John Burns Research and Consulting

@JBREC

Our team produces independent research and custom consulting advice to help executives make the most informed decisions possible.

ID:19424573

http://www.jbrec.com 24-01-2009 00:28:35

3,2K Tweets

15,5K Followers

732 Following

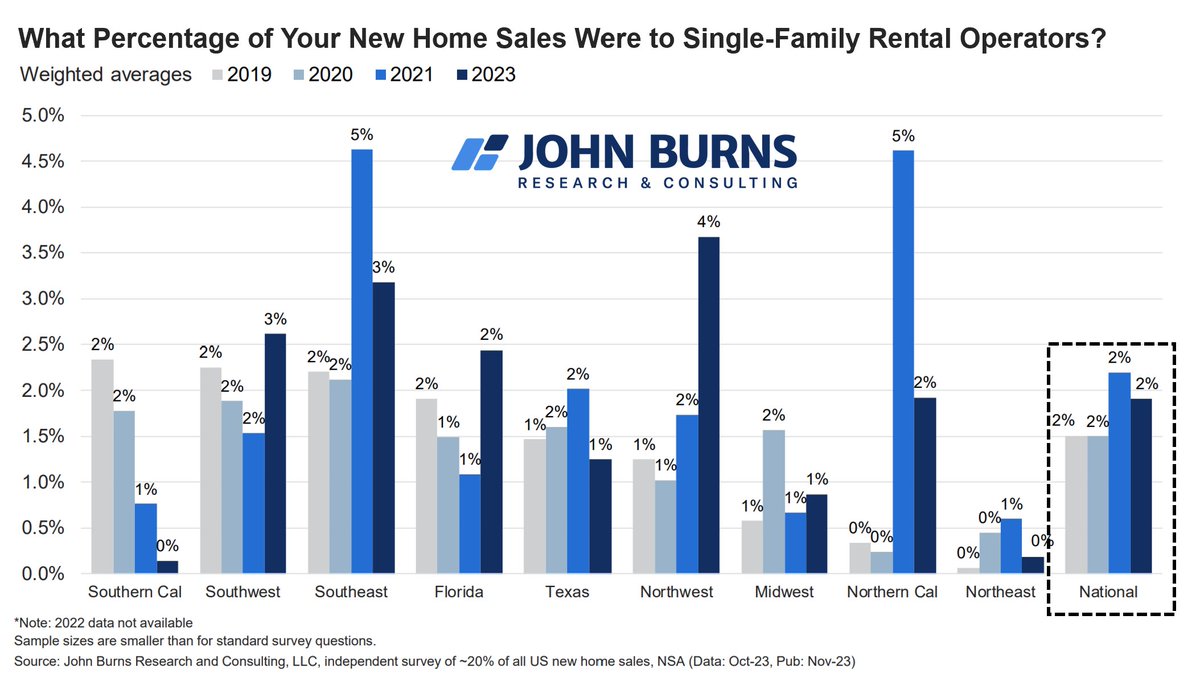

Our John Burns Research and Consulting data on the broader investor home purchase topic was used in this Will Parker The Wall Street Journal article today, but thought I'd share the chart on builders and single-family rental, as that topic doesn't get accurately depicted outside of the work we do. wsj.com/real-estate/wa…

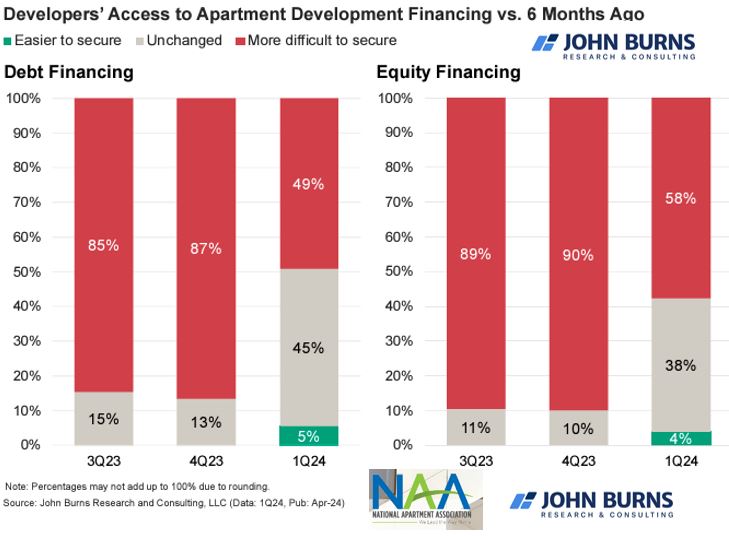

I was quite surprised to learn that debt and equity capital is returning to the apartment market, both for development and acquisition.

Here is our latest survey on development financing.

Thank you to National Apartment Association for partnering with us on this survey.

One month out from our John Burns Research and Consulting Summit conference (speakers below). Always a ton of great discussions, including Neil Dutta RenMac: Renaissance Macro Research who I'll be sitting down with again for our annual temperature check on the economy and Fed.

![Eric Finnigan (@EricFinnigan) on Twitter photo 2024-04-12 21:19:10 Gen Z homeownership is lower than Millennials, Gen X, or Baby Boomers at the same ages. 'The entire Gen Z population, including those living with family or roommates,... are less likely to be homeowners than [millennials, Gen X, or Baby Boomers] at the same stage of life.' Gen Z homeownership is lower than Millennials, Gen X, or Baby Boomers at the same ages. 'The entire Gen Z population, including those living with family or roommates,... are less likely to be homeowners than [millennials, Gen X, or Baby Boomers] at the same stage of life.'](https://pbs.twimg.com/media/GK_nVAxbgAE34nB.jpg)