Invest Europe

@investeuropeeu

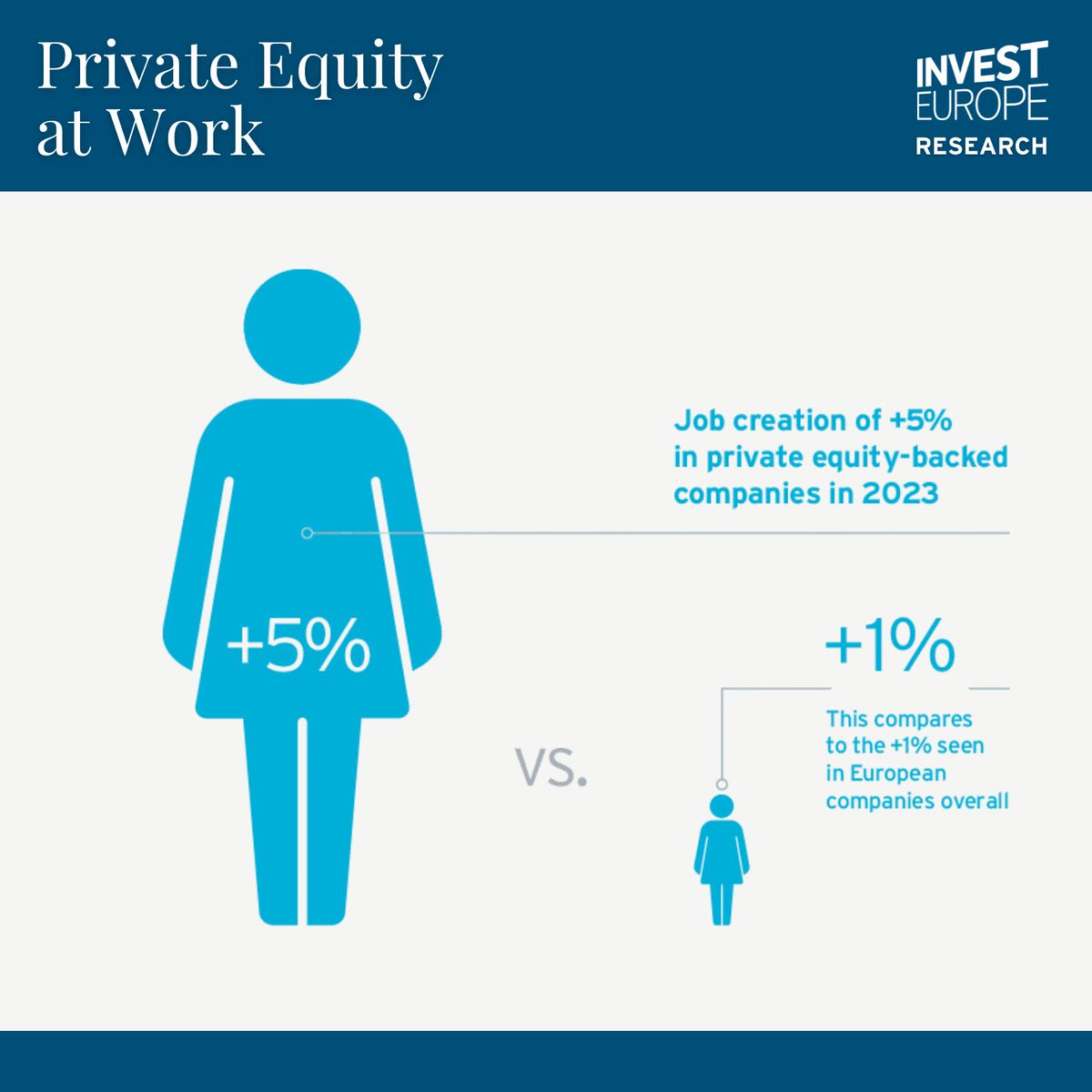

The voice of #investors in privately held companies in #Europe with €1 trillion capital under management in 2023 #PrivateEquity #VentureCapital #Infrastructure

ID: 594719820

http://www.investeurope.eu 30-05-2012 14:30:38

19,19K Tweet

42,42K Followers

2,2K Following

#News in Financial Times 🇬🇧 by Tim Bradshaw 📰 Europe can still win in AI despite US dominance, says Skype co-founder Niklas Zennström of Atomico, an Invest Europe member, believes Europe’s start-ups can still succeed in AI despite their huge funding gap with US rivals by building on top of

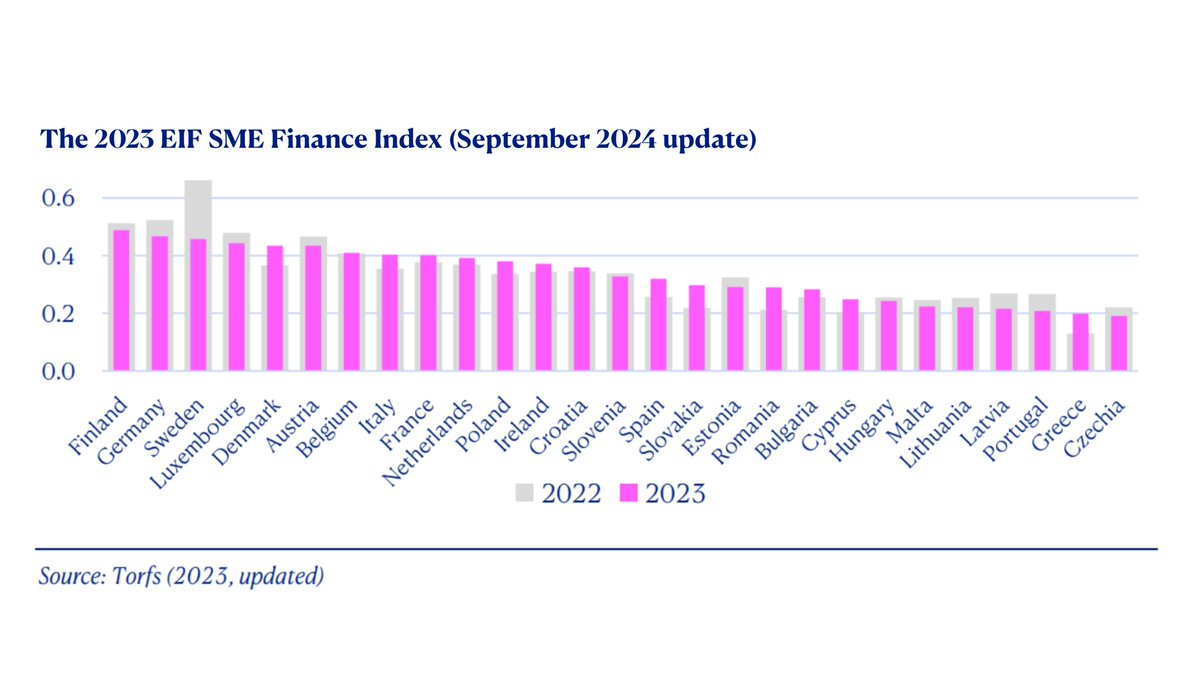

Which are the top investment areas in European VC? 💡 We've asked nearly 400 GPs in our EIF Venture Capital Survey 2024: #biotech, #energy, and #climate are perceived to gain more ground in the next 3-5 years. Download the full report w/Invest Europe🔗 bit.ly/eif-VCsurvey

Good discussion with Invest Europe CEO Eric de Montgolfier about the important role investors and fund managers play in driving economic growth and innovation. Leveraging private investment will be crucial to achieving our ambitious goals at this critical juncture.

🚀 Europe needs a Savings & Investment Union #SIU that truly unlocks #capital for growth. But regulatory barriers still hold back vital investment. Invest Europe position paper outlines 3 key fixes.🔍SIU is a real opportunity—let’s make it work.🧵👇 investeurope.eu/media/1xtlkiuv…

📌 #Ue, il #privatecapital alza l’asticella #Esg 📰 Report 2025 di Invest Europe ➡️ Leggi l'articolo sul nostro sito: eticanews.it/ue-il-private-… #privatemarkets #privateESG #sostenibilità #finanzaESG #finanzasostenibile

The EIB Group spoke with inspiring women leaders on #IWD2025. Venture capital needs more female leadership. The European Investment Fund is committed to driving this change by investing in women as entrepreneurs and founders, said CEO Marjut Falkstedt. 📽️⤵️

Launch of the Investment Intergroup in the European Parliament today with speakers Enrico Letta and Stéphane Séjourné and leading MEPs Stine Bosse / Christine Isabel Benjumea Thomas Pellerin-Carlin. We need public-private investments and a true Single Market to deliver a competitive Europe.

What a way to launch our Investment #Intergroup by welcoming 150+ participants for a dynamic and forward-looking discussion with Stéphane Séjourné and Enrico Letta! The Intergroup has an important role to play in advancing both public and private #investment. Invest Europe

Arthur Jordao, Executive Director of ESNA, has signed a Memorandum of Understanding with Invest Europe, represented by CEO Eric de Montgolfier. This agreement establishes a formal framework for collaboration to support and strengthen the European startup ecosystem through policy

Good meeting with Invest Europe CEO Eric de Montgolfier and Martin Bresson. 📈 We discussed how the venture capital and private equity industries can help unlock the potential of EU scale-up and start-ups.

💚 British Business Bank, BVCA and Venture ESG launch VC data harmonisation project to remove barriers to investment in British venture capital 📊 The British Business Bank, VentureESG and the BVCA have announced the development of a public VC ESG reporting template to reduce the