Octagon Intelligence

@inteloctagon

Global financial, economic, agricultural, energy, trade & climate intelligence.

Visit octagon.online to download & start a free trial.

ID: 1297777590531493889

https://octagon.online 24-08-2020 06:08:00

2,2K Tweet

4,4K Followers

6,6K Following

#EliLilly $LLY | Gross Profit/Assets (Historical, LTM) [2023.Q3] 43.6% [2023.Q2] 41.9% [2023.Q1] 40.5% [2022.Q4] 44.3% [2022.Q3] 46.4% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | Gross Profit/Assets

(Historical, LTM)

[2023.Q3] 43.6%

[2023.Q2] 41.9%

[2023.Q1] 40.5%

[2022.Q4] 44.3%

[2022.Q3] 46.4%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | Gross Profit/Assets

(Historical, LTM)

[2023.Q3] 43.6%

[2023.Q2] 41.9%

[2023.Q1] 40.5%

[2022.Q4] 44.3%

[2022.Q3] 46.4%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4MoH3WgAAMrkg.png)

#HomeDepot $HD | Gross Profit/Assets (Historical, LTM) [2023.Q3] 68.0% [2023.Q2] 67.9% [2023.Q1] 68.3% [2022.Q4] 69.0% [2022.Q3] 68.6% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | Gross Profit/Assets

(Historical, LTM)

[2023.Q3] 68.0%

[2023.Q2] 67.9%

[2023.Q1] 68.3%

[2022.Q4] 69.0%

[2022.Q3] 68.6%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | Gross Profit/Assets

(Historical, LTM)

[2023.Q3] 68.0%

[2023.Q2] 67.9%

[2023.Q1] 68.3%

[2022.Q4] 69.0%

[2022.Q3] 68.6%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5JsyIXIAAvqAy.png)

#EliLilly $LLY | Operating Expenses/Assets (Historical, LTM) [2023.Q3] -26.6% [2023.Q2] -26.4% [2023.Q1] -25.9% [2022.Q4] -26.8% [2022.Q3] -27.6% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | Operating Expenses/Assets

(Historical, LTM)

[2023.Q3] -26.6%

[2023.Q2] -26.4%

[2023.Q1] -25.9%

[2022.Q4] -26.8%

[2022.Q3] -27.6%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | Operating Expenses/Assets

(Historical, LTM)

[2023.Q3] -26.6%

[2023.Q2] -26.4%

[2023.Q1] -25.9%

[2022.Q4] -26.8%

[2022.Q3] -27.6%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4Msw0XUAAvvZd.png)

#HomeDepot $HD | Operating Expenses/Assets (Historical, LTM) [2023.Q3] -38.5% [2023.Q2] -37.7% [2023.Q1] -37.3% [2022.Q4] -37.6% [2022.Q3] -37.2% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | Operating Expenses/Assets

(Historical, LTM)

[2023.Q3] -38.5%

[2023.Q2] -37.7%

[2023.Q1] -37.3%

[2022.Q4] -37.6%

[2022.Q3] -37.2%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | Operating Expenses/Assets

(Historical, LTM)

[2023.Q3] -38.5%

[2023.Q2] -37.7%

[2023.Q1] -37.3%

[2022.Q4] -37.6%

[2022.Q3] -37.2%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5JwkaXcAAHVZD.png)

#EliLilly $LLY | EBITDA/Assets (Historical, LTM) [2023.Q3] 19.5% [2023.Q2] 18.2% [2023.Q1] 17.2% [2022.Q4] 20.6% [2022.Q3] 22.1% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | EBITDA/Assets

(Historical, LTM)

[2023.Q3] 19.5%

[2023.Q2] 18.2%

[2023.Q1] 17.2%

[2022.Q4] 20.6%

[2022.Q3] 22.1%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | EBITDA/Assets

(Historical, LTM)

[2023.Q3] 19.5%

[2023.Q2] 18.2%

[2023.Q1] 17.2%

[2022.Q4] 20.6%

[2022.Q3] 22.1%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4MxhDWIAAT5GV.png)

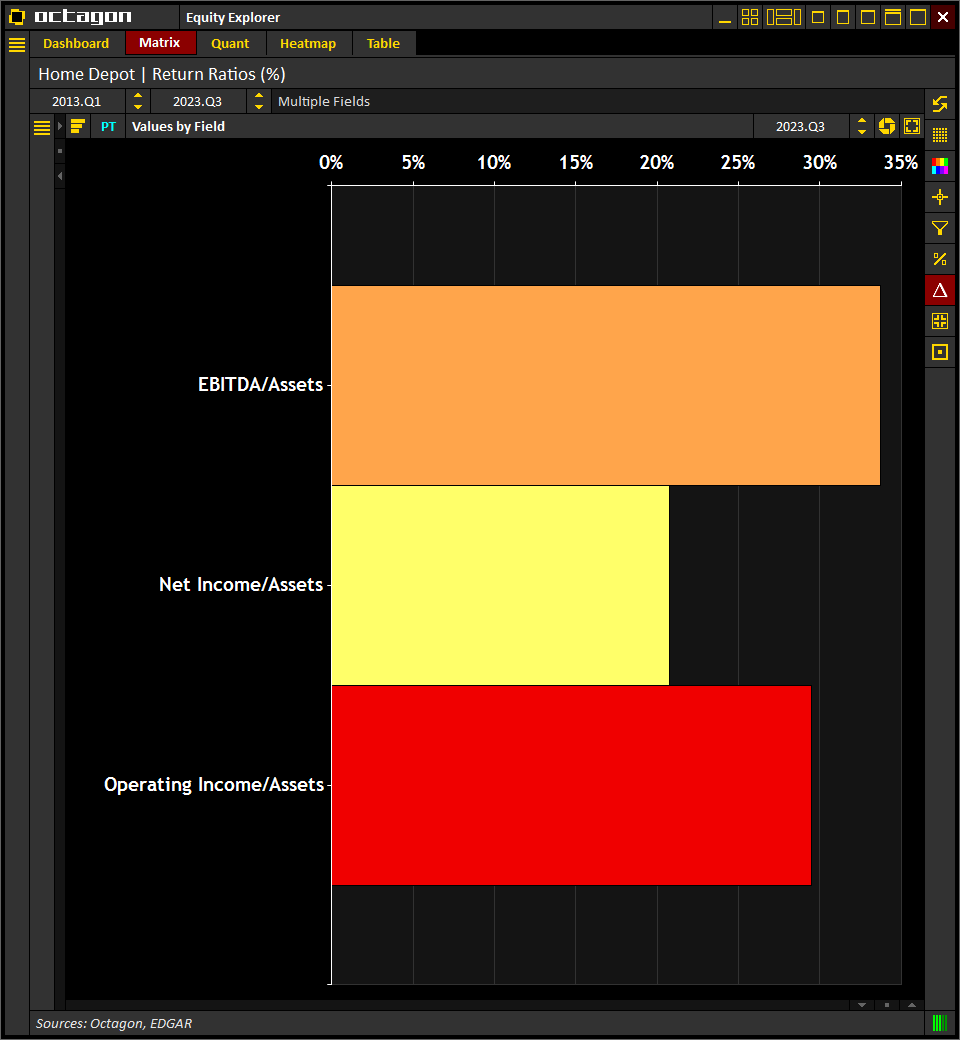

#HomeDepot $HD | EBITDA/Assets (Historical, LTM) [2023.Q3] 33.7% [2023.Q2] 34.2% [2023.Q1] 35.0% [2022.Q4] 35.4% [2022.Q3] 35.2% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | EBITDA/Assets

(Historical, LTM)

[2023.Q3] 33.7%

[2023.Q2] 34.2%

[2023.Q1] 35.0%

[2022.Q4] 35.4%

[2022.Q3] 35.2%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | EBITDA/Assets

(Historical, LTM)

[2023.Q3] 33.7%

[2023.Q2] 34.2%

[2023.Q1] 35.0%

[2022.Q4] 35.4%

[2022.Q3] 35.2%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5J1aIXsAA_Ad3.png)

#EliLilly $LLY | Operating Income/Assets (Historical, LTM) [2023.Q3] 16.9% [2023.Q2] 15.5% [2023.Q1] 14.5% [2022.Q4] 17.5% [2022.Q3] 18.7% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | Operating Income/Assets

(Historical, LTM)

[2023.Q3] 16.9%

[2023.Q2] 15.5%

[2023.Q1] 14.5%

[2022.Q4] 17.5%

[2022.Q3] 18.7%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | Operating Income/Assets

(Historical, LTM)

[2023.Q3] 16.9%

[2023.Q2] 15.5%

[2023.Q1] 14.5%

[2022.Q4] 17.5%

[2022.Q3] 18.7%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4M3moWAAAvdex.png)

#HomeDepot $HD | Operating Income/Assets (Historical, LTM) [2023.Q3] 29.5% [2023.Q2] 30.2% [2023.Q1] 31.0% [2022.Q4] 31.5% [2022.Q3] 31.4% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | Operating Income/Assets

(Historical, LTM)

[2023.Q3] 29.5%

[2023.Q2] 30.2%

[2023.Q1] 31.0%

[2022.Q4] 31.5%

[2022.Q3] 31.4%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | Operating Income/Assets

(Historical, LTM)

[2023.Q3] 29.5%

[2023.Q2] 30.2%

[2023.Q1] 31.0%

[2022.Q4] 31.5%

[2022.Q3] 31.4%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5J4shXMAAMjAr.png)

#EliLilly $LLY | Return Ratios (2023 Q3, LTM) ROA 8.6% ROE 44.2% EBITDA/Equity 100.1% EBIT/Equity 86.7% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

#HomeDepot $HD | Return Ratios (2023 Q3, LTM) ROA 20.8% ROE 1,092.8% EBITDA/Equity 1,773.6% EBIT/Equity 1,552.2% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

#EliLilly $LLY | Return Ratios (2023 Q3, LTM) ROA 8.6% ROE 44.2% EBITDA/Equity 100.1% EBIT/Equity 86.7% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

#HomeDepot $HD | Return Ratios (2023 Q3, LTM) ROA 20.8% ROE 1,092.8% EBITDA/Equity 1,773.6% EBIT/Equity 1,552.2% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

#EliLilly $LLY | Return on Assets (Historical, LTM) [2023.Q3] 8.6% [2023.Q2] 11.9% [2023.Q1] 10.7% [2022.Q4] 12.6% [2022.Q3] 12.7% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | Return on Assets

(Historical, LTM)

[2023.Q3] 8.6%

[2023.Q2] 11.9%

[2023.Q1] 10.7%

[2022.Q4] 12.6%

[2022.Q3] 12.7%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | Return on Assets

(Historical, LTM)

[2023.Q3] 8.6%

[2023.Q2] 11.9%

[2023.Q1] 10.7%

[2022.Q4] 12.6%

[2022.Q3] 12.7%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4NEM2XUAAVYjs.png)

#HomeDepot $HD | Return on Assets (Historical, LTM) [2023.Q3] 20.8% [2023.Q2] 21.3% [2023.Q1] 21.9% [2022.Q4] 22.4% [2022.Q3] 22.2% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | Return on Assets

(Historical, LTM)

[2023.Q3] 20.8%

[2023.Q2] 21.3%

[2023.Q1] 21.9%

[2022.Q4] 22.4%

[2022.Q3] 22.2%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | Return on Assets

(Historical, LTM)

[2023.Q3] 20.8%

[2023.Q2] 21.3%

[2023.Q1] 21.9%

[2022.Q4] 22.4%

[2022.Q3] 22.2%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5KCZVXQAA3fN3.png)

#EliLilly $LLY | Return on Equity (Historical, LTM) [2023.Q3] 44.2% [2023.Q2] 58.3% [2023.Q1] 50.4% [2022.Q4] 57.9% [2022.Q3] 59.3% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | Return on Equity

(Historical, LTM)

[2023.Q3] 44.2%

[2023.Q2] 58.3%

[2023.Q1] 50.4%

[2022.Q4] 57.9%

[2022.Q3] 59.3%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | Return on Equity

(Historical, LTM)

[2023.Q3] 44.2%

[2023.Q2] 58.3%

[2023.Q1] 50.4%

[2022.Q4] 57.9%

[2022.Q3] 59.3%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4NIOlXgAEFWrt.png)

#HomeDepot $HD | Return on Equity (Historical, LTM) [2023.Q3] 1,092.8% [2023.Q2] 1,211.9% [2023.Q1] 4,629.0% [2022.Q4] 1,094.1% [2022.Q3] 1,316.4% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | Return on Equity

(Historical, LTM)

[2023.Q3] 1,092.8%

[2023.Q2] 1,211.9%

[2023.Q1] 4,629.0%

[2022.Q4] 1,094.1%

[2022.Q3] 1,316.4%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | Return on Equity

(Historical, LTM)

[2023.Q3] 1,092.8%

[2023.Q2] 1,211.9%

[2023.Q1] 4,629.0%

[2022.Q4] 1,094.1%

[2022.Q3] 1,316.4%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5KFpwWkAAyMZ4.png)

#EliLilly $LLY | EBITDA/Equity (Historical, LTM) [2023.Q3] 100.1% [2023.Q2] 89.3% [2023.Q1] 81.1% [2022.Q4] 94.5% [2022.Q3] 103.0% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | EBITDA/Equity

(Historical, LTM)

[2023.Q3] 100.1%

[2023.Q2] 89.3%

[2023.Q1] 81.1%

[2022.Q4] 94.5%

[2022.Q3] 103.0%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | EBITDA/Equity

(Historical, LTM)

[2023.Q3] 100.1%

[2023.Q2] 89.3%

[2023.Q1] 81.1%

[2022.Q4] 94.5%

[2022.Q3] 103.0%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4NMetXcAA4HmT.png)

#HomeDepot $HD | EBITDA/Equity (Historical, LTM) [2023.Q3] 1,773.6% [2023.Q2] 1,950.9% [2023.Q1] 7,379.3% [2022.Q4] 1,728.1% [2022.Q3] 2,084.8% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | EBITDA/Equity

(Historical, LTM)

[2023.Q3] 1,773.6%

[2023.Q2] 1,950.9%

[2023.Q1] 7,379.3%

[2022.Q4] 1,728.1%

[2022.Q3] 2,084.8%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | EBITDA/Equity

(Historical, LTM)

[2023.Q3] 1,773.6%

[2023.Q2] 1,950.9%

[2023.Q1] 7,379.3%

[2022.Q4] 1,728.1%

[2022.Q3] 2,084.8%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5KJKhX0AAywLZ.png)

#EliLilly $LLY | Operating Income/Equity (Historical, LTM) [2023.Q3] 86.7% [2023.Q2] 76.1% [2023.Q1] 68.2% [2022.Q4] 80.3% [2022.Q3] 87.3% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #EliLilly $LLY | Operating Income/Equity

(Historical, LTM)

[2023.Q3] 86.7%

[2023.Q2] 76.1%

[2023.Q1] 68.2%

[2022.Q4] 80.3%

[2022.Q3] 87.3%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #EliLilly $LLY | Operating Income/Equity

(Historical, LTM)

[2023.Q3] 86.7%

[2023.Q2] 76.1%

[2023.Q1] 68.2%

[2022.Q4] 80.3%

[2022.Q3] 87.3%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF4NQPvXoAAce9E.png)

#HomeDepot $HD | Operating Income/Equity (Historical, LTM) [2023.Q3] 1,552.2% [2023.Q2] 1,720.0% [2023.Q1] 6,537.3% [2022.Q4] 1,537.4% [2022.Q3] 1,856.9% Source: Octagon Intelligence Visit octagon.online for more info #Earnings #Trading #Investing #Stocks $SPX

![Octagon Intelligence (@inteloctagon) on Twitter photo #HomeDepot $HD | Operating Income/Equity

(Historical, LTM)

[2023.Q3] 1,552.2%

[2023.Q2] 1,720.0%

[2023.Q1] 6,537.3%

[2022.Q4] 1,537.4%

[2022.Q3] 1,856.9%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX #HomeDepot $HD | Operating Income/Equity

(Historical, LTM)

[2023.Q3] 1,552.2%

[2023.Q2] 1,720.0%

[2023.Q1] 6,537.3%

[2022.Q4] 1,537.4%

[2022.Q3] 1,856.9%

Source: <a href="/IntelOctagon/">Octagon Intelligence</a>

Visit octagon.online for more info

#Earnings #Trading #Investing #Stocks $SPX](https://pbs.twimg.com/media/GF5KL9xXAAAxIZ9.png)