Horus

@onchainhorus

Crypto Researcher | RWA | AI | DeSci |

ID: 1936818626675302400

22-06-2025 16:10:17

104 Tweet

6,6K Takipçi

75 Takip Edilen

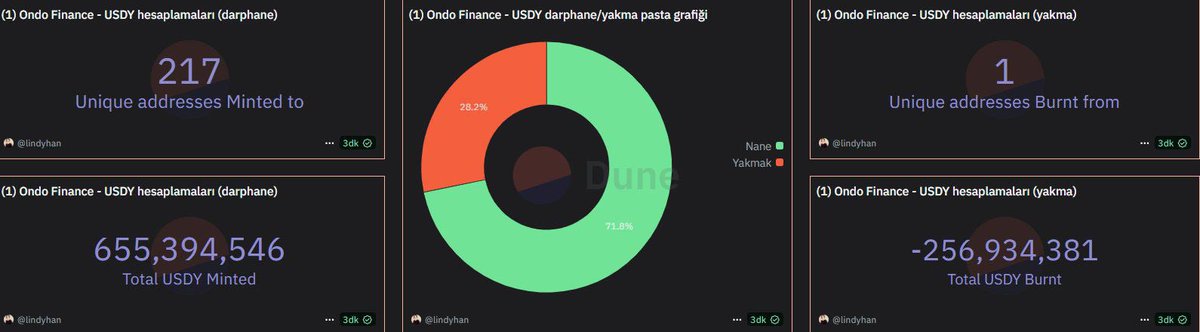

State of the RWA Market Real-world assets are coming onchain. But how big is the market? • Total RWA market size: $25.1B • RWA holder addresses: 324K+ • Tokenized US Treasuries: $6.74B • Avg. yield: 4.1% • Top players: Ondo Finance, Securitize Plume - RWAfi Chain Top 3 RWA

Flux Finance is the DeFi arm of Ondo Finance. • Built on top of Compound • Enables borrowing with $OUSG as collateral • Earn interest with USDC, USDT, or GHO • Institutions borrow, retail users earn yield One of the first DeFi protocols backed by real-world assets (RWA).