Mark Tannenbaum

@marktannenbaum1

Markets editor @ Bloomberg News. Retweets aren't endorsements. Opinions are my own.

ID: 495060232

17-02-2012 15:12:29

6,6K Tweet

1,1K Followers

2,2K Following

COWZ, which tracks companies with high free-cash-flow yields, doesn't hold any of the Mag 7 stocks yet saw inflows every day since July barring one session Mark Tannenbaum bloomberg.com/news/articles/…

US stocks’ torrid climb is evoking worrisome comparisons to past boom-and-bust cycles on Wall Street, but there are plenty of signs that the strength hasn’t turned into a speculative frenzy. With Matt Turner, Mark Tannenbaum: bloomberg.com/news/articles/…

Uranium stocks are having their best run in months on combination of flooding in Kazakhstan, the world’s largest producer of the nuclear fuel, and bullish coverage from banks including Goldman Geoffrey Morgan #uranium Bloomberg Markets bloomberg.com/news/articles/…

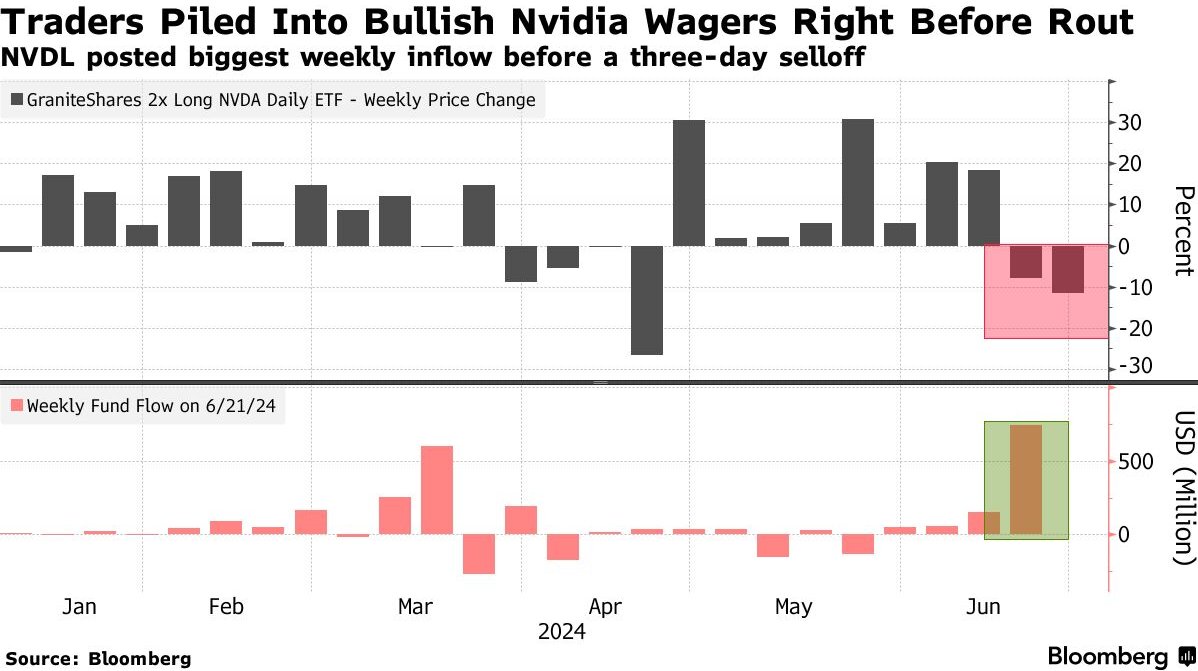

Leveraged Nvidia ETF saw a record $743 million inflow last week but timing wasn't great. The fund has tumbled around 25% since Tuesday’s close as Nvidia fell 13% across three sessions Denitsa Tsekova Mark Tannenbaum bloomberg.com/news/articles/…

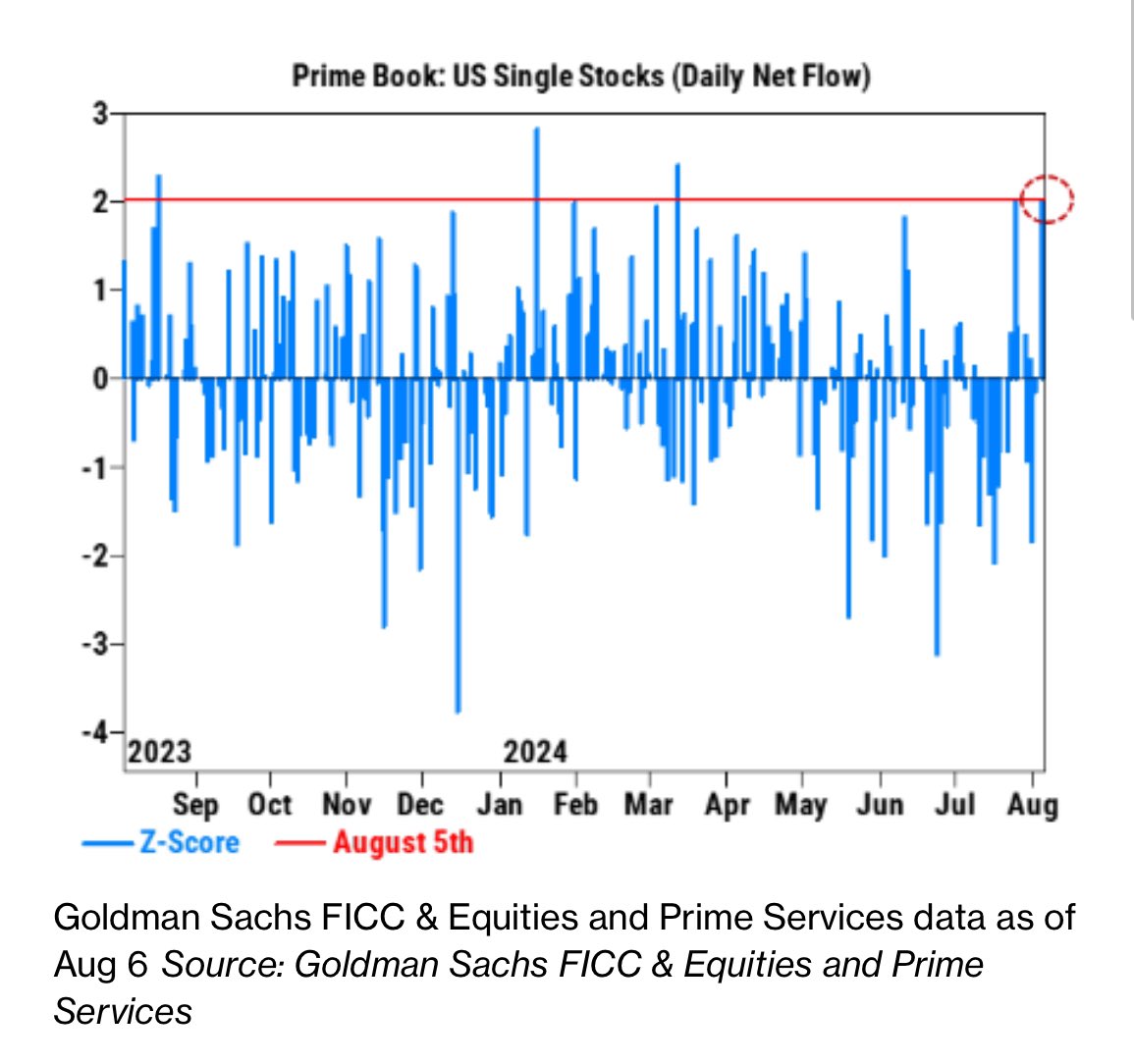

After selling US stocks for months, hedge funds emerged as dip buyers amid yesterday’s rout. Edited by Mark Tannenbaum bloomberg.com/news/articles/…

My friend and co-worker Chris Dolmetsch just got back from a four-day Phish festival in Delaware. Look who he just ran into outside the Bloomberg office in NYC

"Half your coworkers might have just spent August in Europe, but there were no holiday doldrums in the booming world of ETFs." - 🔥 lede by Vildana Hajric via story on the relentless no days off ETF flows bloomberg.com/news/articles/…

Three years after she wounded my face and brain, my attacker goes to trial today with an insanity plea. On Substack I chronicle the criminal case, plus healing with Victoria, the warmblood horse who is my competition partner, friend and trauma therapist. open.substack.com/pub/eliseyoung…

Repo madness. Abundant thanks to Scott Skyrm for help sorting this one out and to Mark Tannenbaum and Rachel Evans for deft editing.

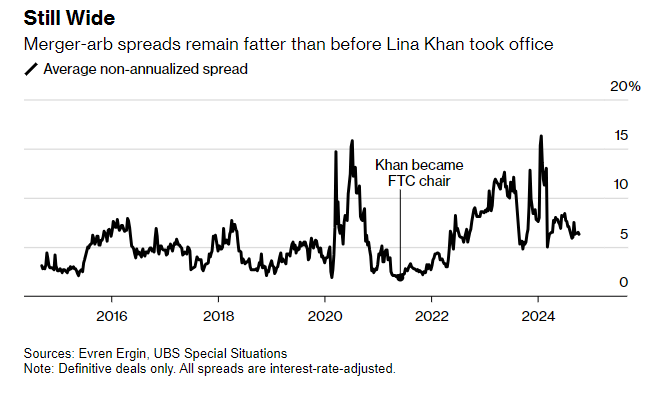

It has been a tough year for merger-arb market but a UBS hedge fund unit is betting on its revival and putting 1/3 AUM ($4bn) in the strategy. I talked to O'Connor's global head, Q4 "looks to be catalyst-rich" 🎁🔗: bloomberg.com/news/articles/… via Bloomberg Markets W/edits by Mark Tannenbaum

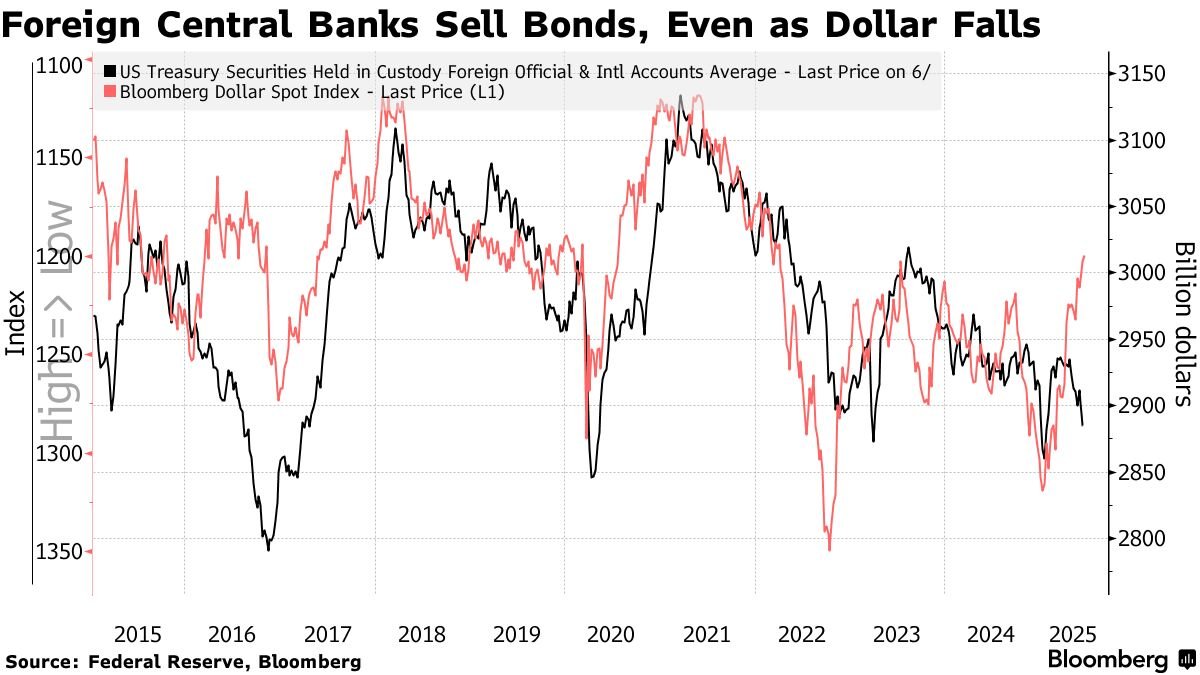

Central banks have been selling Treasuries since March, suggesting that they are diversifying away from dollar assets, according to Bank of America bloomberg.com/news/articles/… w/t Mark Tannenbaum