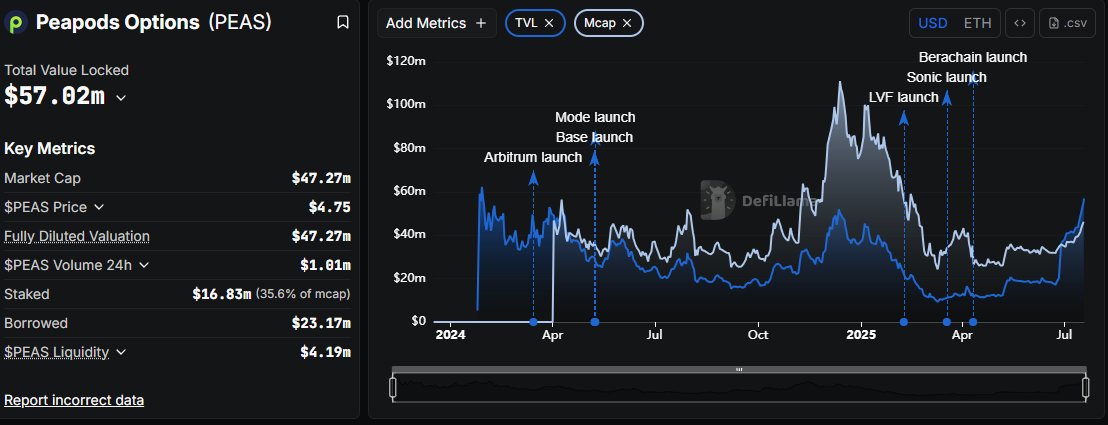

The DeFi protocol in question, as most of you guessed was indeed $PEAS - Peapods Finance & for the first time in it's history the TvL is higher than the market cap. Here's a thread on why I think it could be one of the biggest & sustainable $ETH DeFi protocols of all time. 👇

A few months back, Pashov Audit Group audited Peapods Finance’s LVF upgrade. Over a 4-week audit, it became clear how LVF’s fundamentally novel approach to yield & leverage can be a game-changer for DeFi, ultimately leading me to become $PEAS liquid investor 🧵

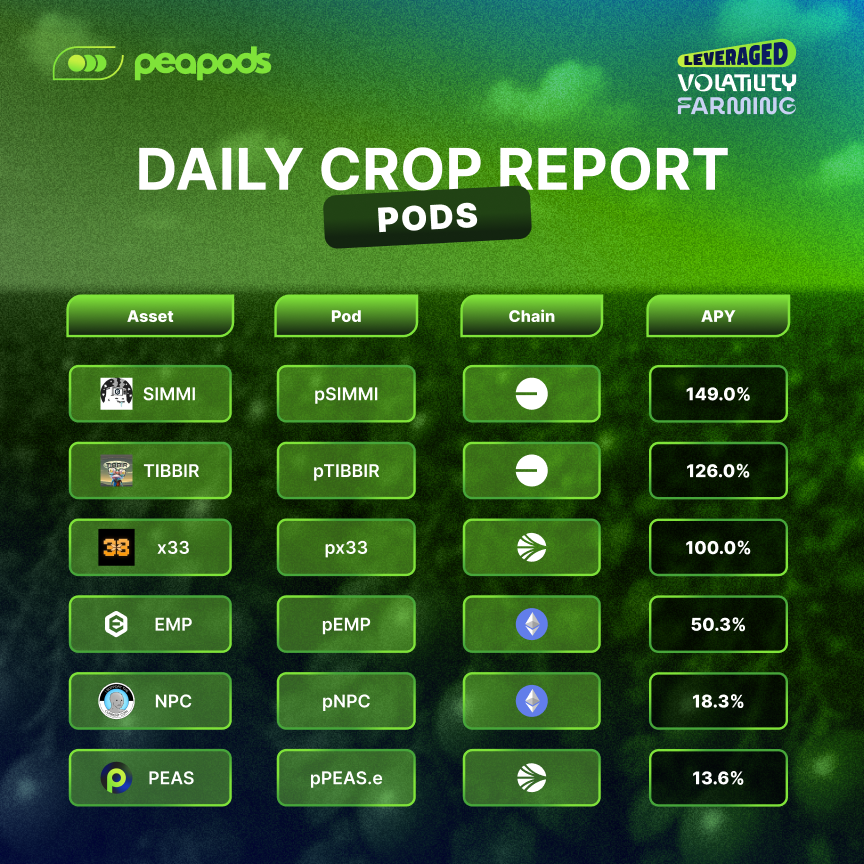

👨🌾 Daily Crop Report (02/08/25) – Leveraged Volatility Farming (Pods) Jim Cramer says he’s always despised both August and September… just tough months to make money. Well… not on Peapods Finance. Where you can farm market volatility, up or down. But August and September is

Take a peep at Peapods Finance $PEAS is building with volatility and stacking yield without a single emission. No inflation. No ponzinomics. No fake APYs. Just pure, sustainable revenue backed by real on-chain activity. Smart tokenomics = no ceiling. Top 50 codebase = coded

Here's another full breakdown of Peapods Finance You'll learn: - How Peapods' Pods and P-tokens work - Why volatility is the most reliable yield source in crypto - How leveraged volatility farming (LVF) works - How $PEAS token is deflationary, efficient, and deeply

How I’m using Peapods Finance to stack more $PEAS: I buy $PEAS I deposit it into $PLONGpeas LVF pod (earning 10.5% from volatility) When $PEAS dips, I borrow USDC from pod → I use that to buy more $PEAS → deposit that back in pod When $PEAS rises, some of position is sold

Unlocking yields has always been an issue in DeFi. It's even more complicated when you intend to use "Volatility farming". This prevalent issue set me to explore Peapods Finance : The First-Class solution to sustainable yields. It will interest you what I found. You'll need