Michael Holland 🇺🇲🇬🇧 (DORMANT ACCOUNT)

@mhollandbr

US/UK Tax Advisor @BlickRothenberg tech geek & @Rovers fan. I help international businesses & their owners overcome the complexities of the US & UK tax systems.

ID: 741010521344905216

https://mhollandbr.start.page 09-06-2016 20:54:10

4,4K Tweet

900 Takipçi

892 Takip Edilen

Your #US #subsidiary will need to be funded through either #debt or #equity. In this guest blog post Michael Holland 🇺🇲🇬🇧 (DORMANT ACCOUNT) from Blick Rothenberg highlights the pros and cons of each funding approach for #usexpansion. usexpansionpartners.com/resources/debt…

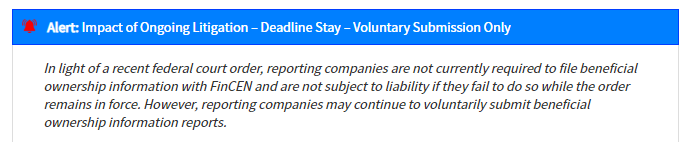

Most US & non-US entities doing business in the US must report their owners to FinCEN under the New Beneficial Ownership reporting system. The filing deadline for many entities is Jan 1st, 2025 Learn more in this article by Blick Rothenberg. 📄🔗 👉 buff.ly/3N3ysrF

On Dec 3 a US District Court issued a preliminary injunction to block the Corporate Transparency Act & the Beneficial Ownership Information Reports. The Treasury Department has now issued the following We recommend taxpayers pause any BOIR submissions ahead of further guidance. #BOIR