Lodestar Finance 🌟

@lodestarfinance

Arbitrum's Native Money Market for its yield bearing assets ⛵️

Join the crew: link3.to/lodestarfinance

ID: 1544467745168818178

05-07-2022 23:46:27

1,1K Tweet

11,11K Followers

0 Following

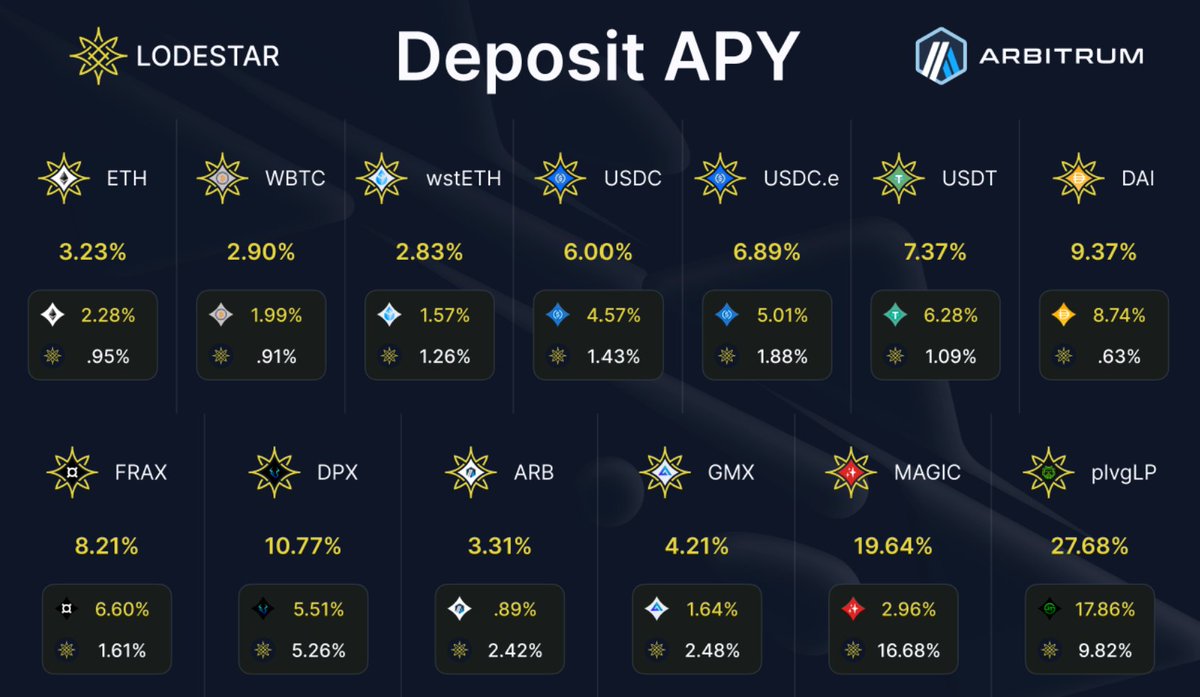

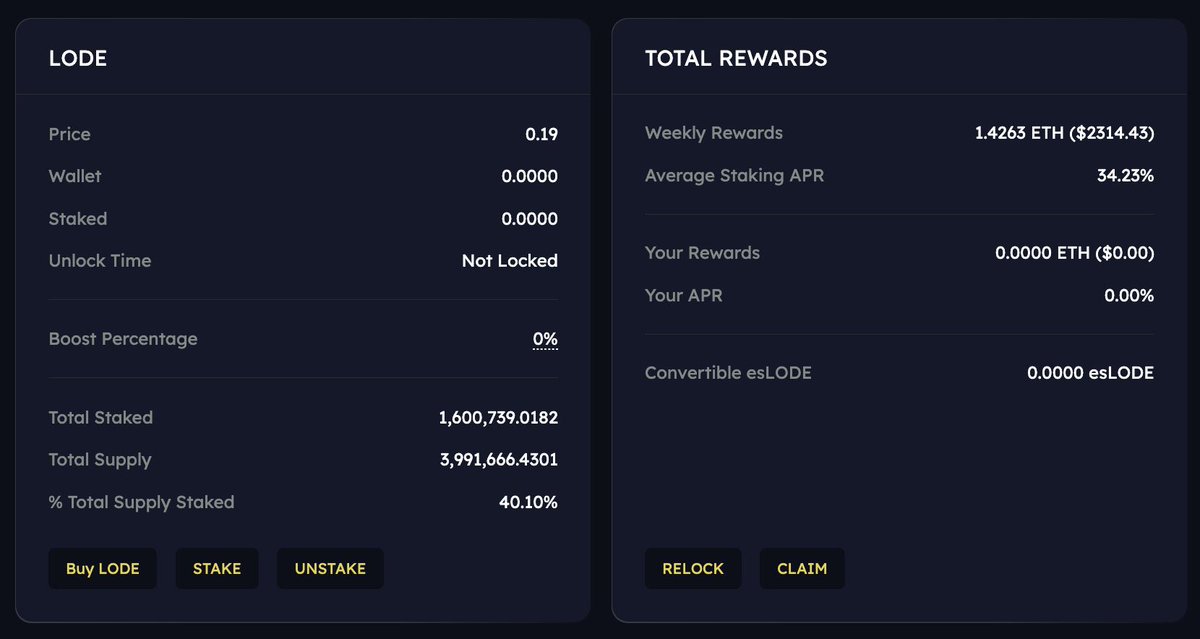

GM GM Linn is back with a Lodestar Finance 🌟 updateerooni and oh boy oh boy lots of changes since my last thread:

🉐 Crypto Linn Lodestar Finance 🌟 Loded up 4 sho

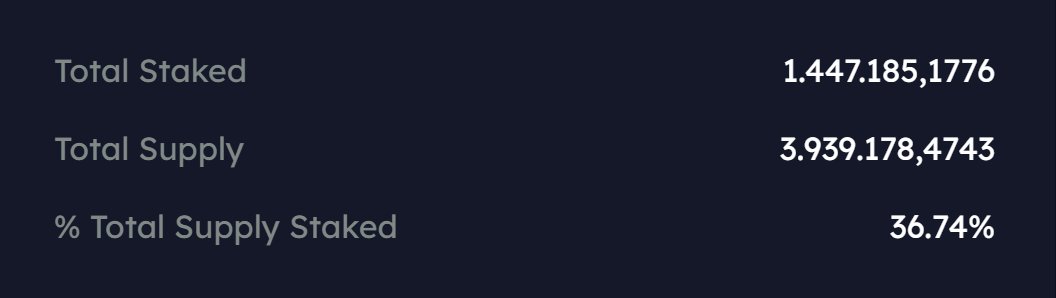

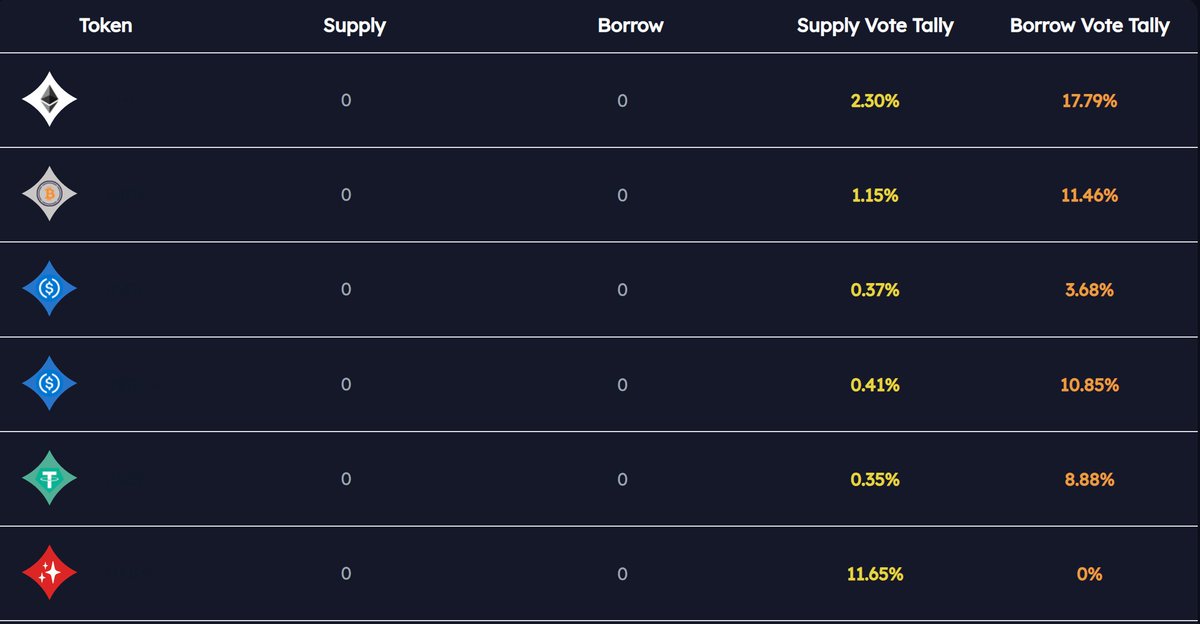

@0xtakezo 🉐 Crypto Linn Lodestar Finance 🌟 Now that the staking/real-yield is live and that emissions epochs are ongoing, next steps is monetising them 🤝 We have a few protocols building vaults on top of Lodestar, and them participating in the $LODE Wars to enhance their yield through staking or bribing should get the