INSPIRE - Greening the financial system

@inspiregreenfin

INSPIRE - International Network for Sustainable Financial Policy Insights, Research, and Exchange - the designated global research stakeholder of the @NGFS_

ID: 1265993185186254848

https://inspiregreenfinance.org/ 28-05-2020 13:11:37

1,1K Tweet

2,2K Followers

87 Following

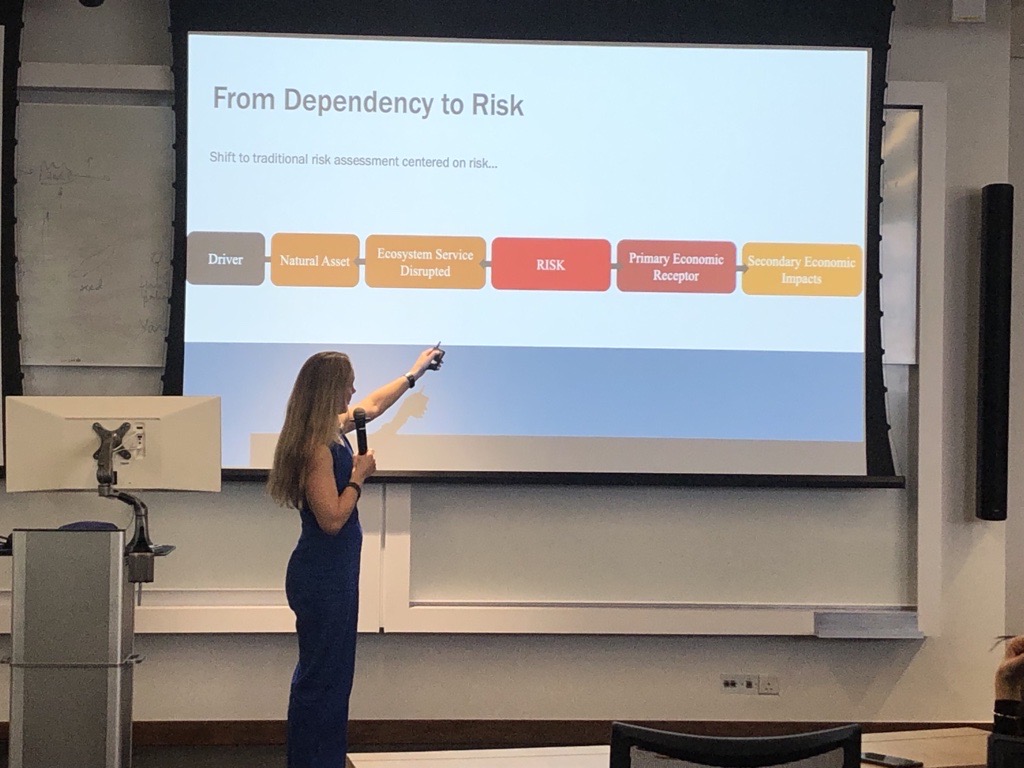

Anna Freeman (ECI, Univ of Oxford) argues for a new approach to nature-related financial risk assessments, one which captures risk that is consistent with best practice in both science and prudential policy, rather than relying on dependencies.

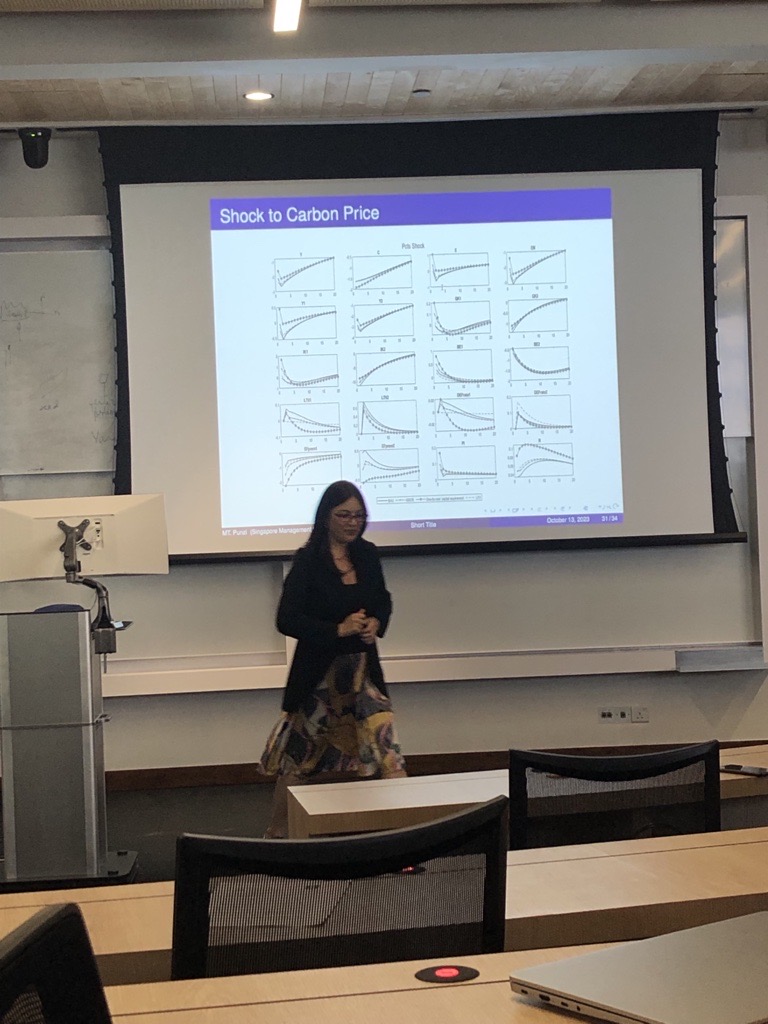

Maria Theresa Punzi (Singapore Management University) argues that for governments aiming to achieve net-zero targets, "one-for-one" prudential capital requirements on fossil fuel financing can be more effective in reducing default and moving to a greener economy than a carbon tax policy alone.

Patrycia Klusak (Cambridge Institute for Sustainability Leadership & UEA) analyses nature loss & sovereign credit ratings to argue that hypothetical world of partial collapse of ecosystem services would directly impact the creditworthiness & probability of default of lower rated sovereigns in EMDE.

We were privileged to play host to this year's Sustainable Macroeconomics Conference "#Nature, #Finance and the #Macroeconomy: Risks, Impact and Feedback Effects" co-organized by INSPIRE - Greening the financial system and Grantham Institute Imperial . It was great to witness an exchange of ideas & impactful research

🎙️ In Conversation with... If you want to learn more about the climate strategy of the Central Bank of Kenya, take a look at the #NGFS' latest interview with Mr. Matu Mugo, Deputy Governor Bank Supervision Sector at the Central Bank of Kenya Read more ⤵️

A number of banks have not delivered within our March 2023 interim deadline to assess their climate and environmental risks, says Supervisory Board Vice-Chair Frank Elderson.

![SA Reserve Bank (@sareservebank) on Twitter photo [Call for Research Proposals] The South African Reserve Bank (SARB), as part of its research agenda, seeks to expand research into the implications of the climate crisis for central banking in Southern Africa. The role of central banks in countries’ responses to climate change [Call for Research Proposals] The South African Reserve Bank (SARB), as part of its research agenda, seeks to expand research into the implications of the climate crisis for central banking in Southern Africa. The role of central banks in countries’ responses to climate change](https://pbs.twimg.com/media/GDpLy_-WUAA-6mR.jpg)