Invest Europe

@InvestEuropeEU

The voice of #investors in privately held companies in #Europe with €1 trillion capital under management in 2022 #PrivateEquity #VentureCapital #Infrastructure

ID:594719820

http://www.investeurope.eu 30-05-2012 14:30:38

18,8K Tweets

43,0K Followers

2,9K Following

#CFOForum24 on alternative structures and features ⤵️

What are the instruments and structures currently available to the sponsors? What are the key considerations for CFOs in such structures?

Register now 👉 cfo.investeurope.eu/registration/

#privateequity #venturecapital

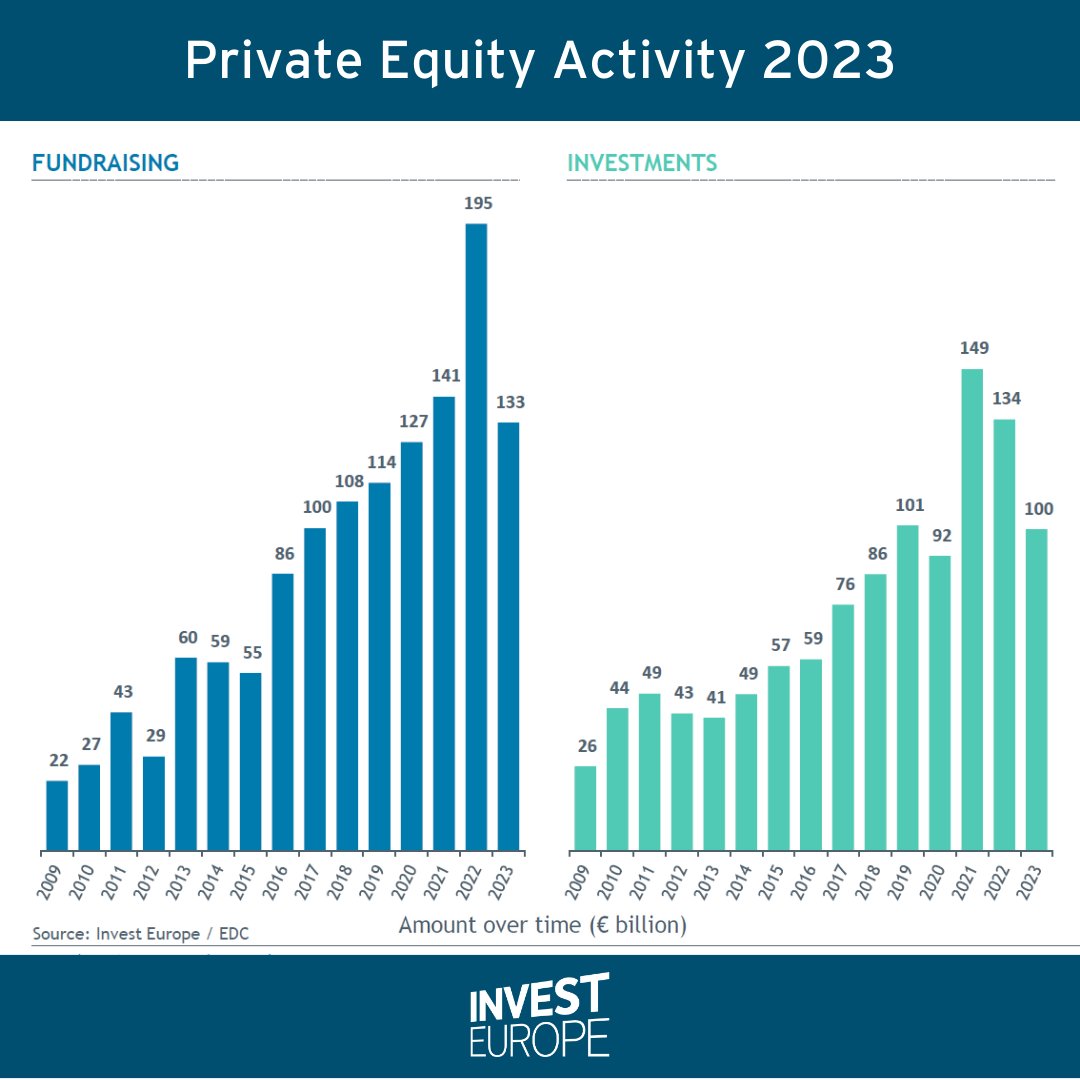

What were the key stats on European #PrivateEquity & #VentureCapital activity in 2023?

✨Fundraising reaches €133bn

✨Investment of €100bn for 4th year on record

✨ 8,391 companies backed

Our European Private Equity Activity report ➡️ bit.ly/IE-ActivityDat…

#PEActivity23

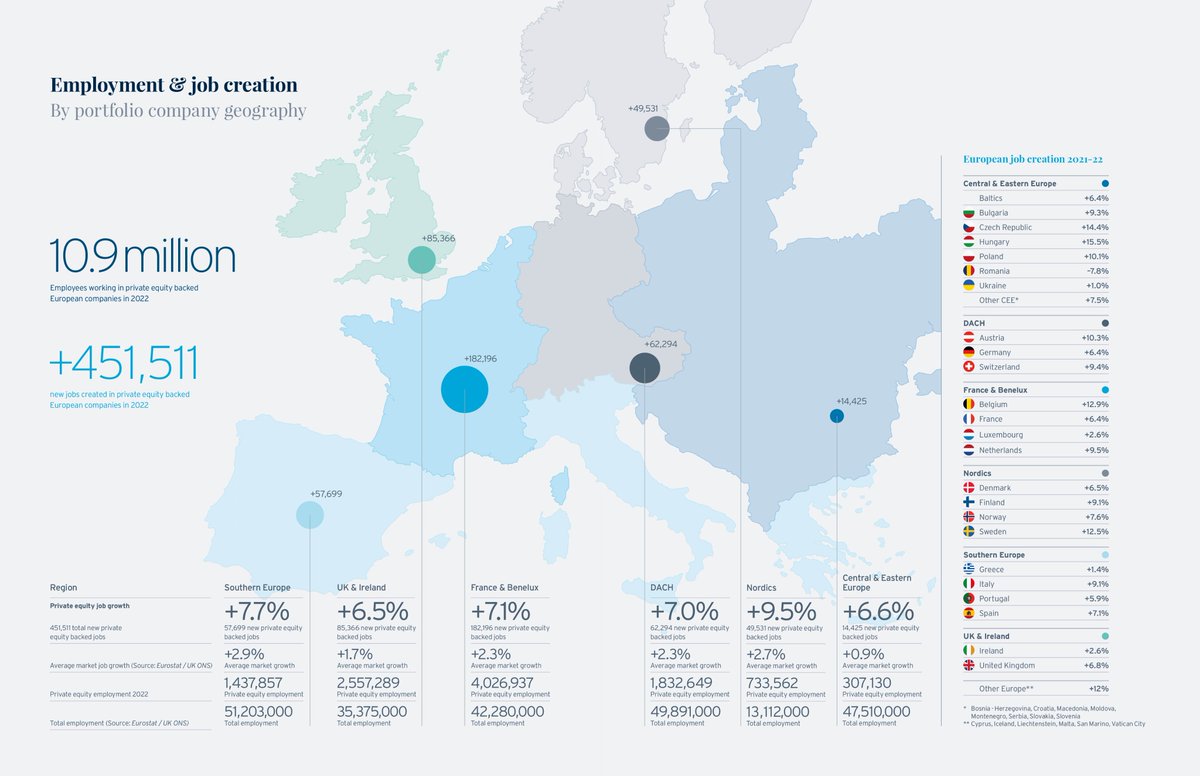

What were the top regions for employment by companies backed by #PrivateEquity & #VentureCapital in 2022?

1️⃣ France and Benelux – 4.0 million

2️⃣ UK and Ireland – 2.6m

3️⃣ DACH – 1.8m

4️⃣ Southern Europe – 1.4m

5️⃣ Nordics – 0.73m

#PrivateEquity AtWork ➡️ bit.ly/PEatWork

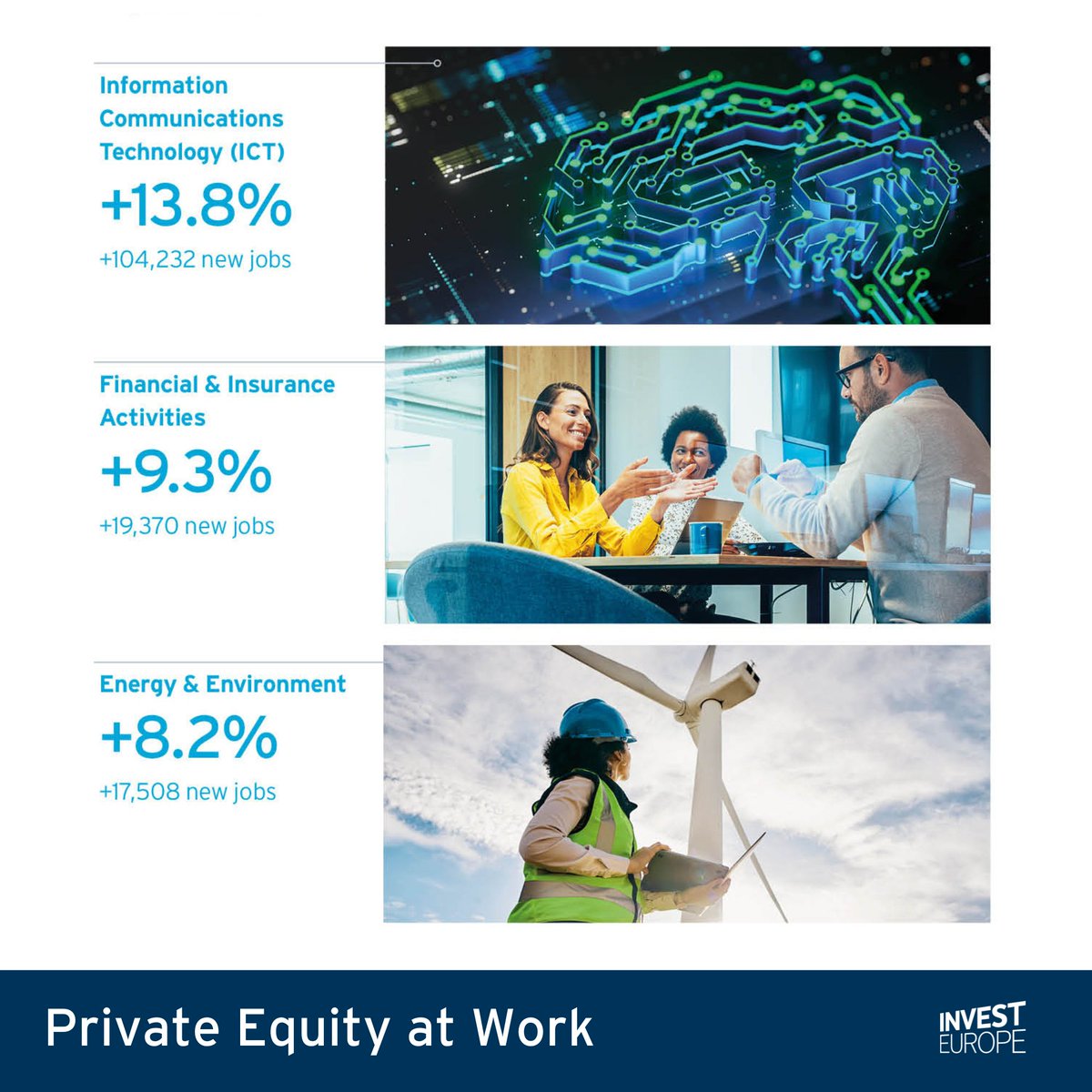

✨ Job growth sector highlights ✨

🔹ICT +13.8%

🔹Finance and insurance +9.3%

🔹Energy and environment +8.2%

Find out how #PrivateEquity and #VentureCapital grew job levels across the sectors in 2022 ⤵️

bit.ly/PEatWork

#PrivateEquity AtWork #BuildingBetterBusinesses

What innovative approaches are CFOs & COOs implementing to build top teams?

Join the panel at #CFOForum24 , with ⤵️

PwC_Luxembourg Target Global Cipio Partners IQ Capital and Deutsche Beteiligungs

Register 👉 cfo.investeurope.eu/registration/

#privateequity #venturecapital

Navigating the not-so-quiet waters of private equity and venture capital ⤵️

In the latest in an exclusive series of articles from members of our LP Council, Sofie Kulp-Tåg of Skandia Mutual Life Insurance Company discusses why a long-term commitment to private capital will…

LAUNCHED TODAY

Invest Europe’s data on #PrivateEquity & #VentureCapital activity is the most comprehensive in Europe, covering 1,150 fund managers and 90% of the €1 trillion in European capital under management.

Get the full report here bit.ly/IE-ActivityDat…

#PEActivity23

Generative AI: what transformative opportunities and challenges lie ahead for Fund Operations?

Our panel at #CFOForum24 looks at the future impacts of #AI adoption in #privateequity and #venturecapital .

Register now and get inspired!

10% discount 👉 cfo.investeurope.eu/registration/

How does #PrivateEquity & #VentureCapital support European job creation & employment?

✅ 451,511 net jobs created by PE/VC-backed companies in 2022

✅ +7.2% job creation

✅ 10.9 million people employed

Our latest #YouAskWeAnswer ➡️ youtube.com/watch?v=doEH5H…

#PrivateEquity AtWork…

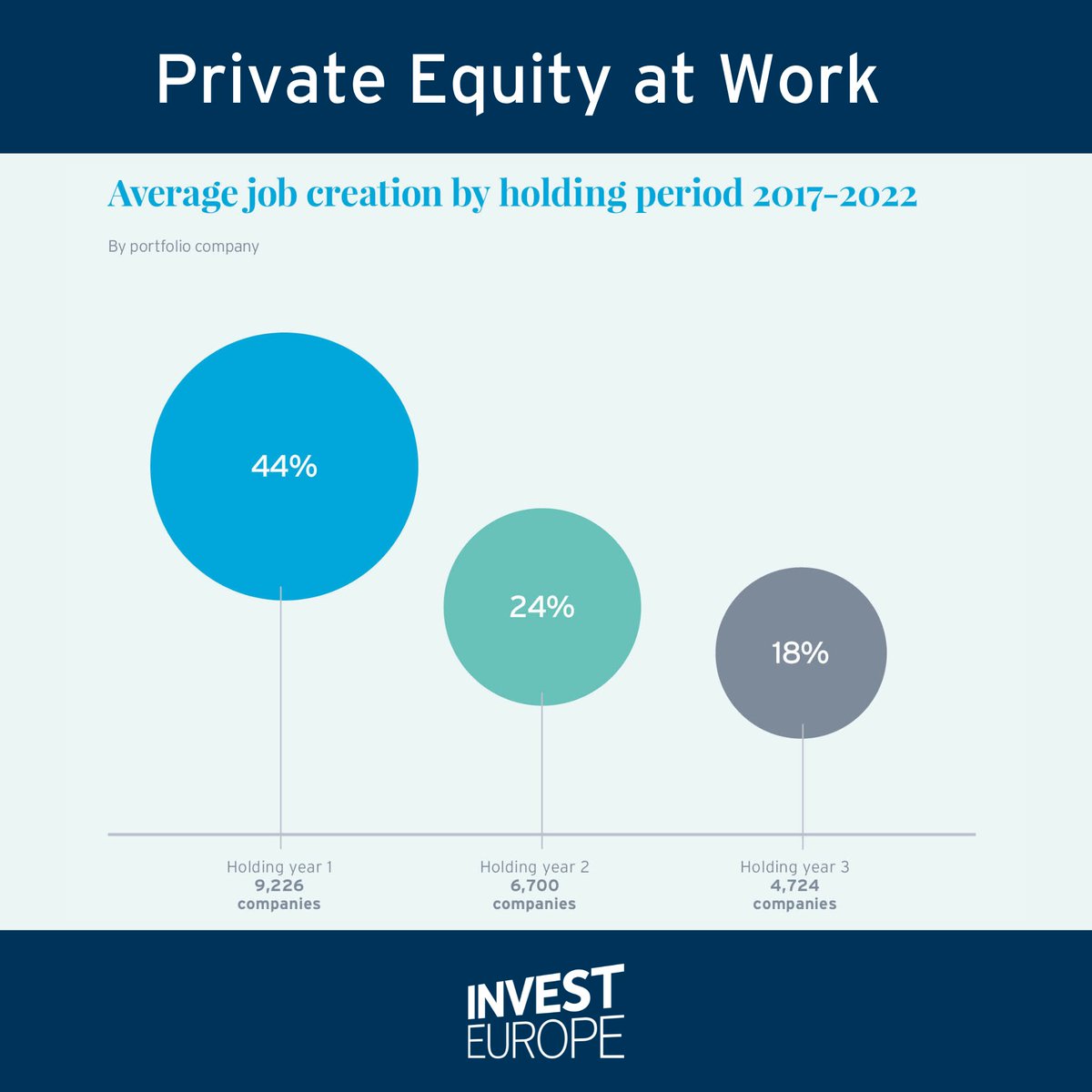

How does private equity and venture capital grow jobs across the lifecycle of an investment?

🔹Year 1 – 44% job creation growth

🔹Year 2 – 24% growth

🔹Year 3 – 18% growth

Download our #PrivateEquity AtWork report here ➡️ bit.ly/PEatWork

#PrivateEquity #VentureCapital

Private capital is the catalyst for growth and job creation Europe needs 📈

In Euractiv, Invest Europe CEO at Eric de Montgolfier discusses our latest #PrivateEquityAtWork , which shows just how ingrained private equity and venture capital is into the fabric of Europe’s economy and…

🚀 Registration has opened for the Venture Capital Forum 2024! 🚀

📆 25-26 September 2024

📍 Amsterdam 🇳🇱

Checkout this year's new LP exclusive pricing and GP early bird 25% discount ⤵️

vcf.investeurope.eu/registration

#VCF24 #venturecapital #privateequity #networking

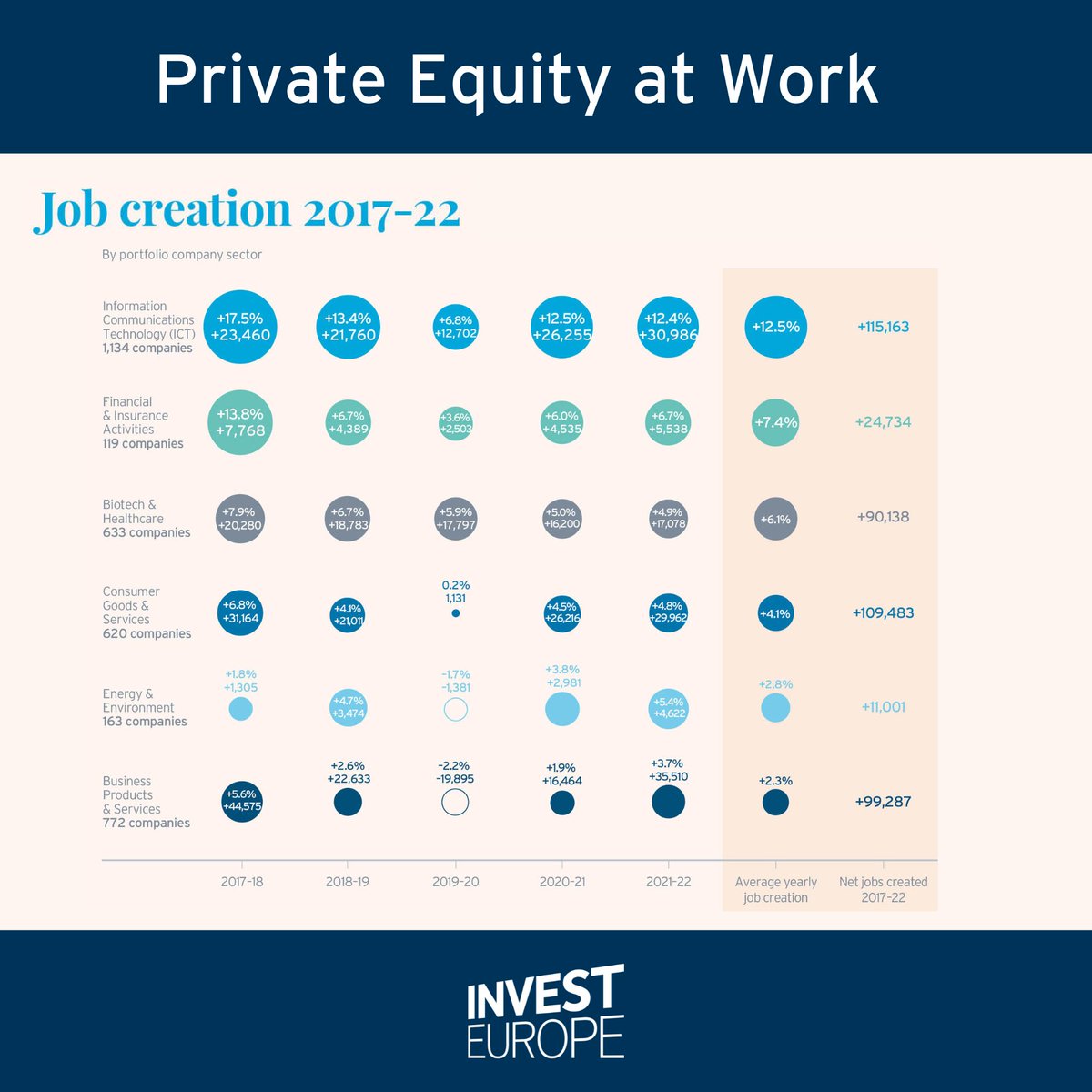

It is strikingly clear that over time the effect on jobs of #PrivateEquity ownership is overwhelmingly positive.

From 2017-2022, PE-backed companies in all sectors recorded net employment growth.

#PrivateEquity AtWork ➡️ bit.ly/PEatWork

#VentureCapital #infrastructure