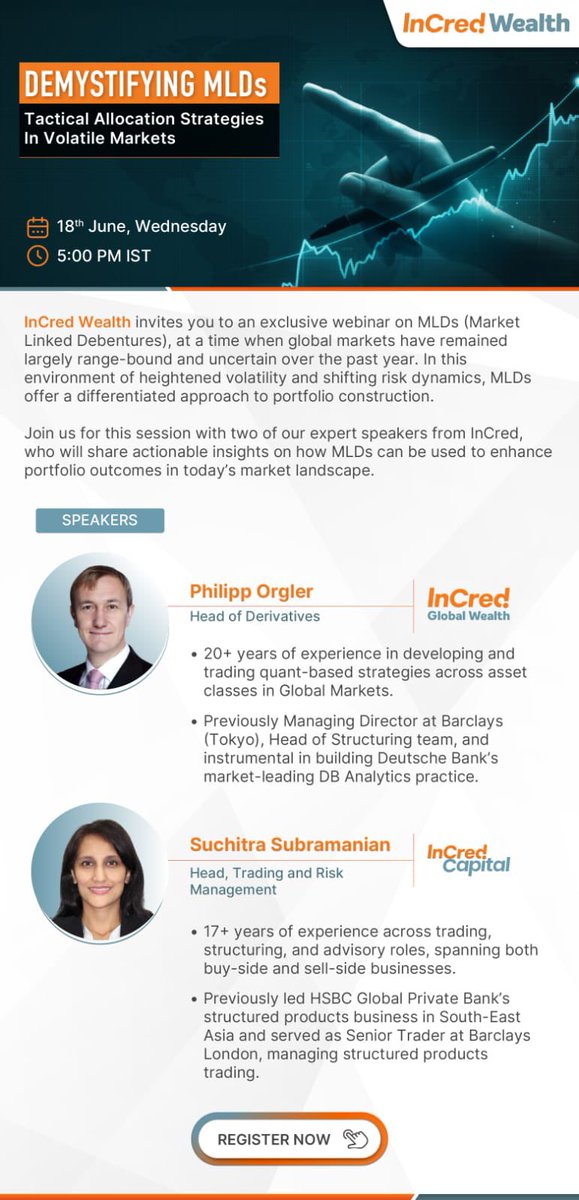

InCred Capital

@incredcapital

Investment Banking | Capital Markets | Wealth Management | Asset Management | Equities Research & Broking

ID: 1021729510197260291

https://www.incredcapital.com/ 24-07-2018 12:11:12

257 Tweet

580 Takipçi

15 Takip Edilen

In an insightful conversation with NDTV Profit News Feed, Aditya Khemka, Fund Manager at InCred Asset Management, shares a grounded perspective on the current state of the pharmaceutical sector. He explores the impact of potential U.S. trade tariffs under a possible Trump administration