Michael R. Strain

@MichaelRStrain

Director of Economic Policy Studies & Senior Fellow at @AEI. Professor of Practice at @Georgetown. Buy "The American Dream Is Not Dead": https://t.co/02npyRToUP.

ID:727088844

http://www.michaelrstrain.com 30-07-2012 23:36:22

473 Tweets

19,6K Followers

398 Following

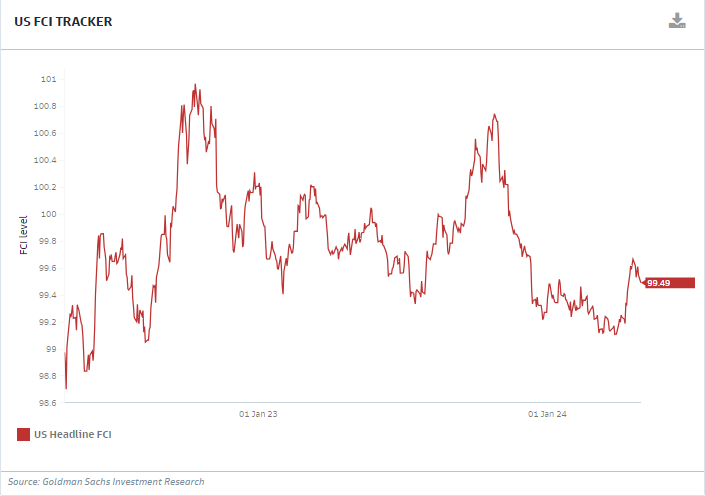

Fin/ The underlying economy is booming, and monetary policy is inadequately restrictive. The prospect that taming price pressures may require a mild downturn is more worrying than stagflation.

My Project Syndicate column. project-syndicate.org/commentary/mil…

The first-quarter GDP report supports the view that the US economy has not landed.

Some economists are concerned about stagflation.

The real worry: taming price pressures may require a mild downturn, writes AEI's Michael R. Strain.

project-syndicate.org/commentary/mil…

While some economists are concerned about stagflation, the real worry is that taming price pressures may require a mild downturn, given strong consumer spending and inadequately restrictive monetary policy.

My Project Syndicate column. prosyn.org/PT3crAD

The underlying economy is booming, and monetary policy is inadequately restrictive. The prospect that taming price pressures may require a mild downturn is more worrying than stagflation.

My Project Syndicate column. project-syndicate.org/commentary/mil…

Thrilled that Jeremy Weinstein will be the next Harvard Kennedy School Dean--he is a fantastic scholar & institution builder with a global outlook--not to mention a thoughtful and kind person. I'm optimistic he will be able to fill Doug Elmendorf's large shoes.

news.harvard.edu/gazette/story/…

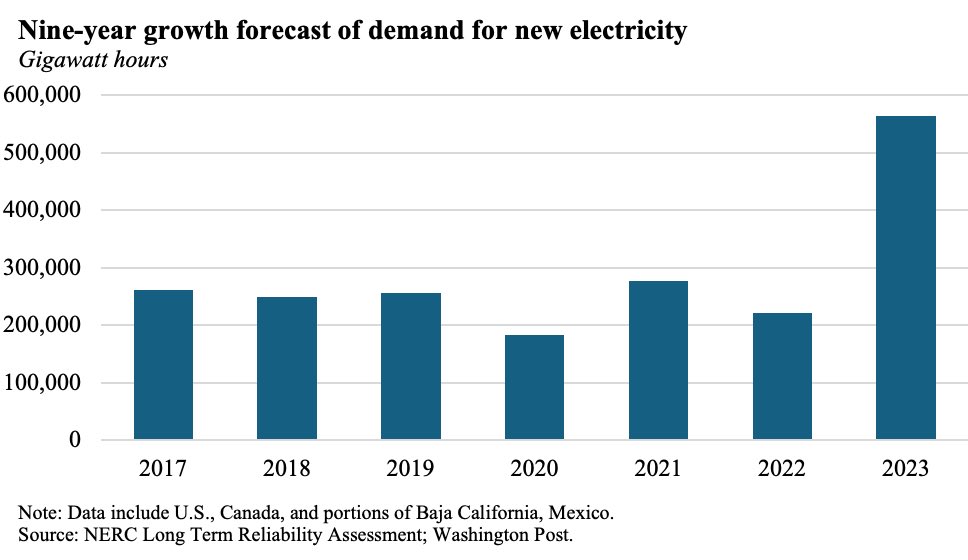

Is the US economy still booming? Or should we be concerned about a period of slow growth and high inflation? Michael R. Strain breaks it down. bit.ly/3QtDH5R