Max Bautin

@maxbautin

Partner/cofounder at IQ Capital, leading early stage deeptech VC in London/Cambridge.

ID: 29950096

http://www.iqcapital.vc 09-04-2009 08:57:17

127 Tweet

217 Takipçi

189 Takip Edilen

We're back with actionable benchmarks for European founders! This time... The European Series A landscape over the past 5 years - trends in round sizes and most active lead VCs - by geo and category. Huge thanks to Dealroom.co and the VCs involved 🙏 medium.com/localglobe-not…

Lots of response to this today - thank you. Also clear to me that HM Treasury & British Business Bank are listening and open to iteration on this scheme, and consideration of others (I have submitted ideas). Thanks Emma Jones Gerard Grech Dom Hallas +others for making the case to Govt.

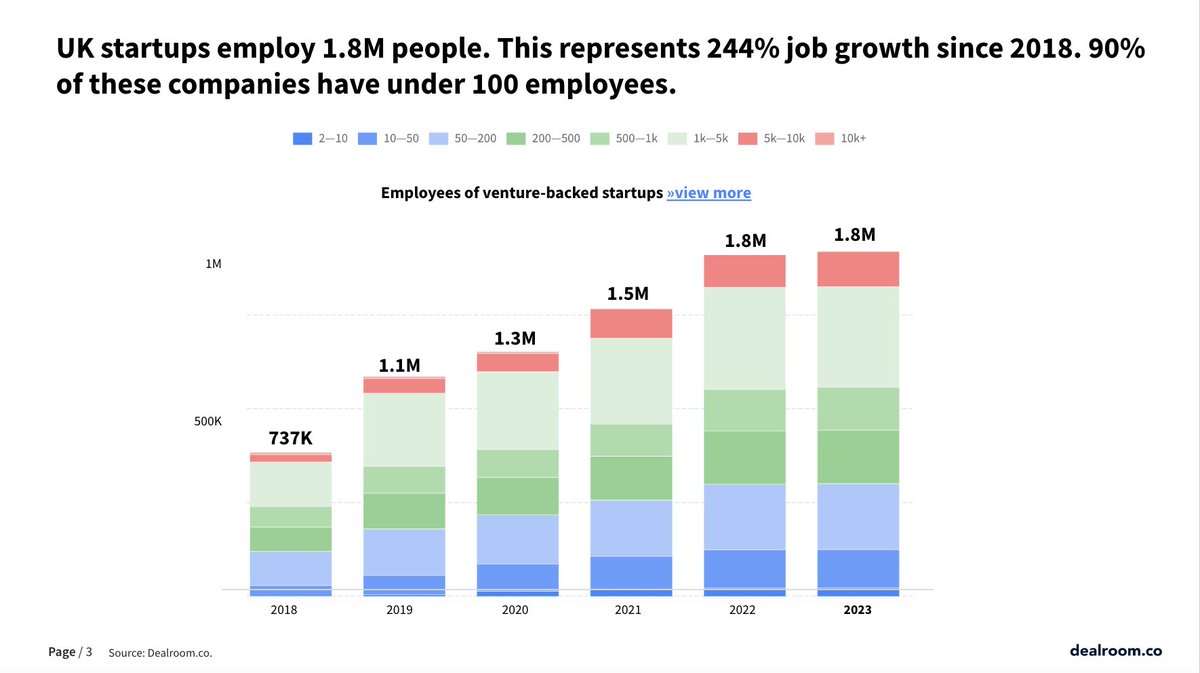

In light of what's been happening, a roundup of some key stats on UK tech. 🧵 SVB UK is now HSBC Innovation Banking UK has 3,300 clients (via Financial Times). There are 6,369 active UK startups with min $500K funding. • UK startups employ 1.8M people • The UK startup ecosystem is collectively worth almost $1T

🚀 Breaking the 'Europe is behind' narrative: European startups are quietly writing a different story. Each new generation taking a bigger slice. Young EU startups now = 18% of new global tech value. Today's Big Tech companies were uncontested in 90s and 00s. Full Dealroom.co