Mubin Haq

@Mubin_Haq

Chief Executive @finan_fairness - tackling financial problems, improving living standards. All views my own

ID:2485456309

https://www.financialfairness.org.uk/ 09-05-2014 14:08:54

5,6K Tweets

3,0K Followers

2,3K Following

The carer’s allowance overpayments is a national scandal. DWP harassing unpaid carers often over small amounts. This example from The Guardian highlights the problem - & yet DWP is often aware there might be an issue but fails to inform the carer immediately theguardian.com/society/2024/a…

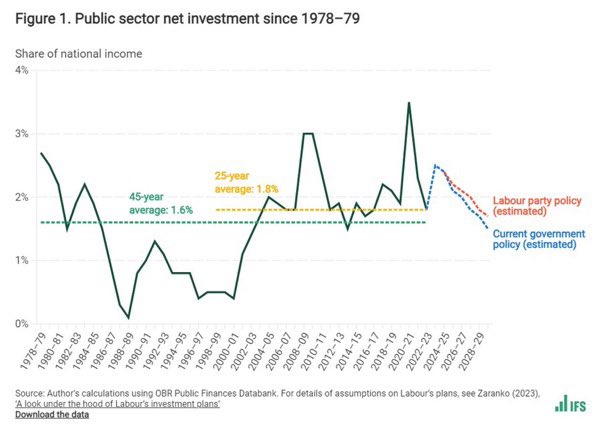

Public investment could increase if fiscal rules are tweaked. But at present investment set to fall. And within this budget are things you might not expect like student loans. Great 101 from Ben Zaranko Institute for Fiscal Studies supported by abrdn Financial Fairness Trust Nuffield Foundation

ifs.org.uk/articles/publi…

New output from the Nuffield Foundation general election projects, funded jointly with abrdn Financial Fairness Trust. This publication relates to a critical issue, given what we know from the research we support about the critical role of investment in supporting sustainable productivity growth.

We’re regularly told taxes in the UK are high - they’ve certainly been increasing. But they’re still low compared to others. Raising taxes to G7 average would raise an extra £79bn annually - analysis Institute for Fiscal Studies supported by abrdn Financial Fairness Trust Nuffield Foundation

financialfairness.org.uk/en/media-centr…

In 2019 (pre-pandemic) 3.2M working-age people were claiming a health-related benefit. That’s now 4.2M & set to rise to 5.4M by 2029 - an increase of 70% over a decade.

New analysis Institute for Fiscal Studies Tom Waters & Sam Ray-Chaudhuri funded by abrdn Financial Fairness Trust

ifs.org.uk/publications/r…

Before the pandemic, 1 in 13 were claiming a health-related benefit. That's now set to rise to 1 in 8 by the end of the decade. We need better understanding of the causes rather than knee-jerk reactions. New analysis Institute for Fiscal Studies funded by abrdn Financial Fairness Trust

ifs.org.uk/news/42-millio…

In 2019 (pre-pandemic) 3.2M working-age people were claiming a health-related benefit. That’s now 4.2M & set to rise to 5.4M by 2029 - an increase of 70% over a decade.

New analysis Institute for Fiscal Studies Tom Waters & Sam Ray-Chaudhuri funded by abrdn Financial Fairness Trust

ifs.org.uk/publications/r…

Before the pandemic, 1 in 13 were claiming a health-related benefit. That's now set to rise to 1 in 8 by the end of the decade. We need better understanding of the causes rather than knee-jerk reactions. New analysis Institute for Fiscal Studies funded by abrdn Financial Fairness Trust

ifs.org.uk/news/42-millio…

One of the reasons inheritance tax isn’t popular is because of loopholes a few benefit from. Closing these could raise more revenue and make the tax fairer.

New Institute for Fiscal Studies analysis by Arun Advani David Sturrock supported by abrdn Financial Fairness Trust

financialfairness.org.uk/en/media-centr…

There’s lots of exemptions in relation to inheritance tax - closing three relating to business assets, farms and pensions could raise over £2bn per yr by the end of the decade. New analysis Institute for Fiscal Studies Arun Advani David Sturrock - supported by abrdn Financial Fairness Trust Nuffield Foundation

UK govt spending now similar to other advanced economies BUT tax levels remain below average - instead debt has grown. Raising taxes to the G7 average would raise an extra £79bn - new analysis Institute for Fiscal Studies supported by abrdn Financial Fairness Trust Nuffield Foundation

ifs.org.uk/articles/spend…

UK govt spending now similar to other advanced economies BUT tax levels remain below average - instead debt has grown. Raising taxes to the G7 average would raise an extra £79bn - new analysis Institute for Fiscal Studies supported by abrdn Financial Fairness Trust Nuffield Foundation

ifs.org.uk/articles/spend…

Today we published the report ‘Coping and hoping: Navigating the ups and downs of monthly assessment in Universal Credit’ by Rita Griffiths and Marsha Wood

➡️ bath.ac.uk/publications/c…