Kendall Payne

@kendallp97

Facts matter.

ID: 788495190

29-08-2012 04:12:00

7,7K Tweet

552 Takipçi

101 Takip Edilen

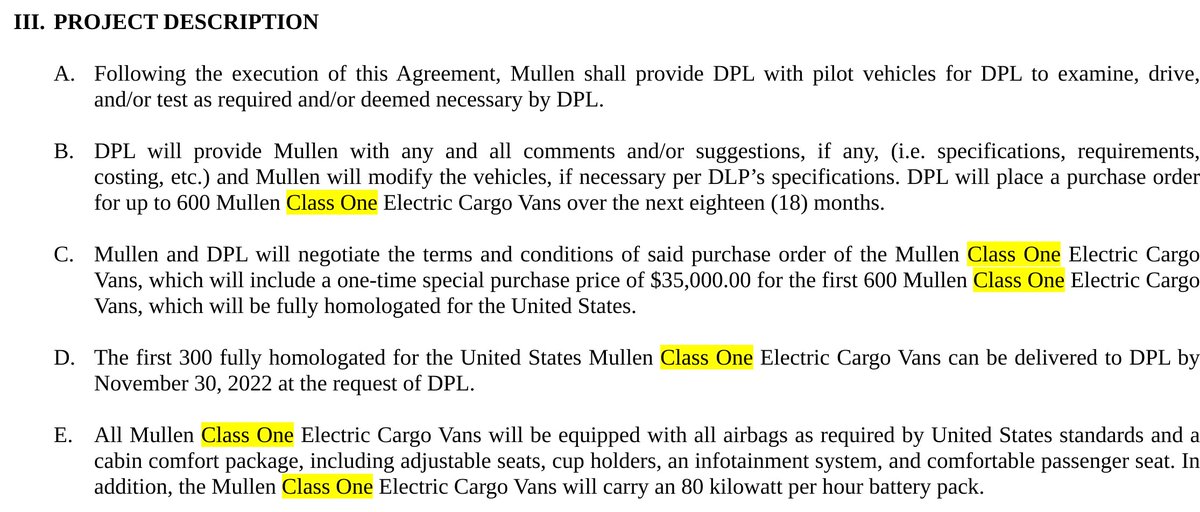

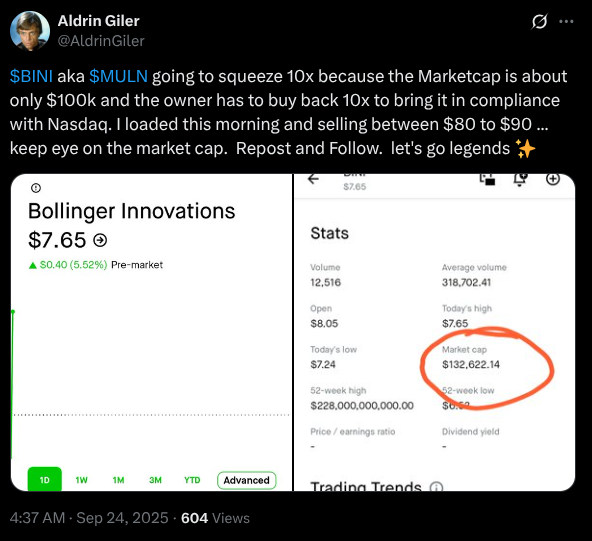

Surely someone who keeps getting it this wrong for this long can't be legit. The $2 "bottom" for $BINI $MULN that Aldrin Giler called back in April is $12,500,000 today after 3 more RS, and he *still* doesn't know how to correctly calculate market cap🤦♂️ x.com/AldrinGiler/st…

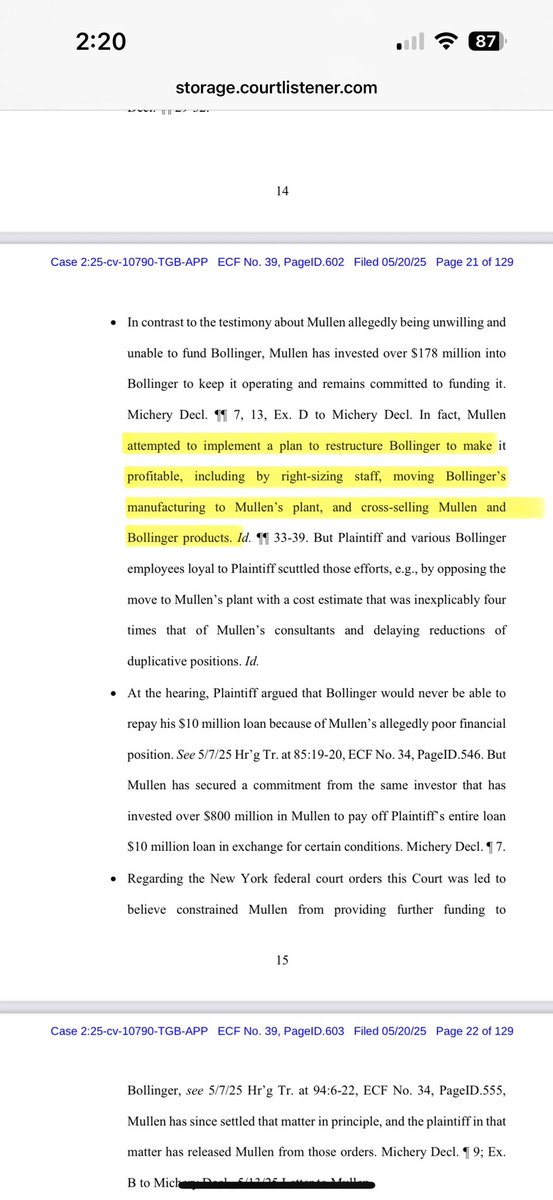

$MULN David Michery has always been such a spin doctor. Here he tries to make it sound like $BINI intentionally chose to move to the OTC as if that was best for the company, rather than getting kicked off the NASDAQ. #MULNscam globenewswire.com/news-release/2…

And now all the pumpers are seeking to cast blame after being complicit in the $BINI $MULN scam. Aldrin Giler was pumping and calling "bottoms" for well over a year, starting back when the SP was over the equivalent of $5 BILLION per share.

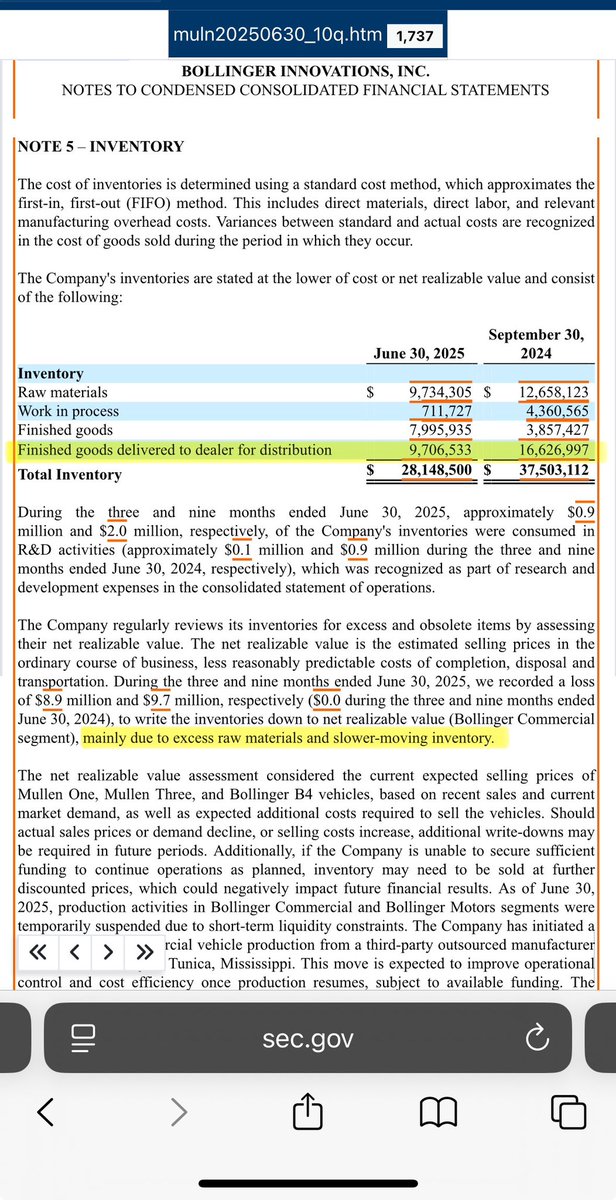

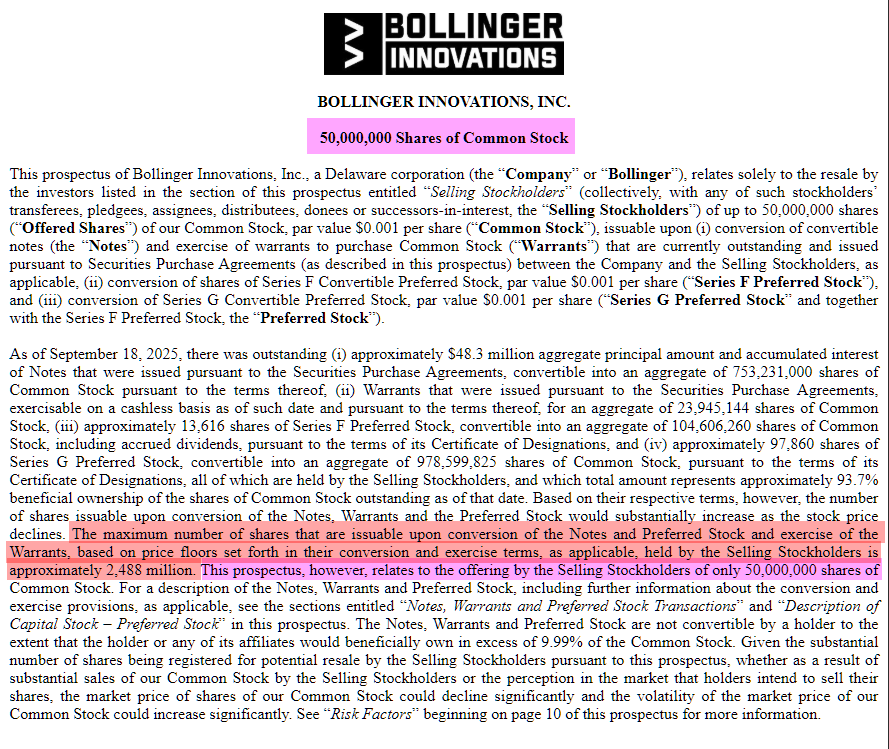

Same moron who filed for 67% ownership of $LGMK in '24 (later revised to 9% because their outstanding shares were 7X higher than he realized) now claims to own 10% of $BINI, and that they have 1500% short interest. Just maybe, he's mistaken on share count again? The Winvest Investment Fund LLC

So Jourdan Matthews (The Winvest Investment Fund LLC) is not just a moron in putting money into $BINI, he appears to be a fraudulent moron who is likely breaking SEC Enforcement rules with this false pump PR from last Friday.