Income Tax Mumbai

@incometaxmum

Official account of the Income Tax Department, Mumbai

ID: 1293447328083263488

http://incometaxmumbai.gov.in 12-08-2020 07:20:58

4,4K Tweet

4,4K Followers

72 Following

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting Lets Learn Tax "Chapter 6" Reimagining tax administration- efficient, transparent, and taxpayer-friendly. ✅ No physical interface ✅ Team-based review ✅ Enhanced taxpayer confidence Step into a system built on trust and technology.

A delegation of eight senior officers from HM Revenue & Customs, London, is on a three-day official visit to India as part of a knowledge-sharing and collaboration initiative with CBDT. The program was inaugurated today at the Centre for Taxation and Finance, New Delhi, by the Hon’ble

Attention taxpayers! The Excel Utility for ITR-1 and ITR-4 for AY 2025-26 has been enabled and is now available for taxpayers. Ministry of Finance Nirmala Sitharaman Office Office of Pankaj Chaudhary PIB India

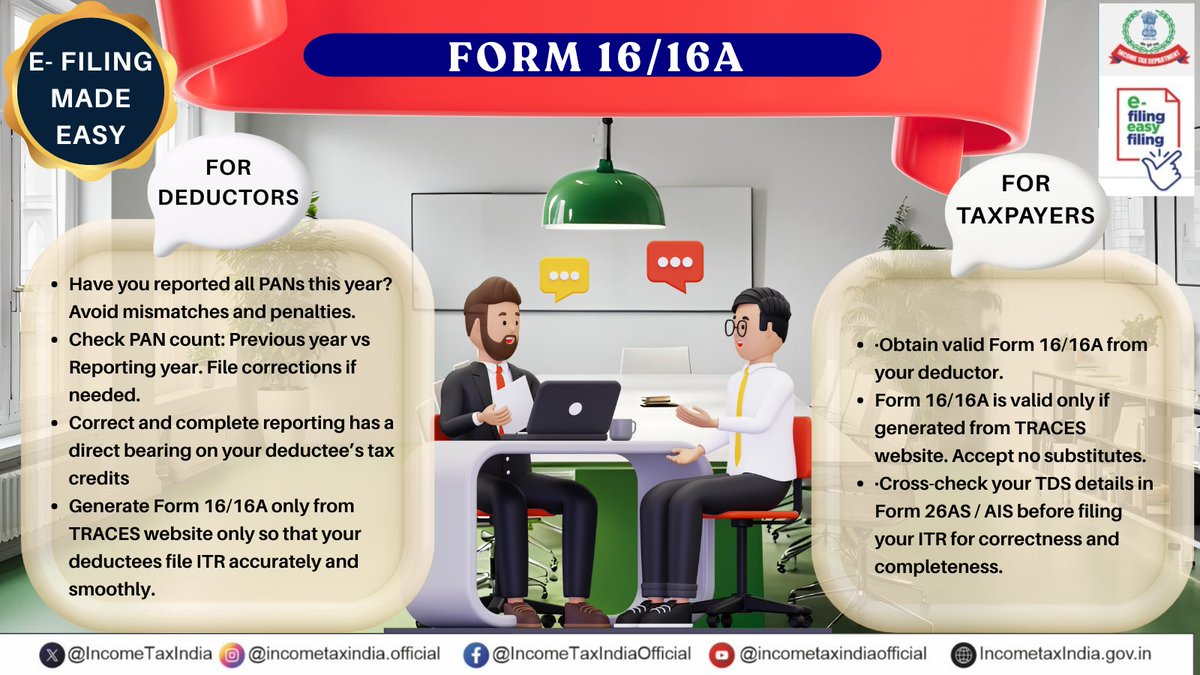

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "E- Filing Made Easy" Form 16/16A – The Starting Point of Your ITR Journey 🔷Deductors: Ensure Form 16/16A is generated only from TRACES for authenticity. 🔷Taxpayers: Always cross-check TDS with your Form 26AS/AIS before filing. Correct forms help avoid mismatches and build

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "E- Filing MadeEasy" Tax Calculator Make informed choices with the Tax Calculator on the Income Tax e-Filing portal! ☝️ Compare Old vs New Tax Regimes ☝️ Choose taxpayer type (Individual, HUF, etc.) ☝️ Get instant tax estimates ☝️ No login required! Calculate smart. File

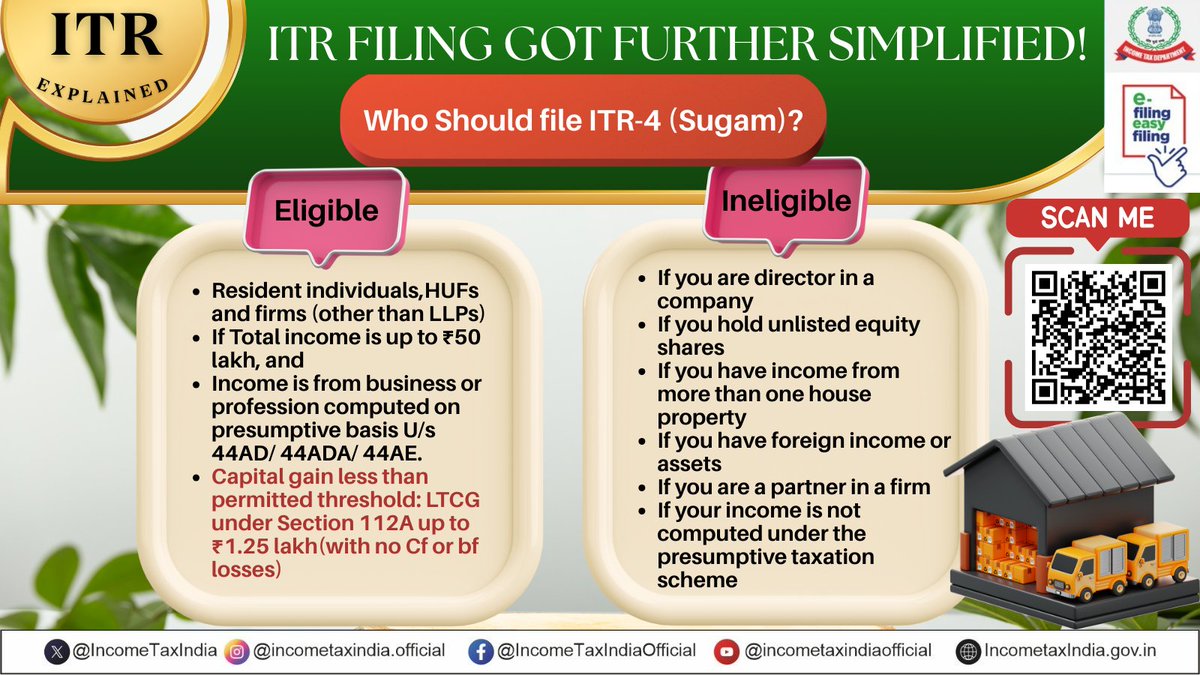

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting PMO India MyGovIndia "E- Filing MadeEasy" who should file ITR-4 (SUGAM) Not sure if ITR-4 is for you? This chapter simplifies eligibility and exclusions - Stay informed. File right. “Right Form. Right Filing.”

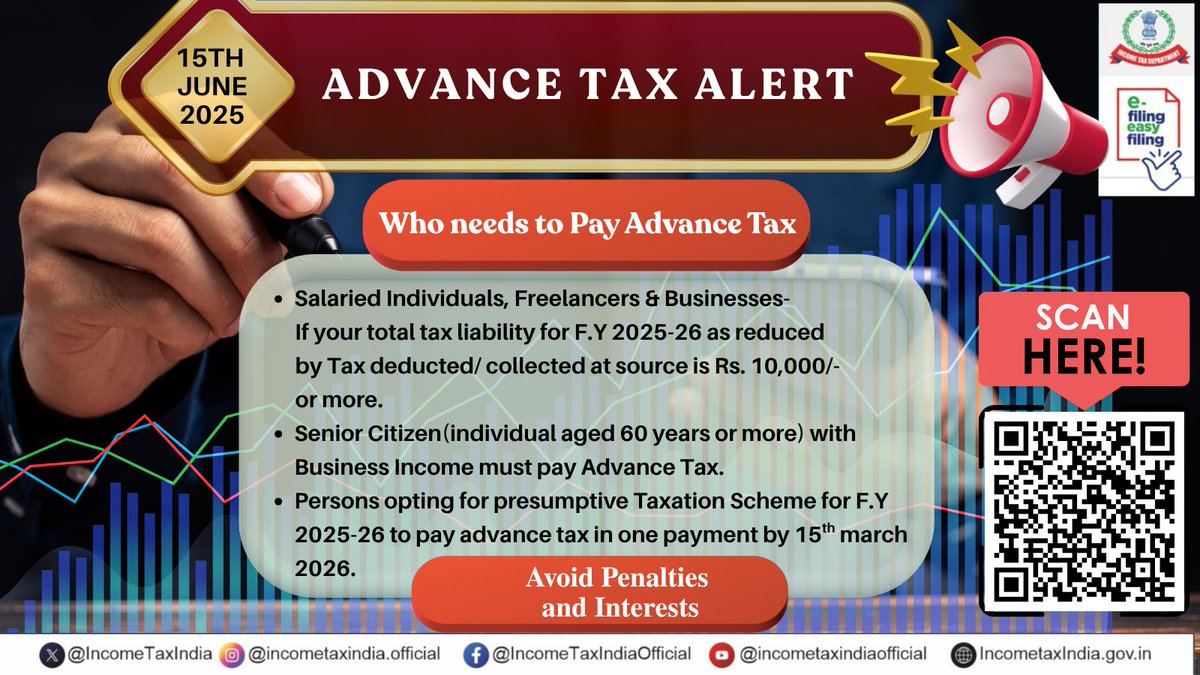

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting Kind Attention Taxpayers! Do check your eligibility and remember to pay your first instalment of Advance Tax by 15th of June, 2025. 👍 Stay compliant 👍 Avoid interest under Sections 234B & 234C 👍 File with pride

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting PMO India MyGovIndia Kind Attention Taxpayers! A validated bank account is necessary for receipt of refunds. Kindly add a bank a/c or update your existing bank a/c with the latest details on efiling portal and validate the same. For Adding a new bank a/c: Pl visit incometax.gov.in/iec/foportal/ ➡️

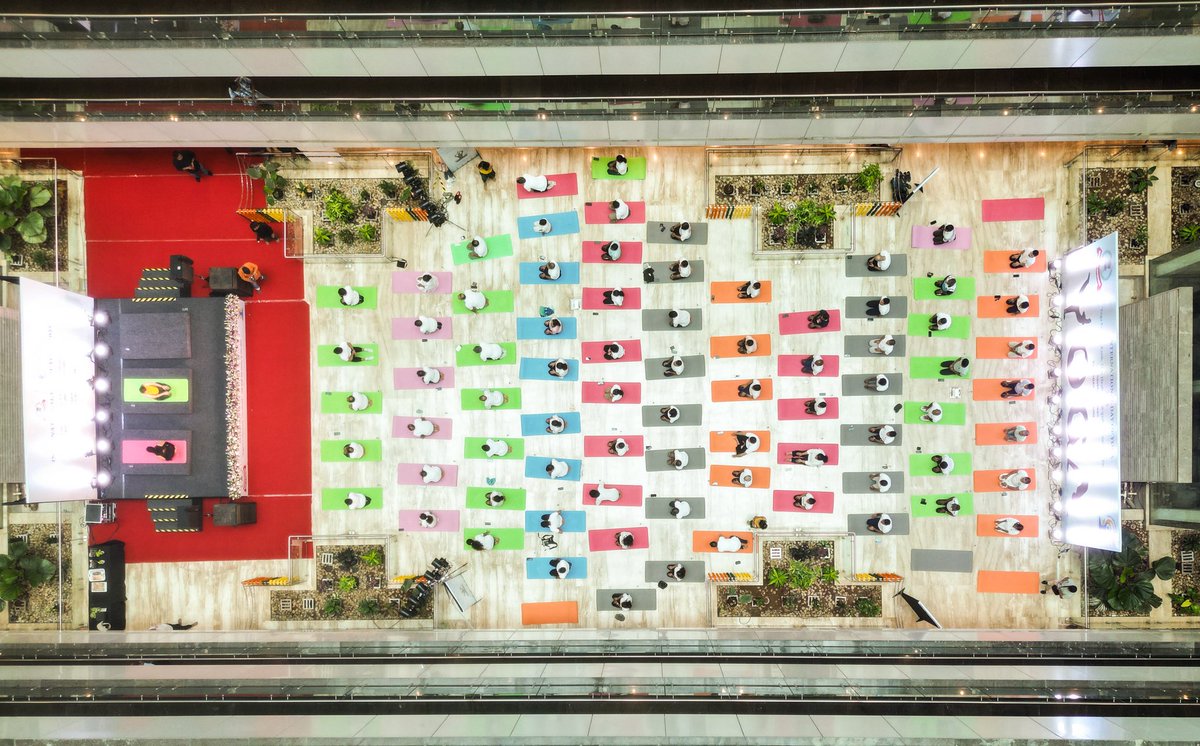

#IDY2025 was celebrated by officials of Income Tax Department, Mumbai. Renowned actors Rajkummar Rao & Aparshakti Khurana graced the occasion. Ms Shammi Gupta, yoga exponent guided the participants. ‘Yoga for One Earth, One Health’ PIB India Income Tax India

Hon’ble Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman chaired a conclave with Pr. Chief Commissioners and Pr. Directors General Income Tax, emphasizing critical reforms & taxpayer-centric initiatives. The meeting focussed on the key areas of: 🔷Taxpayer

👉 Union Minister for Finance and Corporate Affairs Smt. Nirmala Sitharaman chairs Conclave with Principal Chief Commissioners of CBDT, in New Delhi, today 👉 Presentations were made on the overall performance of CBDT including Taxpayer Service (Grievance, Order Giving Effect &

Delhi: Union Minister for Finance and Corporate Affairs Nirmala Sitharaman chaired a conclave with Pr. Chief Commissioners and Pr. Directors General Income Tax, emphasizing critical reforms & taxpayer-centric initiatives. The meeting focused on the key areas of: 🔷Taxpayer services &

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting "TAX ASSIST" Expressing scenarios- If 80GGC deduction is Claimed by Mistake then kindly- Revise your return or file ITR U Pay due taxes & interest Return excess refund Ignoring the communication may lead to scrutiny or penalty. Correct it before it costs you!

A 2 day interactive capacity building program was organised on 27–28 June 2025 for first appellate authorities to update them about key legal issues. Eminent CAs & Tax Professionals shared insights on oft litigated issues & discussed the evolving tax landscape. Income Tax India

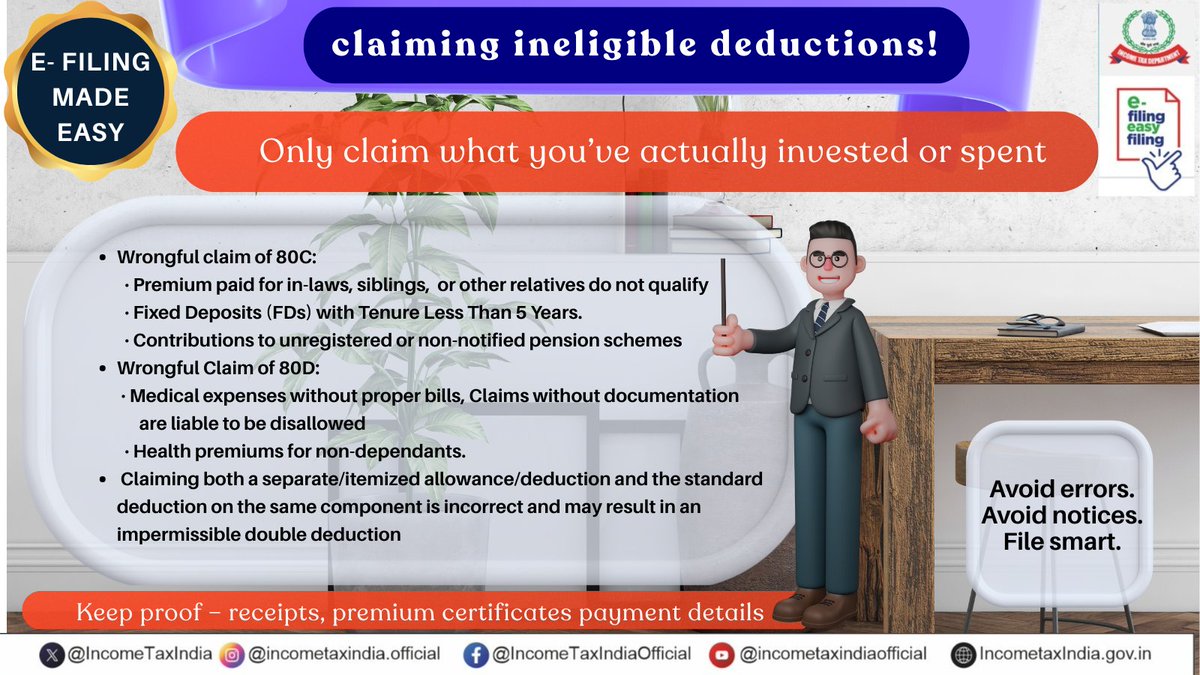

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting PMO India MyGovIndia "E- Filing Made Easy" Are you Claiming Deductions Without Eligibility ? Claim only if you're genuinely eligible. Example- 🔹 80C – Investments like PPF, ELSS, Life Insurance 🔹 80D – Health insurance premiums 🔹 80E – Education loan interest 🔹 80TTA/TTB – Savings & deposit

Nirmala Sitharaman Office Office of Pankaj Chaudhary Ministry of Finance PIB India Ministry of Information and Broadcasting PMO India MyGovIndia "E- Filing Made Easy" Are you claiming ineligible deductions? Wrongful claim of deductions may invite penal provisions. Avoid errors, Avoid notices, File Smart.