Ole S Hansen

@Ole_S_Hansen

Head of Commodity Strategy @SaxoBank and a regular contributor to both broadcast and print media. Broad focus, but mostly #gold #silver #copper #oil & #grains

ID:334571039

https://www.home.saxo/insights#analysis 13-07-2011 09:34:14

25,1K Tweets

62,1K Followers

611 Following

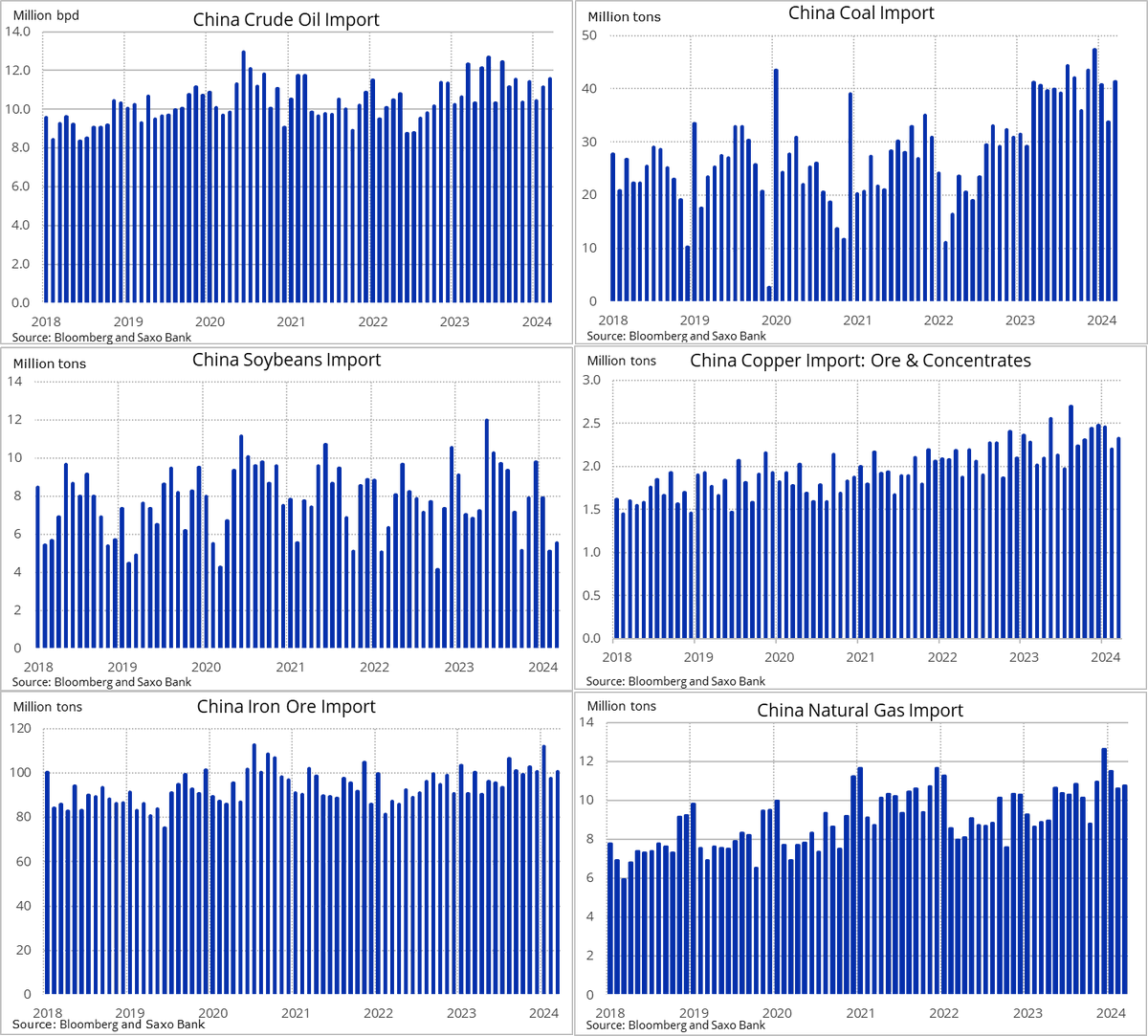

China March import of key #commodities :

Crude oil: 11.58m b/d, -6.2% YoY (+4% MoM)

Natural gas: 10.8m tons, +21.3% YoY

Coal: 41.4m tons, +22.6% YoY

Copper: 2.33m tons, +15.4% YoY

Iron Ore: 100,7m tons, flat YoY

Soybeans: 5.54m tons, -19.1% YoY